While the next G isn’t quite ready to launch, discussions about 6G have gone through various stages with more to come.

Is 6G becoming outdated?

Having participated in multiple 6G conferences since 2021, there has been much deliberation on the potential of 6G. The shadow of 5G looms large over these conversations, posing both opportunities and challenges.

Many individuals often inquire, “What exactly is 5G?” In response, I often provide a simplified explanation, as most individuals associate 5G solely with smartphones. However, the realm of 5G technologies extends far beyond the consumer market.

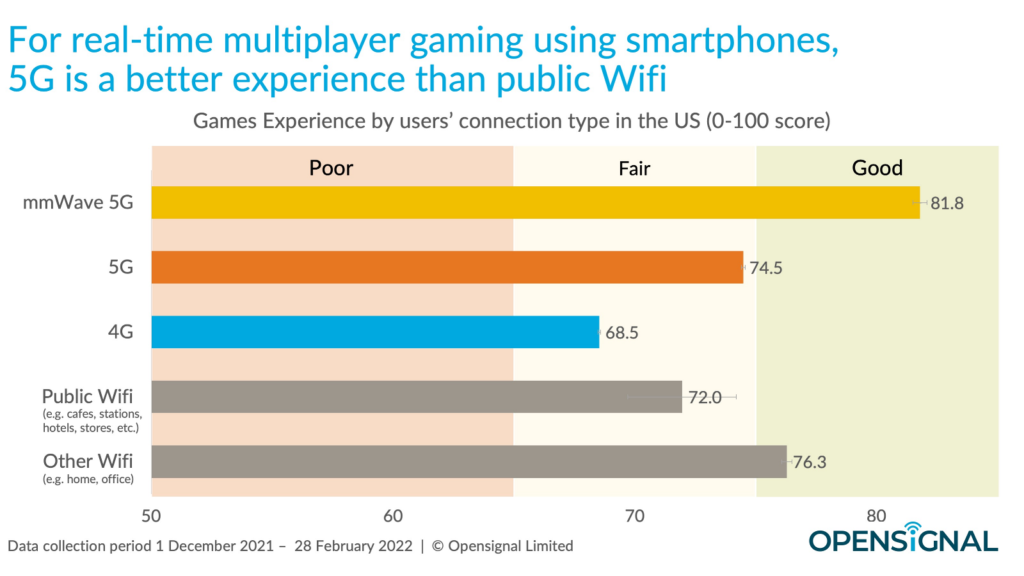

While 5G has introduced numerous technologies, only a few directly impact consumers, and in most cases, users notice minimal or no performance difference compared to LTE. Consequently, they are hesitant to pay extra for the faster speeds promised by 5G. Refer to Figure 1 from DeepSig‘s Tim O’Shea at the 2024 Brooklyn 6G Summit for further details. O’Shea’s list lacked mention of mmWave, a technology capable of delivering those high speeds.

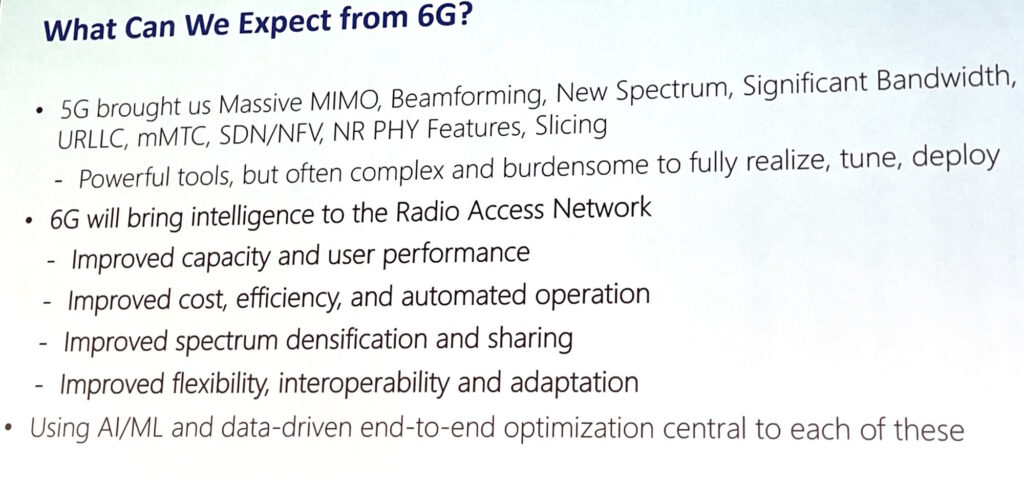

Figure 1. This slide from DeepSig shows that 5G introduced numerous new technologies to wireless. Will 6G bring forth new technologies or primarily build upon 5G applications?

