Dental insurance can be a lifesaver when it comes to managing the costs of dental care. However, it can be confusing to navigate, especially when it comes to understanding what “out of network” means for your coverage. Out of network refers to dental care providers who are not contracted with your insurance company. This means that if you choose to receive treatment from an out of network provider, your insurance may not cover the entire cost of the procedure.

Many dental insurance plans have a network of dentists who have agreed to provide services to plan members at a discounted rate. These dentists are considered “in network” providers. However, if you choose to see a dentist who is not in your plan’s network, you may have to pay more out of pocket for the same procedure. Understanding how out of network coverage works is crucial when selecting a dental insurance plan and finding a provider that meets your needs and budget. In this article, we will take a closer look at what out of network means for dental insurance coverage and how it can impact your dental care expenses.

What Does Out of Network Mean for Dental Insurance?

When an individual has dental insurance, there are likely terms and conditions that are associated with the coverage. One of the most important terms to understand is the concept of “out of network.” Knowing what this means can help an individual save money and get the most out of their dental insurance.

What is Out of Network?

Out of network simply refers to a dentist or other provider that is not a part of the insurance company’s network. In most cases, insurance companies have negotiated rates with specific providers in order to offer more affordable coverage. When an individual uses a provider that is out of network, they may pay more out-of-pocket expenses than they would for an in-network provider.

For example, if an insurance company has negotiated a rate of $100 for a particular service and the provider charges $150 for the same service, the individual would be responsible for paying the additional $50. Depending on the insurance plan, the individual may be responsible for the entire $150 if they use an out of network provider.

What are the Benefits of Choosing an In-Network Provider?

Using an in-network provider provides the most cost savings for an individual. These providers have agreed to accept the negotiated rate that the insurance company has set. This can save the individual money, as they will not be responsible for additional costs that may be associated with using a provider that is not in the network.

In addition to saving money, using an in-network provider can also provide the individual with more convenience. These providers are typically located in close proximity to the individual’s home or workplace. This makes it easier to schedule appointments and ensure that the individual can get the care they need.

How Can an Individual Find an In-Network Provider?

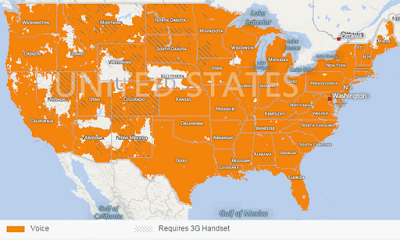

Insurance companies typically provide lists of in-network providers on their websites. These lists can be searched by location, specialty, or other criteria. This makes it easy for an individual to find a provider that meets their needs.

It is also possible for individuals to call their insurance company and ask for a list of in-network providers. The company may also be able to provide information on the services that are covered by the insurance plan and any additional costs that may be associated with using an out-of-network provider.

Frequently Asked Questions

Out-of-Network dental insurance is a type of coverage that reimburses you for dental services you receive from providers who are not part of the network of providers your insurer has contracted with. This can include dentists, specialists, labs, and other providers.

What is Out-of-Network Dental Insurance?

Out-of-Network dental insurance is a type of coverage that reimburses you for dental services you receive from providers who are not part of the network of providers your insurer has contracted with. This can include dentists, specialists, labs, and other providers. With Out-of-Network coverage, you may still be eligible for reimbursement for services, but the amount may be lower than if the provider was in-network.

What are the Benefits of Out-of-Network Dental Insurance?

Out-of-Network dental insurance can be beneficial in a number of ways. One of the biggest advantages is that it provides you with more flexibility in choosing a provider. You may be able to find a provider that offers better services or more convenient hours than an in-network provider. It can also save you money, since you can potentially receive a higher amount of reimbursement than if you went with an in-network provider.

What are the Disadvantages of Out-of-Network Dental Insurance?

The main disadvantage of Out-of-Network dental insurance is that the amount of reimbursement you receive may be lower than if the provider was in-network. Additionally, there may be additional paperwork and preauthorizations that need to be completed in order to receive reimbursement for services. Furthermore, you may be required to pay for services upfront and then file a claim for reimbursement.

How Do I Know if a Provider is In-Network or Out-of-Network?

The easiest way to determine if a provider is in-network or out-of-network is to contact your insurance company. Most insurance companies will have an online directory where you can search for providers that are in-network. Additionally, you can contact the provider directly to ask if they are in-network or out-of-network.

Will My Insurance Company Cover Out-of-Network Services?

It depends on your insurance plan. Some insurance plans will cover Out-of-Network services, but at a lower rate of reimbursement than In-Network services. Additionally, there may be additional paperwork and preauthorizations that need to be completed in order to receive reimbursement for services. It is important to check with your insurance company to determine what is covered and what is not.

In conclusion, understanding what out of network means for dental insurance is important for anyone looking to utilize their dental benefits effectively. It’s essential to know the difference between in-network and out-of-network providers, and what that means for your coverage and costs. While in-network providers offer lower fees and better coverage, out-of-network providers may offer services not available in-network. However, it’s essential to check with your insurance provider to know what is covered and what you’ll be responsible for paying when you see an out-of-network provider.

In summary, taking the time to understand the intricacies of your dental insurance plan can save you money and provide you with the best possible dental care. Be sure to read the fine print and ask questions before choosing a provider to ensure you get the most out of your dental insurance. By being informed and proactive, you can make the most of your dental benefits and keep your smile healthy and happy for years to come.