Tron (TRX) has recently seen a significant price drop of over 12%, but now it seems poised for an upward rally as both its price action and on-chain metrics suggest bullishness. After breaking through a strong resistance level at $0.145, TRX has surged more than 16% without any retests.

Successful Breakout and Retest for Tron

Despite the recent market decline, TRX has successfully retested its breakout area and is now showing signs of upward movement with a strong daily candle.

Currently, TRX is trading around the $0.151 mark, experiencing a price increase of over 3% in the last 24 hours. However, its trading volume has decreased by 17% during the same period, possibly due to the volatility in the market and bearish sentiment.

Price Prediction for Tron

According to technical analysis experts, TRX appears to be bullish unlike many other major cryptocurrencies. It is trading above the 200 Exponential Moving Average (EMA) across four different time frames, indicating an uptrend. Additionally, the formation of a doji candle at the support level and the 200 EMA further reinforce the bullish outlook.

TRX has successfully broken out of a descending trendline and is currently facing a minor resistance level near $0.152. Based on past price momentum, if TRX manages to close a candle above this resistance level, there is a strong possibility of it surging by 10% to reach the $0.167 level.

Bullish On-Chain Metrics

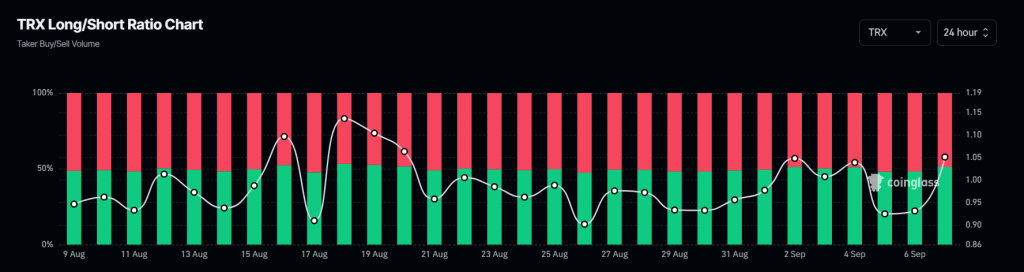

The TRX Long/Short ratio from CoinGlass indicates a bullish sentiment, with the ratio currently standing at 1.0509 (a value above 1 signifies bullish sentiment). Among traders, 51.24% hold long positions while 48.7% are in short positions.

Furthermore, TRX’s open interest has seen an 8% increase in the last 24 hours, indicating a rise in long positions during this period. The combination of a bullish long/short ratio with growing open interest presents a strong buying opportunity. Traders often consider these factors when making long/short decisions.