What’s the current status?

Due to its limited range, mmWave technology has seen minimal implementation. Its deployment necessitates a vast number of small cells, a commitment that many wireless carriers are unwilling to make. As one individual mentioned during a breakfast meeting at the summit, “You can’t defy the laws of physics.” Consequently, mmWave has received scant attention at 5G/6G conferences.

Most of the other discussed points revolve around use cases that have been circulating for over a decade. Businesses, often referred to as “verticals,” are reluctant to invest in new technology unless they perceive a tangible return in terms of increased revenue, reduced operational costs, or a competitive advantage.

Another challenge arises from the lack of familiarity among individuals in these businesses regarding the features of 5G. The myriad features of 5G can overwhelm them, leading to the question, “How does this benefit my business?” This disconnect between telcos boasting advanced technologies and vertical industries’ lack of understanding has been a recurring theme at the 6G conferences I attended, including the 2024 6G Symposium in Washington, DC, and the 5G Techritory from Riga, Latvia. This sentiment has echoed multiple times within a short span.

Similar sentiments were shared in 2023, and I anticipate encountering them again in 2025.

“The telecom industry must reflect on the shortcomings of 5G, while the business applications are just starting to emerge,” remarked 6G-IA chairman Colin Willcock during a panel at the Brooklyn event focusing on the gaps that 6G must address. Adding to this, Takehiro Nakamura of NTT DoCoMo stressed the need for 6G to transcend the conceptual realm of 5G and deliver tangible performance enhancements.

Indeed, discussions surrounding 6G are centered on the potential use cases it should encompass and those that 5G could potentially address but haven’t yet. Despite the speculation, the exact nature of these use cases remains elusive. A recent report from GSMA highlighted that the exploration of 5G applications beyond consumer-oriented services is still in its infancy. Telcos are urged to educate potential enterprise clients on the diverse solutions available and target them with offerings that align with their requirements to drive market progression.

With the prevailing belief in a ten-year development cycle for telecom generations, many anticipate the standardization process for 6G to commence in 2025. However, initiating technology standards without clearly defined use cases poses a significant challenge. Although the telecom industry presumed to understand the use cases for 5G during its development, uncertainties persist. It’s too early to ascertain.

Despite the nascent stage of non-consumer use cases for 5G, discussions surrounding 6G delve into potential technologies it could introduce. Integrated Sensing and Communications (ISAC) is one such technology under scrutiny, with ongoing deliberations on leveraging mmWave and sub-THz signals. While the focus of ISAC currently centers around military applications, as highlighted by DoD’s Thomas Rondeau at both the 6G Symposium and Brooklyn 6G conferences, this represents a niche application.

Addressing Energy Consumption

In the initial years of 6G discussions, a significant emphasis was placed on reducing energy consumption within devices and networks. However, the emphasis on energy gradually waned in 2023 and 2024 due to the absence of concrete use cases.

A crucial aspect contributing to the energy challenge is the widening bandwidth accompanying each new wireless generation, resulting in heightened energy consumption in radios and wired connections. While efforts are made across various domains to enhance energy efficiency per bit, the escalating data rates offset these gains, leading to an overall increase in energy consumption.

The Role of AI

AI deployment exerts a substantial influence on energy consumption across the board. While some argue that AI could serve as a tool to curb energy usage, the data generated by users engaging with generative AI, coupled with the data essential for training AI/ML systems, might counteract efficiency gains. As highlighted by Andreas Roessler of Rohde & Schwarz during a panel discussion on energy consumption at the Brooklyn 6G event, “we’ll require measurements to monitor energy usage.”

AI was a relatively minor topic in discussions during 2021 and 2022. However, AI was indeed considered during the development phase of 5G, with applications such as AI in channel sounding. Although such applications continue to be explored, discussions around AI are poised to persist in the foreseeable future.

To underscore this point, Nokia’s Chief Strategy and Technology Officer Nishant Batra presented a slide in Figure 2 depicting the projected growth of AI and non-AI traffic until 2033. While non-AI traffic (comprising video and audio data) is anticipated to surge, AI-generated traffic is expected to claim a larger share of network traffic over time.

Figure 2. This slide from Nokia predicts that AI-generated traffic will increasingly dominate network traffic through 2033.

“Data is the new raw material,” remarked Peter Merz, Head of Nokia Standards, underscoring the omnipresence of AI across various domains, including 3GPP standards, Open RAN, devices, Operation, Administration, and Management (OAM), and network cores. He highlighted the distinctive nature of AI traffic, characterized by intermittent bursts.

