Several cryptocurrency analysts are noting a significant breakout in altcoins, suggesting a potential shift towards an altcoin-dominated market phase. The total market capitalization of altcoins is on the rise, breaking out of long-standing downward trends. On-chain analyst Ali Martinez highlighted that while it’s unclear if a full altcoin season has arrived, the current developments show a promising start.

Analyst Caleb Franzen pointed out that altcoins measured through TradingView indexes like TOTAL.3 and OTHERS have surpassed significant moving averages such as the 100-day and 200-day exponential moving averages (EMAs). Franzen emphasized the importance of monitoring daily closes to confirm this trend. The last similar breakout occurred in July 2023, where altcoins used these EMAs as dynamic support to achieve higher highs.

Negentropic also highlighted the cyclical nature of the crypto market, suggesting that altcoins typically follow Bitcoin’s bullish momentum. The analysis indicates a simultaneous uptick in both Bitcoin and altcoin markets, unlike previous cycles where Bitcoin surged without triggering an altcoin season.

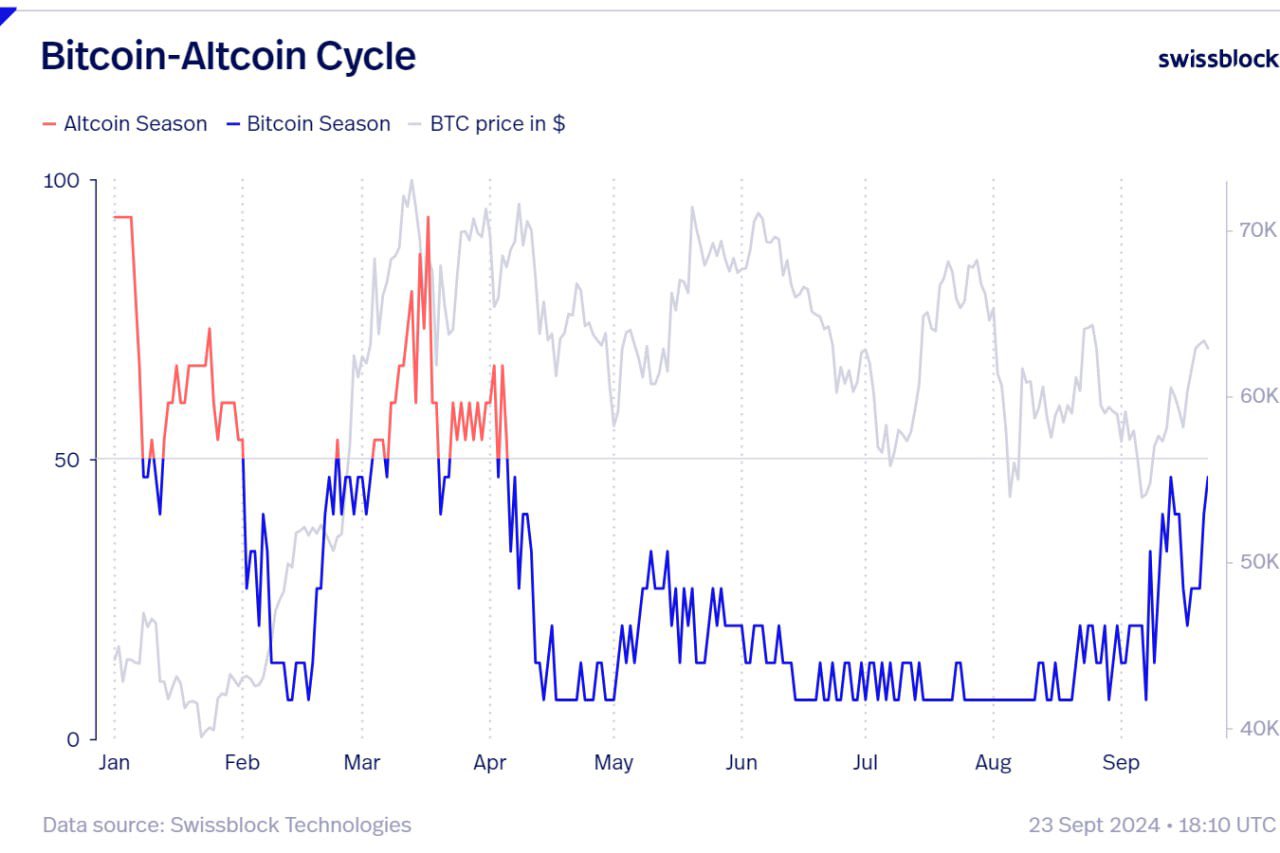

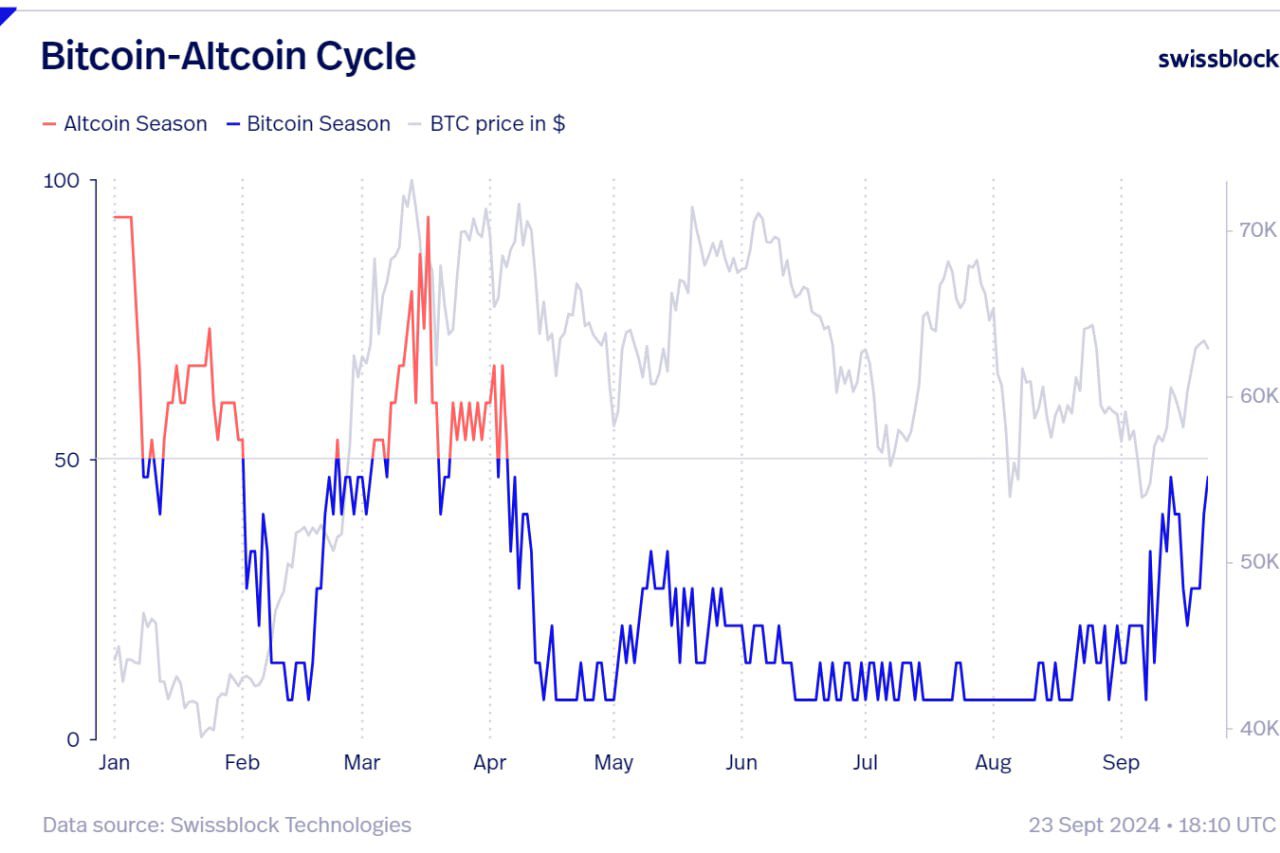

The Bitcoin-Altcoin Cycle chart from Swissblock Technologies illustrates the inverse relationship between Bitcoin and altcoin seasons throughout the year. Currently, the index suggests that altcoins are gaining strength alongside Bitcoin rather than lagging behind as in previous cycles.

Bitcoin season dwarves altcoins so far in 2024

Despite positive signs, altcoins have generally underperformed compared to Bitcoin in the past nine months. While Bitcoin is trading around $64,334, approximately 12.77% below its all-time high, many altcoins remain significantly below their peak prices. This performance gap may be attributed to factors such as regulatory scrutiny, Bitcoin’s market maturity, and institutional interest favoring Bitcoin.

The current breakout in altcoin markets could signal a change in this trend, potentially leading to a more balanced recovery across the wider crypto market. Bitcoin dominance is currently at 57%, slightly down from previous levels, indicating a potential shift in market dynamics.