Bitcoin has been trading for more hours than the modern US fiat stock market since the Nixon Shock, but claims of it surpassing the entire history of US stock trading or global fiat would be premature. A closer look reveals a more nuanced perspective on market longevity and trading activity.

The crypto community recently sparked a discussion about Bitcoin accumulating more trading hours than the fiat stock market following an analysis by Cory Bates.

Bates notes that Bitcoin trading has exceeded the fiat stock market, but it’s essential to remember that this doesn’t encompass the entire history of the US stock market. Nonetheless, it can be deduced that Bitcoin trading predates fiat trading in the US, although not globally.

The earliest known use of fiat currency dates back to China during the Song Dynasty (960–1279 CE). This paper money, not backed by physical commodities, gained widespread acceptance for trade and taxation.

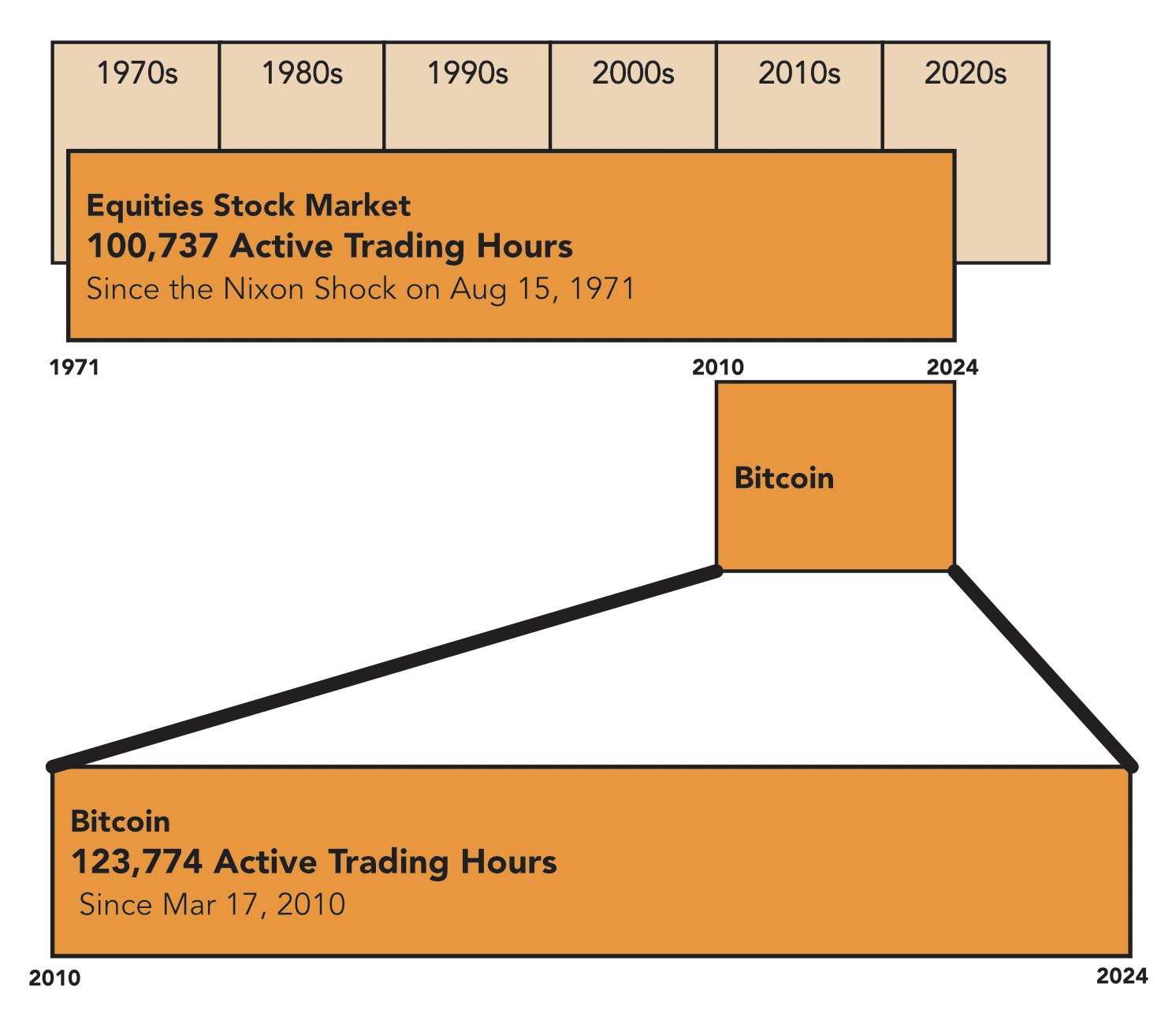

Bitcoin trading hours vs US fiat stock market

Bitcoin, established in 2009, has accumulated 123,774 active trading hours since its inception. This surpasses the 100,737 hours logged by US equities markets since the Nixon Shock in 1971.

However, the US stock market’s history dates back to 1792, with the New York Stock Exchange having a legacy spanning over two centuries.

Calculations based on the NYSE’s founding date reveal approximately 380,509 active trading hours up to September 6, 2024, surpassing Bitcoin’s current tally.

Bitcoin’s 24/7 availability gives it an advantage in accumulating trading hours compared to the traditional stock market’s limited schedule.

Projections suggest that Bitcoin may surpass the total trading hours of the US stock market’s entire history around April 15, 2053, assuming both markets continue operating without disruptions.

However, trading hours alone do not fully capture market depth, liquidity, or economic impact. The US stock market remains a cornerstone of global finance with a breadth of listed companies and trading volume unmatched by Bitcoin.

While Bitcoin has shown progress, the US stock market’s centuries-long history remains a significant benchmark.

A complete history of fiat money trading

Bitcoin’s journey, though rapid, has yet to outlast the cumulative trading hours of America’s stock markets. Additionally, while it has surpassed post-1971 US fiat equities market hours, global fiat trading hours since the inception of organized forex markets are significantly higher.

Modern forex trading operates around 120 hours per week since 1971, estimating approximately 330,720 trading hours for fiat in global markets.

In summary, Bitcoin has exceeded post-1971 US fiat equities market hours but has not surpassed the total global trading hours of fiat currencies, considering modern forex trading and the deep history of fiat globally.

Unless major forex markets open for weekends, Bitcoin could potentially catch up in trading hours. Some brokerages allow limited weekend trading for popular forex pairs.