Cryptocurrency has been making waves in the financial world for the past decade, and with its increasing popularity, more and more people are interested in getting involved. One of the most popular platforms for trading cryptocurrencies is Binance, which has gained a reputation as one of the most user-friendly and reliable exchanges in the market. However, new traders may wonder whether they can short on Binance, and how to go about doing so.

Shorting is a trading strategy that involves betting on the price of an asset to decrease, rather than increase. This can be a profitable strategy in a bear market, or when there is a specific negative event that could impact the value of an asset. In this article, we will explore whether shorting is possible on Binance, and how to do it effectively. Whether you are a seasoned trader or a beginner looking to dip your toes into the world of cryptocurrency trading, this guide will provide you with all the information you need to get started.

Can You Short On Binance?

Binance is one of the leading cryptocurrency exchanges and is the world’s largest by trading volume. It offers an array of features, including margin trading, which allows users to borrow money to trade digital assets. Does this mean that you can short on Binance? Read on to find out.

What Is Short Selling?

Short selling is a trading strategy in which an investor borrows and sells an asset, expecting the price to drop. The investor then repurchases the asset and returns it to the lender, pocketing the difference between the borrowed price and the repurchase price. Short selling can be a risky strategy, as the investor may be exposed to unlimited losses if the asset’s price rises.

In order to short sell, investors must have access to margin trading. Margin trading is a type of trading in which an investor borrows funds from a broker to trade assets. The investor can then buy and sell assets with the borrowed money and make a profit if the price of the asset moves in the anticipated direction.

Can You Short On Binance?

Yes, you can short on Binance using margin trading. Binance offers margin trading on a select number of trading pairs, allowing users to borrow funds to open short positions. However, it is important to keep in mind that margin trading can be risky and investors should only trade with money they can afford to lose.

In order to open a short position on Binance, you must first enable margin trading. This can be done by going to the Margin tab in the Binance dashboard and clicking on the “Enable Margin Trading” button. Once margin trading has been enabled, you can open a short position on a trading pair by clicking on the “Sell” button next to the pair in the Margin tab.

What Are The Risks?

Short selling is a risky strategy and investors should be aware of the potential losses they may incur. Binance does not guarantee profits and investors can be exposed to unlimited losses if the asset’s price rises. Additionally, margin trading can be volatile and investors should not invest more than they can afford to lose.

It is also important to keep in mind that Binance charges a fee for margin trading. This fee is calculated on a per-trade basis and can vary depending on the trading pair being traded. It is important to be aware of these fees as they can have a significant impact on your profits or losses.

Conclusion

Yes, you can short on Binance using margin trading. However, it is important to keep in mind that short selling is a risky strategy and investors can be exposed to unlimited losses if the asset’s price rises. Additionally, Binance charges a fee for margin trading, which can have a significant impact on your profits or losses. As such, it is important to do your research and only invest money you can afford to lose.

Frequently Asked Questions

Binance is a global cryptocurrency exchange that provides a platform for trading more than 100 cryptocurrencies. With Binance, you can short a wide range of digital assets, including Bitcoin, Ethereum, and other altcoins.

Can I Short on Binance?