Exploring Space

In addition to AI, discussions surrounding satellite-based non-terrestrial networks (NTNs) have gained momentum. These networks hold the potential to address coverage challenges, with allusions made to potential public safety and military applications. NTNs could serve as a focal point for marketers looking to leverage 6G for consumer-oriented applications.

The Need for a New Radio

As conversations about 6G and a new radio persist, uncertainties abound. The lack of defined use cases and uncertainty surrounding spectrum availability contribute to the ambiguity. While there is considerable discourse around FR3 (spanning approximately 7 GHz to 15 GHz or 24 GHz), its realization hinges on novel spectrum-sharing technologies, government spectrum allocations, or a combination of both. With AI assuming a central role in discussions, proposals advocating for AI-driven air interface (radio) design for 6G have sparked debates. This development prompts reflection among RF engineers on the feasibility of such an approach.

Will conventional channel models and channel-sounding measurements, which inform model creation, remain essential in the era of AI-generated air interface models? The path forward remains uncertain.

Comparing 6G to 5G in 2014

While my involvement in 5G coverage commenced around 2017, primarily from a radio perspective, insights from longstanding experts in the field shed light on the 2014 landscape of 5G. According to individuals like Doug Castor from InterDigital, who have been integral to 5G since its inception, mmWave technology dominated discussions in 2014, overshadowing topics like massive machine-type communications (mM2MC) and ultrareliable low-latency communications (URLLC). The prevailing sentiment suggested that mmWave held the key to significant advancements in download speeds, contingent on successful deployment – a vision that did not fully materialize.

As per Castor and other industry veterans, 6G development trails behind the trajectory of 5G in 2014. This, coupled with limited insights derived from 5G’s operational phase, raises questions about the pace of 6G development. EE World hosted a dialogue on the evolution of 5G and 6G, featuring Matsing’s Manish Matta and Keysight’s Roger Nichols, yielding a mixed perspective.

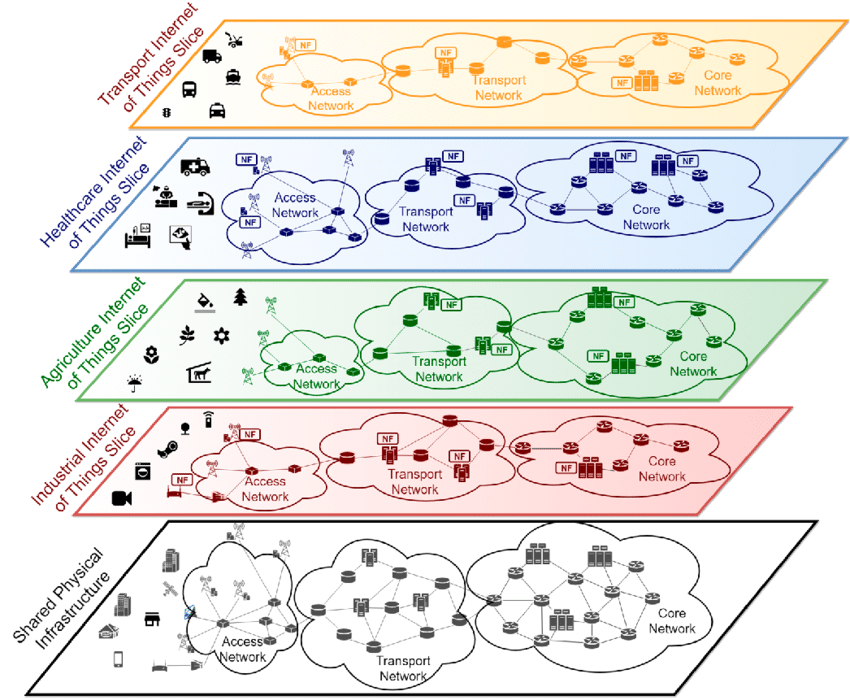

Given the substantial knowledge gap pertaining to 5G use cases beyond smartphones, a cautious approach in slowing 6G development appears logical. However, the impetus for telecom marketers to capitalize on the next generational leap by the end of the 2020s is strong. Should widespread enterprise adoption materialize through private networks and network slicing (Figure 3), 5G could witness prolonged relevance. The prevailing sentiment leans towards the necessity of 6G, given the unmet expectations surrounding 5G.

Figure 2. Network slices enable private networks and applications to operate in customized configurations tailored to specific use cases. Image: CEVA