The rise of Bitcoin and other digital currencies has ushered in a new era of blockchain technology. Many believe that decentralized financial solutions may eventually replace traditional financial services. While the future remains uncertain, a new competition is emerging within the blockchain ecosystem, known as “DeFi vs CeFi” or “centralized vs decentralized cryptocurrency.”

Centralized exchanges (CeFi) have long been the norm for cryptocurrency trading, but decentralized finance (DeFi) is gaining traction among investors who value decentralization and control over their assets. Will CeFi lose its appeal to DeFi? Only time will tell as we compare the two.

What Sets DeFi Apart from CeFi?

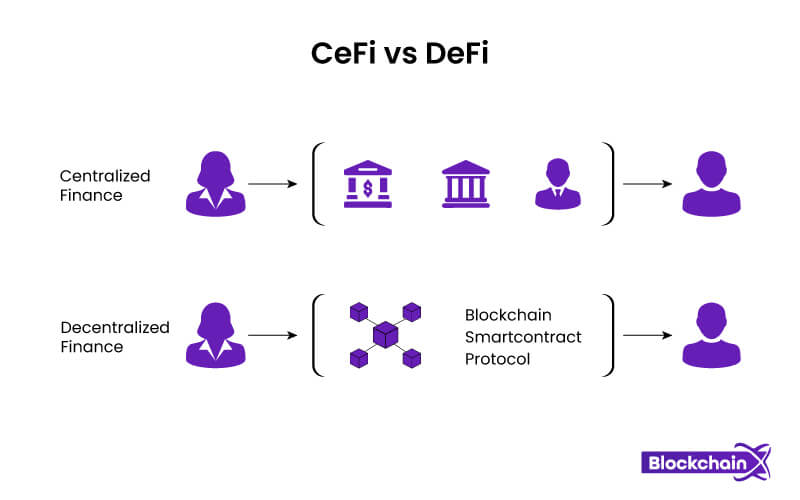

The fundamental difference between DeFi and CeFi lies in whether users place their trust in technology or in people.

DeFi users trust in the technology to execute services as intended, while CeFi users rely on a company’s personnel to manage funds and provide services.

Both DeFi and CeFi offer a range of cryptocurrency financial services, each with unique characteristics and examples that distinguish them from one another.

Understanding DeFi (Decentralized Finance)

DeFi represents a global, open financial system that emphasizes transparency and accessibility in the financial market. It encompasses trading, insurance, lending, staking, payments, and other services without the need for a central authority.

DeFi blockchains enable peer-to-peer transactions, eliminating the need for intermediaries and enhancing accessibility and community engagement.

Key Characteristics of DeFi

Trustless – DeFi offers trustless transactions, allowing users to verify transactions and services independently.

Permissionless – DeFi platforms are open to anyone worldwide without the need for approval, fostering inclusivity and community participation.

Quick Innovation – DeFi is known for its rapid development and innovative financial services.

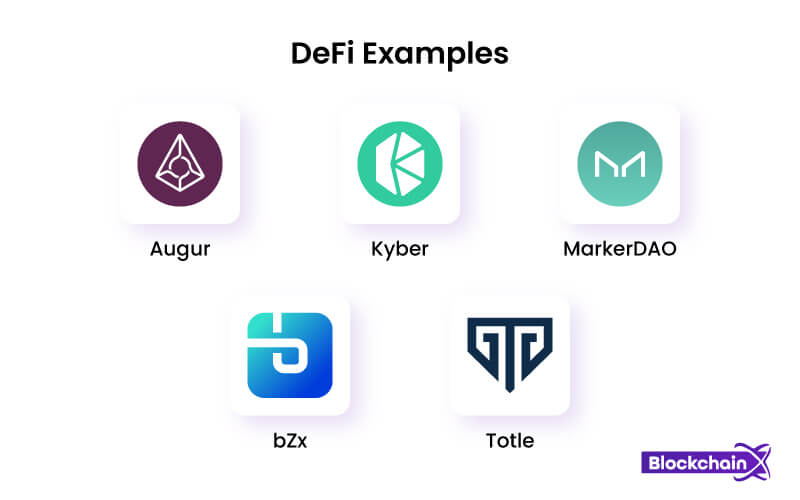

Examples of DeFi Platforms

Totle

A decentralized liquidity aggregator with automatic price optimization.

