As the world becomes increasingly digital, so do our financial transactions. Cryptocurrencies have emerged as a popular alternative to traditional currencies, enabling people to conduct secure and anonymous transactions online. However, one question that often arises in the cryptocurrency world is who facilitates these transactions? Enter the market maker, a key player in the world of cryptocurrency trading.

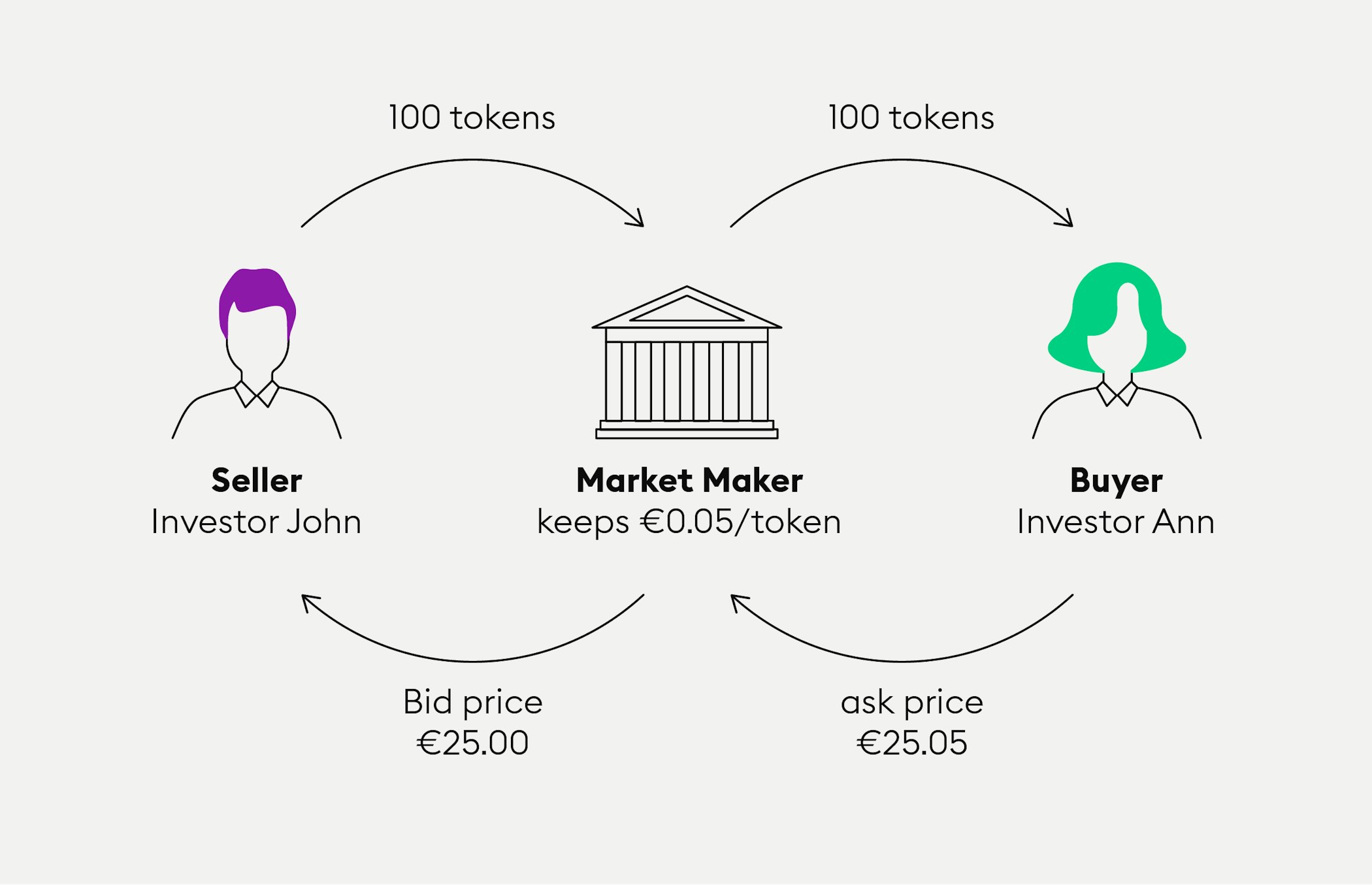

In simple terms, a market maker is an individual or a firm that helps to maintain liquidity in a particular market by buying and selling assets, such as cryptocurrencies, at bid and ask prices. The market maker does this by constantly providing buy and sell prices for a particular asset, which ensures that there is always a buyer or seller available at any given time. In the world of cryptocurrency, market makers play a crucial role in maintaining a stable and liquid market, making it easier for traders to buy and sell their cryptocurrencies.

A market maker in cryptocurrency is a trader, investor or institution that provides liquidity to the digital asset market by placing buy and sell orders in the order book. Market makers are usually compensated for the risk they take by receiving a rebate when they place the order. Market makers may also benefit from a reduction in transaction fees.

What is a Market Maker Crypto?

Market Maker Crypto is an online service that facilitates the buying and selling of cryptocurrency. The service uses a system of market makers, which are companies that specialize in providing liquidity to the cryptocurrency markets. Market makers provide liquidity by taking both sides of the trade, and they are the ones that are responsible for providing the market with the best prices.

