Investment opportunities are evolving with blockchain technology, real world assets, and Defi. Real estate tokenization is changing the landscape of property investment by leveraging blockchain technology. This platform provides immediate benefits such as fractional ownership, wider investment pool access, and unconstrained opportunities.

Real estate tokenization involves digitizing real estate assets into tradable tokens on the blockchain. This allows asset owners to divide properties into fractions, making them more affordable and easily represented as digital tokens. These tokens can be bought, sold, and traded, providing ownership and authority over high-value properties.

Tokenized real estate assets offer unique selling points in the industry, amplifying asset values and providing fractional ownership, global access, and increased liquidity.

1. Fractional Ownership

Investors can purchase fractional tokens representing ownership of residential, commercial, or industrial properties.

2. Global Access

Real estate tokenization enables investors worldwide to participate in digital real estate markets.

3. Liquidity

Tokenized real estate assets offer increased liquidity compared to traditional investments, as tokens can be bought and sold on secondary markets.

Real estate tokenization ensures legal compliance, transparency, and efficiency through smart contracts, making it a popular and user-friendly investment option.

Owners and investors interact and transact on the real estate tokenization platform, which provides tools for asset token management, transactions, and stakeholder involvement. The platform streamlines processes and ensures security and transparency.

From an admin perspective, the platform focuses on user onboarding, KYC, AML authorization, and showcasing investment opportunities. Transactions are recorded on an immutable ledger.

1. Asset Identification

Property owners identify assets suitable for tokenization, such as commercial buildings or development projects.

2. Tokenization

Chosen assets are tokenized into digital tokens on the blockchain, representing fractions of the property.

3. Investment Opportunity

Investors can purchase tokens on the platform, choosing fractional ownership or whole assets based on their preferences.

4. Income Distribution

Rental income and profits from the property are distributed to token holders based on their ownership percentage.

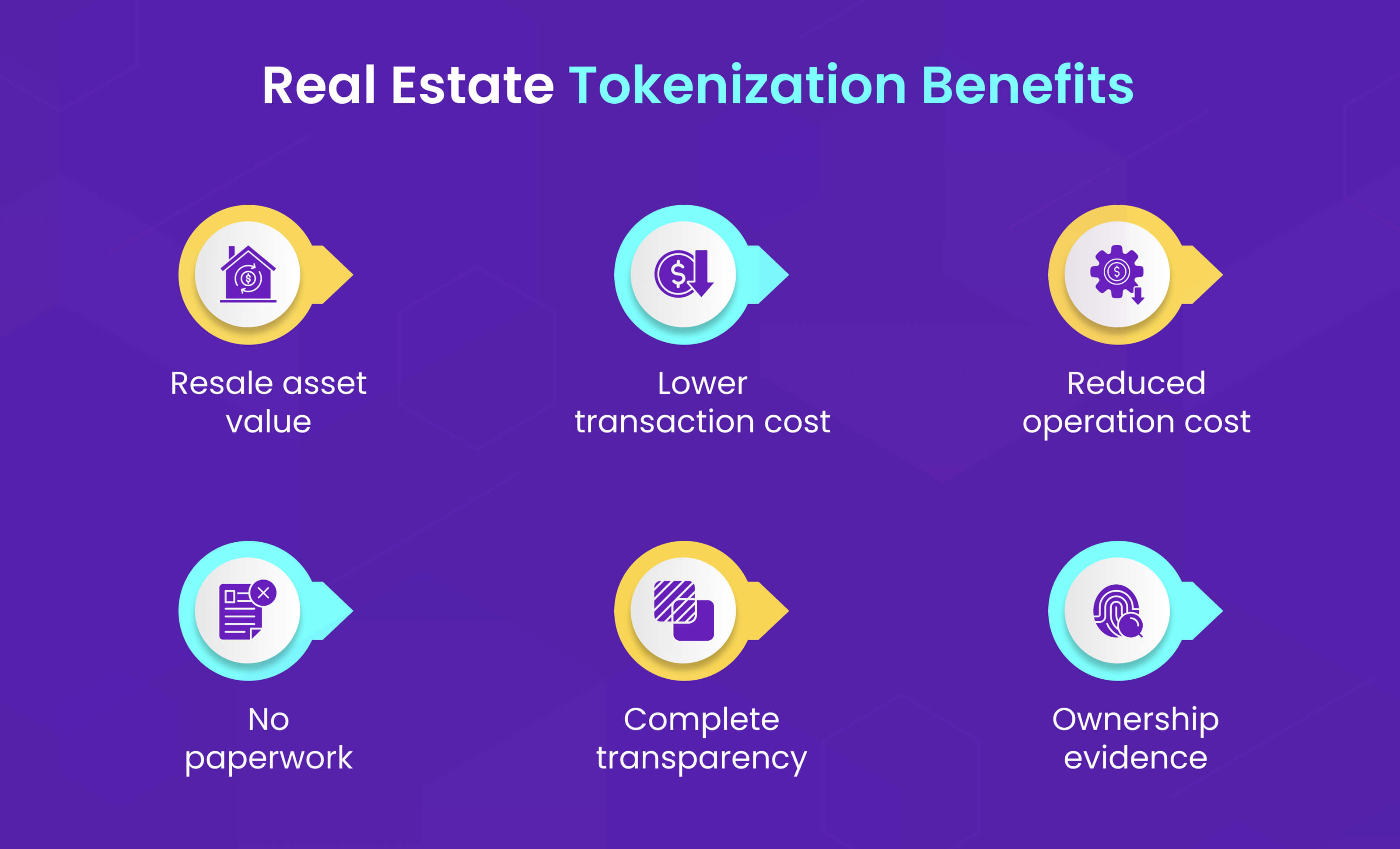

Real estate tokenization offers benefits such as increased liquidity, fractional ownership, and reduced transaction friction, making it a valuable investment option for property owners and investors.

Real estate tokenization faces challenges with regulatory frameworks and market fluctuations, but it holds immense opportunities for democratizing property access and innovating real estate transactions.

Real estate tokenization transforms property transactions with fractional ownership and blockchain technology, benefiting asset owners, investors, and the market. Embrace innovation with BlockchainX to create a customized real estate tokenization platform and unlock new opportunities in the evolving real estate industry.