Cryptocurrency, also known as digital currency, has taken the financial world by storm. With the rise of Bitcoin and other cryptocurrencies, investors are looking for ways to capitalize on the potential profits. One of the most popular investment vehicles for cryptocurrency is the hedge fund. A crypto hedge fund is a fund that utilizes various investment strategies to maximize returns for its investors. If you’re interested in starting your own crypto hedge fund, there are a few things you need to know.

First and foremost, it’s important to understand the basics of cryptocurrency and blockchain technology. This includes understanding how cryptocurrencies are created, how they are traded, and how they are stored. It’s also important to have a solid understanding of the market and the various factors that can impact it. Additionally, you will need to have a solid business plan in place, including a clear investment strategy and a plan for managing risk. With the right knowledge and preparation, starting a crypto hedge fund can be a lucrative and rewarding venture.

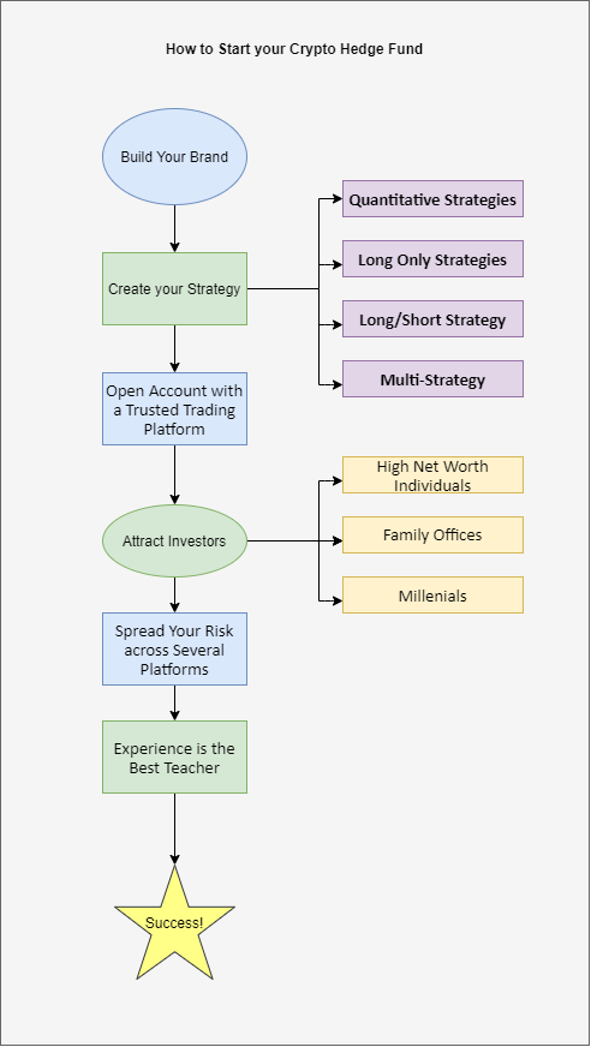

Starting a Crypto Hedge Fund: A Step-by-Step Guide

- Research the legal requirements in your jurisdiction, including potential licensing and registration requirements.

- Set up a corporate structure to manage the fund.

- Develop an investment strategy for the fund.

- Develop a compliance and risk management program for the fund.

- Secure the necessary financing to launch the fund.

- Find investors and raise capital.

- Develop a plan for accounting, tax management, and reporting.

- Launch the fund and start investing.

How to Start a Crypto Hedge Fund

Crypto hedge funds are a great way to diversify your portfolio and make profits from the volatile cryptocurrency markets. With the right strategies and the right knowledge, you can make a lot of money with a crypto hedge fund. Here is a step-by-step guide on how to start a crypto hedge fund.

Step 1: Research and Strategize

Before you start a crypto hedge fund, you need to do your research and strategize. You need to be aware of the different strategies and strategies that work best in the crypto markets. You also need to know the different types of assets you are looking to invest in and the risks associated with each one. Once you have this information, you can start to create a strategy and determine the best way to structure your hedge fund.

It is important to understand the different types of assets you are investing in and how they can be used to make profits. You need to have an understanding of the different types of trading strategies you can use and the risks associated with each one. You also need to know the different types of fees associated with your hedge fund and what fees you are required to pay. Once you have an understanding of the different strategies, fees, and risks associated with your hedge fund, you can start to create a strategy that works for you.

Step 2: Choose the Right Platform

Once you have a strategy and know the different types of assets you are investing in, you need to choose the right platform to manage your hedge fund. There are many different options available, such as traditional investment banks, online brokers, and cryptocurrency exchanges. Each one offers different advantages and disadvantages, so it is important to research each one and decide which one is right for your hedge fund.