How Does Market Maker Crypto Work?

Market Maker Crypto works by providing liquidity to the cryptocurrency markets. The market makers take both buy and sell orders from traders and attempt to match them together in order to create a market. The market makers provide liquidity by allowing traders to trade without needing to wait for an order to be filled. This helps to keep the market liquid and allows for more efficient trading.

Market Maker Crypto Fees

Market Maker Crypto charges a fee for each trade that is executed. This fee is typically a small percentage of the trade size and is used to cover the cost of providing liquidity. The fees are typically very low, and they are one of the primary reasons why Market Maker Crypto is an attractive option for traders.

Benefits of Using Market Maker Crypto

Using a Market Maker Crypto provides a number of benefits to traders. The most notable benefit is the ability to access liquidity quickly and efficiently. Market makers are able to provide the best prices on the market, which allows traders to make quick and profitable trades. Additionally, the fees are typically low, which allows traders to keep more of their profits.

Risks of Using Market Maker Crypto

There are some risks associated with using Market Maker Crypto. The most notable risk is the potential for market manipulation. Market makers have the ability to move prices in their favor, which can lead to losses for traders. Additionally, the fees associated with Market Maker Crypto can add up quickly if trades are not carefully managed.

How to Choose a Market Maker Crypto

When choosing a Market Maker Crypto, it is important to consider a number of factors. The most important factor is the reputation of the company. It is important to make sure that the company is reliable and trustworthy. Additionally, it is important to consider the fees that are charged by the company and to make sure that they are competitive. Finally, it is important to make sure that the company has a good customer service record and is able to provide support when needed.

Frequently Asked Questions

A market maker crypto is a type of trader that provides liquidity to a certain cryptocurrency market. Market makers play an important role in the cryptocurrency markets by providing liquidity and smoothing out the order book by filling buy and sell orders.

What is a market maker crypto?

A market maker crypto is a trader that provides liquidity to a cryptocurrency market. They do this by placing limit orders on both the buy and sell sides of the order book, allowing buyers and sellers to transact with each other. Market makers are important participants in the crypto markets as they provide much-needed liquidity and help to smooth out the order book.

Market makers can also provide additional services such as hedging and arbitrage, which can help to increase overall market efficiency. By providing these services, market makers help to make the cryptocurrency markets more efficient and accessible for all participants.

What is the role of a market maker crypto?

The main role of a market maker crypto is to provide liquidity to the market. By placing limit orders on both sides of the order book, they can provide a source of liquidity for buyers and sellers. This helps to make the market more efficient as it allows buyers and sellers to transact with each other without having to wait for an order to be filled.

Market makers also provide additional services such as hedging and arbitrage. By providing these services, market makers can help increase the overall efficiency of the market. By helping to reduce volatility and spread the risk between buyers and sellers, market makers can help to make the market more accessible for all participants.

What are the benefits of market making crypto?

The main benefit of market making crypto is that it provides liquidity to the market. By providing a source of liquidity, market makers can help to make the market more efficient and accessible for all participants. This can help to reduce volatility and spread the risk between buyers and sellers.

Market makers also provide additional services such as hedging and arbitrage. By providing these services, market makers can help to reduce volatility and make the market more accessible for all participants. This can also help to make the market more efficient as it can reduce the spread between bid and ask prices.

What risks are associated with market making crypto?

The main risks associated with market making crypto are the potential for sudden price movements and the risk of losses due to liquidity shortages. As market makers provide liquidity to the market, they can be exposed to sudden price movements that can lead to losses. Additionally, market makers can also be exposed to liquidity shortages, which can occur if buyers or sellers are unable to transact with each other due to a lack of liquidity.

In order to mitigate these risks, market makers should have a risk management strategy in place. This can include setting stop losses and having adequate capital reserves to cover any potential losses. Additionally, market makers should also be aware of the market conditions and be prepared to adjust their strategies accordingly.

What skills are needed to be a successful market maker crypto?

In order to be successful as a market maker crypto, a trader needs to have a good understanding of the markets and the tools available to them. They should also have a good understanding of risk management and how to mitigate potential losses. Additionally, a successful market maker crypto should also have a good understanding of technical and fundamental analysis, as well as being able to read and interpret market signals.

It is also important for a market maker crypto to have strong discipline and the ability to remain calm in volatile markets. They should also be able to adapt their strategies and adjust to changing market conditions. Finally, a successful market maker crypto should also be able to set realistic goals and have a good understanding of the risks associated with market making.

Before You Trade Bitcoin, You Need To Know The Market Maker

In conclusion, market makers play a critical role in the world of cryptocurrency trading. These entities provide liquidity to the market by constantly buying and selling assets, ensuring that there are always buyers and sellers available for any given cryptocurrency. Without market makers, the market would be much less efficient and more volatile, making it difficult for investors and traders to make informed decisions.

If you’re thinking about investing in cryptocurrency, it’s essential to understand the role of market makers and how they impact the market. By working with reputable exchanges and understanding the market dynamics, you can make informed investment decisions and take advantage of the opportunities that the crypto market has to offer. With the right knowledge and strategy, you can navigate the world of cryptocurrency trading with confidence and potentially achieve significant returns on your investment.