As a merchandiser, one of the most important tasks you face is determining your net income. Net income is the profit you make after all expenses have been deducted from your revenue. It’s a crucial metric that helps you understand your financial health and make informed decisions about your business. However, computing net income can be a daunting task, especially if you’re new to the world of accounting.

In this article, we’ll explore the different components that go into calculating net income for a merchandiser. We’ll break down each step of the process, from calculating revenue to deducting expenses, and provide helpful tips to ensure you get an accurate and comprehensive picture of your financial performance. Whether you’re a seasoned merchandiser looking to brush up on your accounting skills or a newbie trying to navigate the complex world of finance, this article has got you covered. So let’s dive in!

Net income for a merchandiser is computed by subtracting total expenses from total revenue. The total expenses include the cost of goods sold, operating expenses and taxes. The total revenue includes all sales, returns and discounts.

To calculate net income, begin by subtracting the cost of goods sold from total revenue. Then subtract operating expenses such as rent, wages, marketing, and overhead from the result. Finally, subtract taxes from the result to calculate the net income.

Understanding Net Income for a Merchandiser

Net income is an important metric for any business, and especially for a merchandiser. It is the difference between total revenue and total expenses, and it is the overall measure of a company’s financial performance. Understanding how to compute net income is essential for any merchandiser, and this article will explain the process in detail.

Calculating Total Revenue

The first step in calculating net income for a merchandiser is to calculate total revenue. Total revenue is the total amount of money that a company brings in from its sales. This includes both the sales of products and services. It is important to note that total revenue includes all income from sales, including taxes, discounts, and other fees.

The next step is to subtract any discounts, taxes, or other fees from total revenue. This will give you the net revenue, which is the total amount of money that a company actually earns from its sales. This number can then be used to calculate the net income for a merchandiser.

Calculating Total Expenses

The next step in calculating net income for a merchandiser is to calculate total expenses. Total expenses are all of the costs associated with running a business, including labor costs, overhead costs, materials costs, and other expenses. It is important to note that total expenses do not include any taxes, discounts, or other fees.

The next step is to subtract total expenses from total revenue. This will give you the net income, which is the overall measure of a company’s financial performance. This number can then be used to measure the success of a business.

Calculating Taxes

The final step in calculating net income for a merchandiser is to calculate taxes. Taxes are a deduction from a company’s net income and can vary depending on the company’s tax rate. It is important to note that taxes are not included in total revenue or total expenses, but rather are a deduction from the total amount of net income.

Once all of the above steps have been taken, the net income for a merchandiser can be determined. This is the total amount of money that a company actually earns from its sales, minus any taxes, discounts, or other fees. Understanding how to calculate net income is essential for any merchandiser, and this article has explained the process in detail.

Frequently Asked Questions

Net income, also known as net profit or the bottom line, is the amount of money a business has after all of its expenses have been deducted from its total revenue. Computing the net income of a merchandiser is a process that involves using the company’s financial statements and computations.

What is net income?

Net income is the amount of money a business has after all of its expenses have been deducted from its total revenue. Net income can be used to measure the financial performance of a business, as well as to calculate the return on investment for a business. It is typically reported on a company’s income statement.

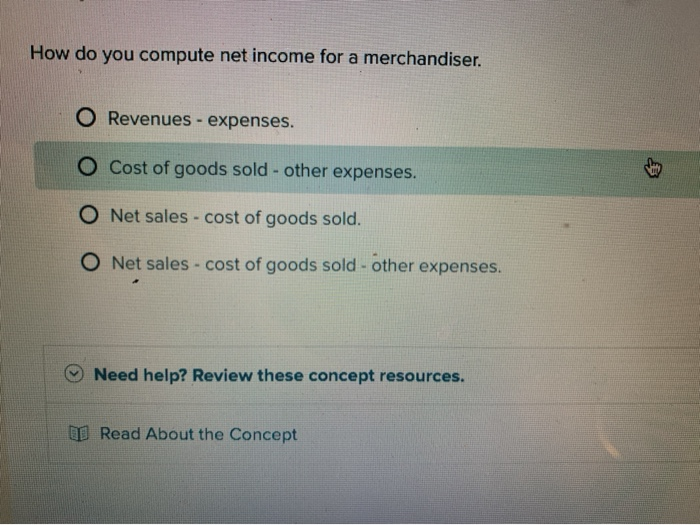

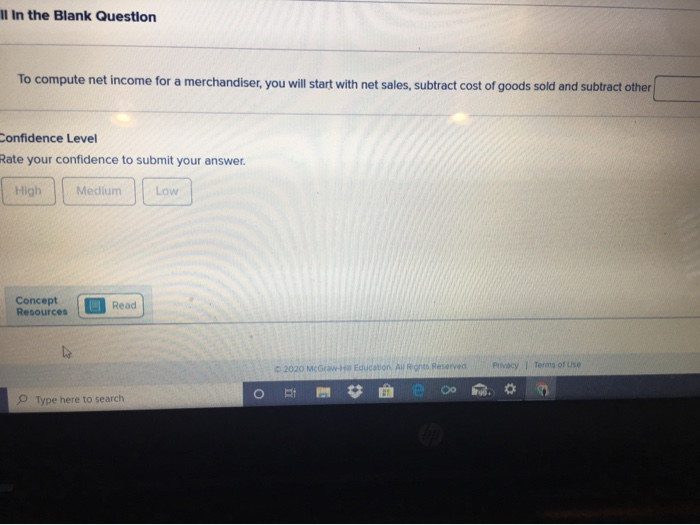

How do you compute net income for a merchandiser?

To compute net income for a merchandiser, you need to begin by looking at the company’s income statement. This document will provide the total revenue and total expenses of the company. You can then subtract the total expenses from the total revenue to calculate the net income. It is important to note that some expenses, such as taxes and depreciation, may be reported on other financial statements and must be accounted for when calculating net income.

What other factors need to be taken into consideration when computing net income?

When computing net income, it is important to take into consideration any non-operating income or expenses. These include items such as gains or losses on the sale of assets, income from investments, or any other income or expenses that are not related to the day-to-day operations of the business. Additionally, any income taxes or other taxes must be accounted for when calculating net income.

What is the difference between net income and gross income?

Net income and gross income are two terms used to refer to the amount of money made by a business. Gross income is the total amount of money made by the business before any deductions, such as taxes, are taken out. Net income is the amount of money the business has after all of its expenses have been deducted from its total revenue.

What is the importance of net income?

Net income is an important measure of a business’s financial performance and is typically reported on its income statement. Net income can be used to measure the overall profitability of a business, as well as to calculate the return on investment for a business. It also serves as a key indicator of the company’s health, as it shows how much money the business actually has after expenses.

Let’s Enjoy School: Calculate Net Income in a Merchandising Company

In conclusion, computing net income for a merchandiser is a crucial aspect of any business operation. It helps in evaluating the financial health of the organization and making informed decisions regarding future investments. By subtracting the cost of goods sold and operating expenses from the total revenues earned, businesses can determine their net income and assess whether they are generating profits or incurring losses.

Overall, understanding the concept of net income is essential for any merchandiser. With accurate calculations and proper analysis, businesses can make informed decisions about pricing strategies, inventory management, and expansion plans. By keeping a close eye on their net income, merchandisers can ensure long-term success and profitability.