Ethereum (ETH), the second-largest cryptocurrency in the world by market capitalization, is showing bullish signs and is expected to experience a significant upward movement. This positive price action is supported by favorable on-chain metrics, as well as a notable decrease in Ethereum exchange reserves due to whales and investors moving a substantial amount of ETH off exchanges in the past week.

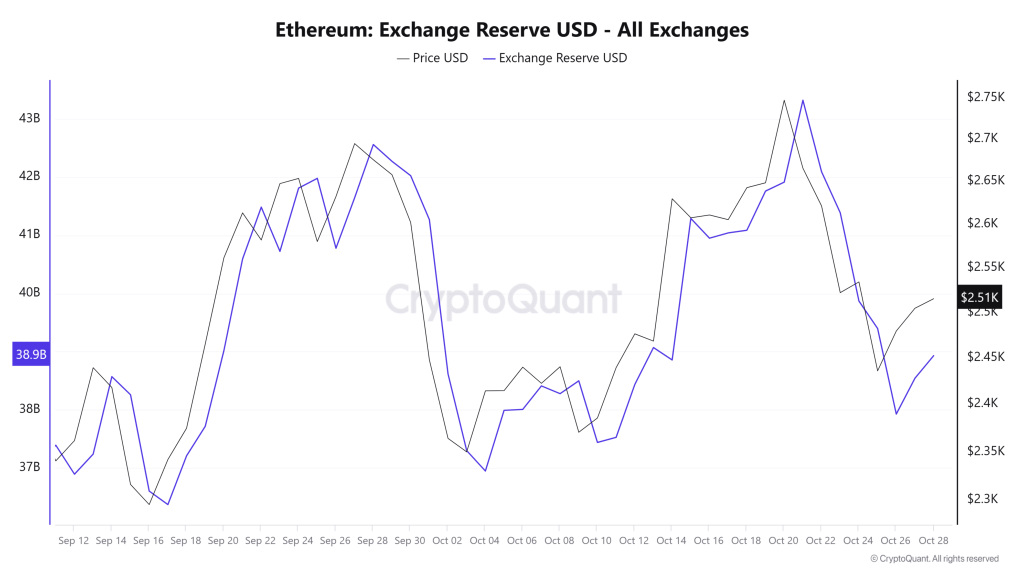

Decline in Ethereum Exchange Reserves

According to CryptoQuant, Ethereum’s exchange reserves have dropped from $42 billion to approximately $38.5 billion, signaling a decline of around $3.5 billion. This decrease in exchange reserves suggests a possible accumulation or acquisition of ETH by large holders or investors.

Furthermore, the reduction in exchange reserves has coincided with a strong support level where Ethereum is currently trading.

Ethereum Technical Analysis and Future Levels

Technical analysis indicates that ETH is in a bullish trend, moving within a bullish channel pattern and forming higher highs and higher lows. Currently, ETH is at the lower boundary of the pattern, creating a higher low.

Based on historical data and price corrections, there is a strong likelihood that Ethereum could surge by 12% to reach the resistance level of $2,800 in the near future. This level not only acts as a resistance point but also aligns with the 200-day Exponential Moving Average (EMA) and the upper boundary of the bullish pattern.

This bullish scenario is contingent on Ethereum maintaining its position above $2,400; otherwise, the rally may falter.

Bullish On-Chain Metrics

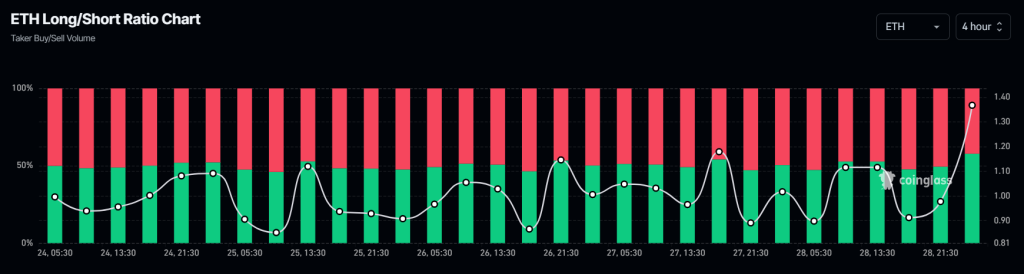

Positive on-chain metrics further reinforce Ethereum’s bullish outlook. According to Coinglass, ETH’s long/short ratio is currently at 1.36 over the last four hours, indicating a strong bullish sentiment among traders. During the same period, 57.76% of top traders have opened long positions, while 42.24% have taken short positions.

ETH’s open interest has increased by 4.9% in the last 24 hours and 3.1% in the last four hours, indicating a growing interest from traders and the formation of new positions.

Considering the bullish on-chain metrics alongside technical analysis, it is evident that bulls are in control of Ethereum and are likely to continue supporting it in the upcoming rally.

Current Price Momentum

At the time of writing, Ethereum is trading around $2,520, with a 24-hour increase of 1.20%. The trading volume has surged by 90% during the same period, indicating increased participation from traders and investors in anticipation of a potential upward movement.