The platform you choose should offer features that are suitable for your hedge fund and offer a secure and reliable way to manage your funds. It should also offer a user-friendly interface and provide access to the latest news and market updates. It is also important to make sure that the platform is secure and offers customer support when needed.

Step 3: Set Up Your Trading Accounts

Once you have chosen the right platform to manage your hedge fund, you need to set up your trading accounts. You need to choose the right trading platform, such as a cryptocurrency exchange, to ensure that you get the best prices and the most liquidity. You also need to set up wallets to store your funds and make sure that your funds are secure.

Once you have set up your trading accounts, you can start to trade and make profits. You need to be aware of the different trading strategies and the risks associated with each one. You also need to be aware of the different fees associated with the different trading platforms and make sure that you understand the fees associated with each one. It is important to research the different fees and make sure that you are getting the best deals.

Step 4: Create a Risk Management Plan

Once you have set up your trading accounts, you need to create a risk management plan. This will help you to manage the risks associated with your hedge fund and ensure that you are making the most out of your investments. You need to set up stop-loss orders and position limits to ensure that you don’t lose too much money. You also need to monitor the markets and make sure that you are taking the right trading decisions.

You also need to create a portfolio management plan to ensure that you are diversifying your investments and making the most out of your hedge fund. This will help you to manage the risks associated with your investments and make sure that you are making the most out of your investments.

Step 5: Monitor the Markets

Once you have set up your trading accounts and created your risk management plan, you need to start monitoring the markets. You need to be aware of the different market conditions and make sure that you are taking the right trading decisions. You also need to be aware of the different types of news and market updates and make sure that you are taking the right trading decisions.

It is important to keep track of the different market conditions and make sure that you are making the most out of your investments. You also need to monitor the different news and market updates and make sure that you are taking the right trading decisions. It is also important to keep track of the different fees associated with your hedge fund and make sure that you are getting the best deals.

Frequently Asked Questions

Starting a crypto hedge fund involves researching the market, understanding the existing regulations, and developing a robust operational strategy. Here are some of the most commonly asked questions about starting a crypto hedge fund.

What is a Crypto Hedge Fund?

A crypto hedge fund is an investment vehicle that uses digital assets to generate returns for its investors. It is similar to a traditional hedge fund in that it uses a variety of strategies, including long and short positions, leveraged positions, and margin trading. The primary difference is that a crypto hedge fund uses digital assets, such as Bitcoin and Ethereum, rather than traditional stocks and bonds.

How Do I Set Up a Crypto Hedge Fund?

Setting up a crypto hedge fund requires a lot of preparation and research. First, you’ll need to decide what type of fund you want to create and what strategies you’ll use. You’ll also need to develop a legal and compliance framework, including registering with the appropriate regulatory bodies. Additionally, you’ll need to create a robust operational structure and develop a strategy for recruiting and retaining qualified investors.

What are the Benefits of Starting a Crypto Hedge Fund?

There are numerous benefits of starting a crypto hedge fund. First, it allows investors to access the rapidly growing digital asset class, while simultaneously taking advantage of the expertise of experienced fund managers. Additionally, it can be a highly profitable venture, as crypto hedge funds have the potential to generate substantial returns.

What are the Risks of Starting a Crypto Hedge Fund?

As with any investment venture, there are risks associated with starting a crypto hedge fund. The primary risk is the volatility of the digital asset market, which can lead to rapid losses. Additionally, there are regulatory risks, as many jurisdictions have not yet established clear regulations for crypto hedge funds.

What are the Costs of Starting a Crypto Hedge Fund?

The cost of starting a crypto hedge fund will vary depending on the type of fund and its operational structure. Generally speaking, the cost of setting up a crypto hedge fund will include legal fees, compliance costs, technology infrastructure costs, and marketing expenses. Additionally, you may need to hire experienced staff to manage the fund and develop the necessary operational strategy.

In conclusion, starting a crypto hedge fund requires a significant amount of research, planning, and dedication. It is important to have a clear understanding of the market, the latest technologies, and the legal and regulatory requirements. Building a strong team with diverse skills and experience is also essential for the success of your hedge fund.

While the crypto industry is still relatively new and rapidly evolving, it presents a unique opportunity for investors and entrepreneurs to tap into a growing market. By following the right steps, you can create a successful crypto hedge fund that delivers strong returns for your investors and helps to shape the future of the industry. With the right mindset and approach, you can turn your passion for crypto into a thriving business.