Solana Latest Update: Despite the market recovery, a crypto wallet associated with bankrupt FTX/Alameda has withdrawn a substantial 177,693 SOL, valued at $23.75 million, from Solana PoS, as reported by SolScan. Traders and investors should monitor this significant fund closely, as its transfer to centralized exchanges (CEXs) has the potential to create notable selling pressure.

FTX-Linked Wallet Raises Concern of Selling Pressure

Currently, Solana traders and investors are intrigued by the reasons behind the unstaking. Once the tokens are unstaked, they may move to CEXs, increasing the SOL reserve on exchanges and potentially causing substantial selling pressure and negative price impacts.

In addition to the significant token withdrawal from staking, the wallet currently holds a considerable 7.057 million SOL, valued at $943 million, in Solana PoS Staking.

Current Price Momentum

At the time of writing, SOL is trading around $135 and has seen a price increase of over 2.85% in the last 24 hours. Interestingly, this significant fund withdrawal did not impact the SOL price. However, its trading volume has decreased by 30% during the same period, indicating reduced participation from traders, possibly due to the recent transaction by the FTX-linked wallet.

Solana Technical Analysis and Upcoming Levels

According to expert technical analysis, SOL is currently encountering a strong resistance level at $138, which it has been struggling with for the past two weeks. Furthermore, it is trading below the 200 Exponential Moving Average (EMA) on a daily timeframe, suggesting a downtrend.

Based on historical price momentum, if SOL closes a daily candle above $138, there is a high chance it could surge by 18% to $163 or even higher, potentially reaching $185. However, this bullish scenario will only materialize if SOL closes a daily candle above $138, otherwise, it may not come to fruition.

Bullish On-chain Metrics

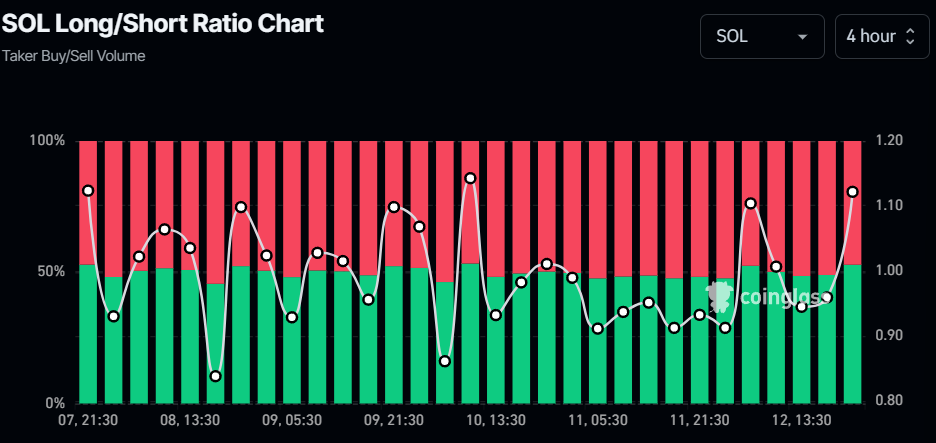

Furthermore, this optimistic outlook is bolstered by on-chain metrics. Coinglass’s SOL Long/Short ratio currently stands at 1.121, indicating a bullish market sentiment. Additionally, 52.86% of the top Solana traders are in long positions, while 47.14% hold short positions.

Meanwhile, SOL’s Future open interest has remained stable in the last 24 hours but has been decreasing since the start of September 2024.