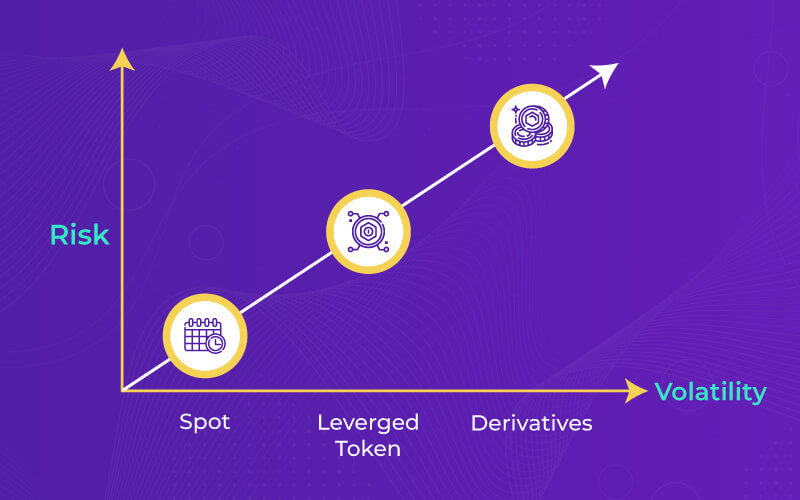

Leverage trading has become a popular term in the digital market. While DeFi lending and borrowing processes are well-known, leveraged trading is gaining traction in the crypto trading world. But what exactly is leverage trading? In simple terms, it is a trading strategy where traders use borrowed funds to increase their potential profits.

For beginners, understanding crypto trading is essential before delving into leverage trading. Let’s explore how leverage can be utilized in crypto trading and its connection to margin trading, which involves using assets as collateral to enhance purchasing power.

It’s crucial to acknowledge both the advantages and drawbacks of leveraged trading. While it can be a lucrative venture, it also comes with significant risks. However, with the right tips and strategies, leveraged trading can be a valuable tool to boost business profits.

Leverage Trading

Leverage and margin trading are often used interchangeably, but there is a distinction between them. Leverage serves as a tool to facilitate margin trading, allowing traders to amplify their market exposure.

Essentially, leverage involves using borrowed funds to potentially increase returns on investment. By borrowing money, investors can expand their buying power in the market, enabling them to capitalize on opportunities that would not be feasible solely with their own funds.

Furthermore, leverage tokens have emerged as a new concept in the crypto market. These tokens, such as the 3X Short Ethereum, operate similarly to other ERC-20 tokens and can serve as risk management tools for traders.

Pros and Cons of Leverage

From a trader’s perspective, leverage trading encompasses both shorting and longing strategies. Shorting involves anticipating a decline in asset value, while longing focuses on expecting an increase in value over time.

Let’s quickly examine the pros and cons of crypto-leveraged trading.

Pros:

Experienced traders can yield higher profits

High reward/risk ratio

Applicable to spot and derivatives markets

Leveraged tokens offer additional opportunities

Cons:

More complex for beginners

High-risk nature

Incur additional fees

Requires understanding of technical indicators

Leverage Margin

Margin trading is a common strategy used by experienced traders to enhance buying power beyond their existing funds. This approach allows traders to enter the market with larger positions and potentially maximize returns on successful trades.

Margin trading enables traders to open multiple positions with lower costs and without compromising position size. However, it comes with higher risks, as losses can exceed the initial investment, especially in volatile market conditions.

Leverage DeFi & Borrowing

Leverage trading extends beyond digital finance and encompasses traditional and crypto finance realms. The primary distinction lies in the borrowing mechanism, where DeFi borrowing typically involves full leverage.

DeFi borrowing and lending have become prevalent in the market, with established players offering these services. Borrowing crypto assets can amplify trading opportunities, allowing traders to leverage their assets for increased exposure.

Limitation of Leverage Trading

While crypto leverage trading offers high reward potential, it also carries significant risks and is considered speculative. Traders must implement robust risk management strategies before engaging in leveraged trading to mitigate potential losses.

It’s essential for traders to approach leverage trading with caution, avoiding impulsive decisions and ensuring they trade within their means. By adhering to sound trading practices and strategies, traders can navigate the complexities of leveraged trading effectively.

Conclusion

In conclusion, leverage trading involves borrowing assets to engage in crypto trading, amplifying potential gains or losses. While leverage can enhance trading opportunities, it also introduces risks that traders must manage effectively. By adopting prudent risk management practices and trading sensibly, traders can harness the power of leverage trading for profitable outcomes.