Augur

A decentralized prediction market.

Nexus Mutual

A decentralized insurance platform.

Kyber

A decentralized exchange.

MakerDAO

A platform for minting and lending decentralized stablecoins.

bZx

A platform for decentralized margin lending and trading.

Understanding CeFi (Centralized Finance)

CeFi refers to the practice of entrusting centralized companies, such as cryptocurrency exchanges, with the storage and management of funds. Most CeFi platforms adhere to KYC and AML regulations to prevent illicit activities.

While CeFi platforms offer convenience and customer support, users have limited control over their assets and must comply with regulations.

Key Characteristics of CeFi

Seamless Customer Support – CeFi platforms provide dedicated customer support and account management.

Flexible Conversion – CeFi facilitates fiat-to-crypto conversions with user-friendly platforms like Coinbase.

Interoperability – CeFi supports lending, trading, and payment services across multiple blockchain networks.

Cross-Chain Swaps – CeFi enables cryptocurrency trading across different blockchain platforms, simplifying asset custody and management.

Centralized Exchange (CEX) – CEX platforms offer centralized management of assets without blockchain transaction costs.

Examples of CeFi Platforms

Coinbase

A cryptocurrency exchange offering trading, borrowing, lending, and payment services.

FairlayIt

A cryptocurrency prediction market based on CeFi principles.

BlockFi

A platform for lending and borrowing cryptocurrencies and fiat.

Celsius

A platform for cryptocurrency lending and borrowing.

Ledn

An insured Bitcoin-to-DAI lending platform.

Libra

A global financial infrastructure and cryptocurrency platform.

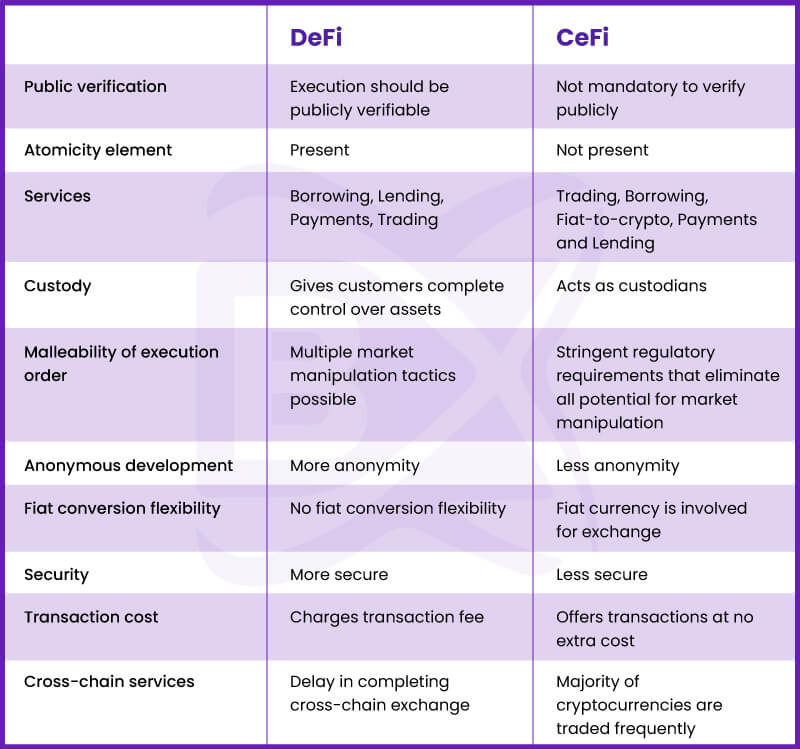

DeFi vs CeFi: Key Differences

While DeFi and CeFi both aim to promote blockchain adoption, they differ in their approach. Each offers unique benefits and drawbacks, catering to diverse user preferences and needs.

Both centralized and decentralized finance play essential roles in the blockchain ecosystem, offering distinct advantages to users. Whether you prioritize privacy and transparency or flexibility and shared risk, there’s a financial system that suits your preferences.

In Summary

Centralized and decentralized financial systems share a common goal of advancing cryptocurrency adoption and innovation. While they operate differently, both DeFi and CeFi contribute to the growth of the blockchain industry, each catering to a unique set of user needs.