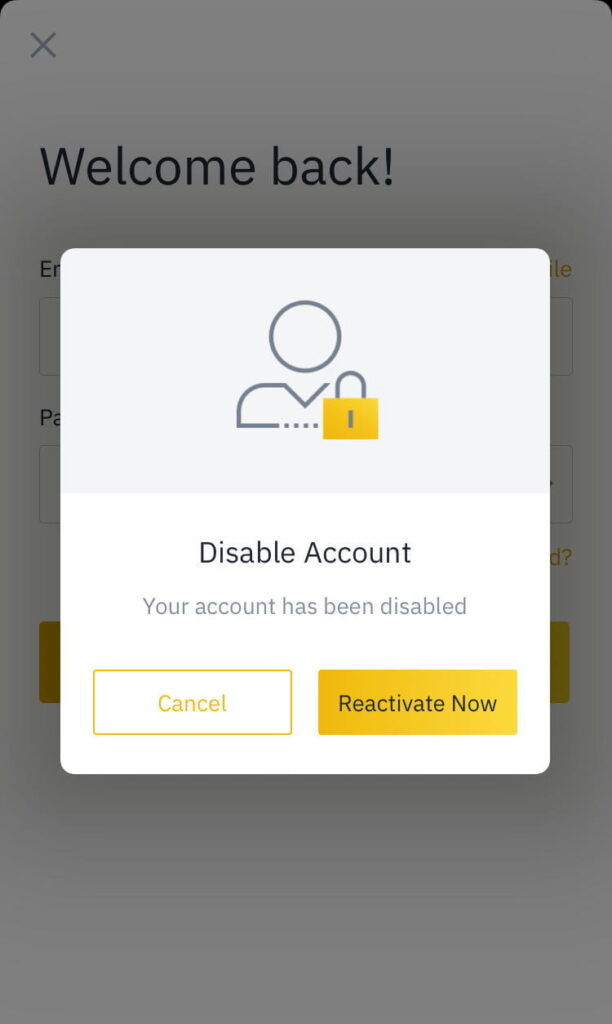

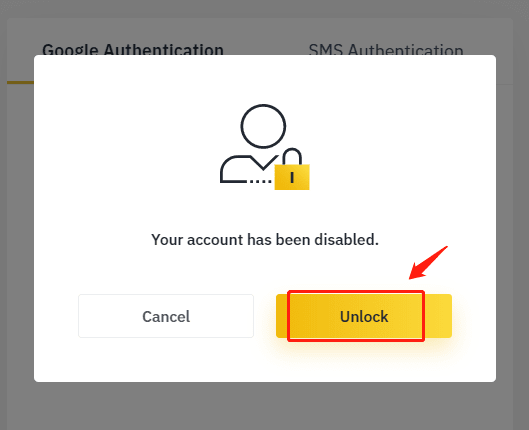

Yes, you can short on Binance. This means that you can open a position that will benefit if the value of the asset you are trading decreases. To short on Binance, you will need to open a margin account and transfer funds from your spot wallet to your margin wallet. Once the funds are transferred, you will be able to open a margin position.

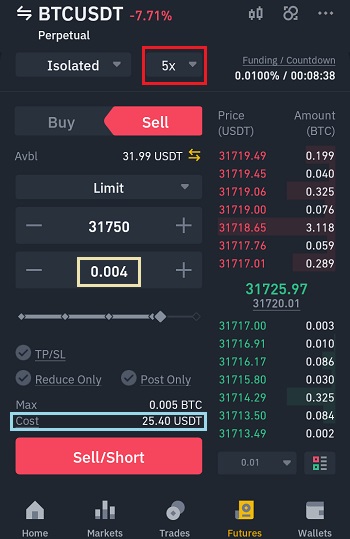

When you open a margin position, you need to select the type of order you want to submit, the amount of the asset you want to buy or sell, and the leverage you want to use. You can choose up to 5x leverage for most assets. When you open a margin position, you will need to pay a funding fee, which goes to other traders on the platform who provide liquidity. If your margin position is profitable, you can choose to close the position and take your profits. However, if the value of the asset you are trading goes against you, you need to close the position manually or add extra funds to keep it open.

How to Short on Binance (Step by Step)

In conclusion, shorting on Binance is a viable option for traders looking to profit from a decline in cryptocurrency prices. However, it is important to note that shorting involves taking on a significant amount of risk and should only be attempted by experienced traders who have a thorough understanding of the market. Proper risk management strategies should also be in place to minimize potential losses.

Overall, Binance provides a user-friendly platform for shorting cryptocurrencies, with a variety of features and tools to aid traders in their endeavors. As with any investment, it is important to do your research and seek professional advice before making any decisions. By staying informed and diligent, traders can potentially profit from both bullish and bearish market conditions on Binance.