Amidst the ongoing challenges in the cryptocurrency market, a well-known crypto expert has shared an optimistic outlook for Chainlink (LINK), suggesting that LINK could see a significant surge in the near future.

Chainlink (LINK) Price Prediction

In a recent post on X (formerly Twitter), the expert highlighted the potential for LINK to break out from an ascending triangle pattern within the next 1 to 2 weeks. The expert also mentioned that if the breakout is successful, LINK could reach $18.

LINK Technical Analysis and Upcoming Level

Technical analysis indicates that LINK has been forming an ascending triangle pattern since the beginning of August 2024, with the price currently consolidating within a narrow range. However, further analysis of the daily chart suggests that more time may be needed for the pattern to fully develop.

If LINK manages to break above the resistance level or the neckline of the ascending triangle and close a daily candle above $13, there is a strong possibility of a 15% increase to reach $15.5 initially, and potentially $18 if market sentiment remains positive.

Current Price Momentum

Currently, LINK is trading around $11.07, marking a 4.5% increase in the past 24 hours. The trading volume has also risen by 5%, indicating growing interest from investors and traders.

Despite the positive outlook, LINK has been struggling to gain momentum in recent days, with further challenges expected until it surpasses the $13 level.

Major Liquidation Levels

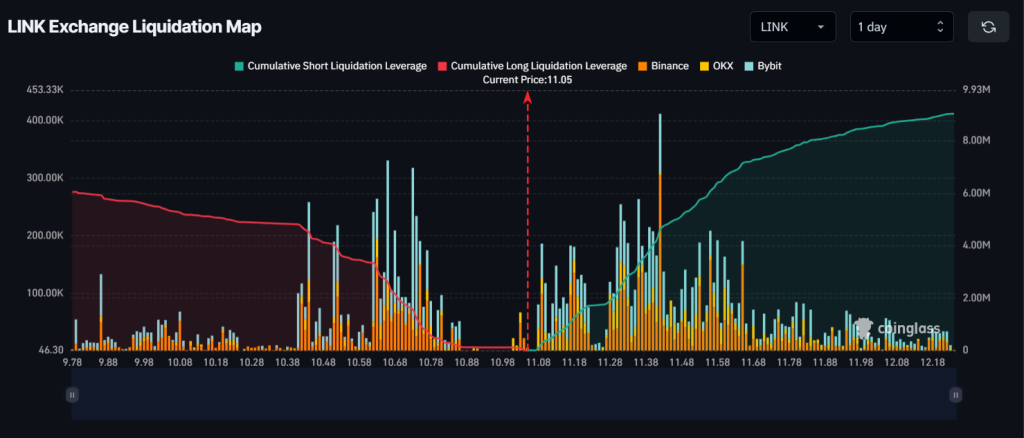

At present, the major liquidation levels are set at $10.66 on the lower end and $11.42 on the upper end, with traders holding significant positions at these levels, as per data from on-chain analytics firm Coinglass.

If the price reaches $11.42, approximately $4.62 million worth of short positions could be liquidated. Conversely, a drop to $10.66 could lead to liquidation of around $2.61 million worth of long positions.

The liquidation data suggests that bears currently have the upper hand, posing a challenge for bulls looking for an upward movement in price.