Listen to the Audio :

Are you ready to explore the world of centralized cryptocurrencies? Starting your own centralized cryptocurrency exchange software development could be a lucrative business venture. Imagine a platform that allows users to buy, sell, and trade their favorite cryptocurrencies safely and easily. Sounds interesting, right?

To create a centralized crypto exchange, you need to be tech-savvy, entrepreneurial, and have some knowledge of regulations. Every step, from understanding the market to managing compliance and security protocols, is crucial to creating a successful platform.

This guide will walk you through the entire process, making it easier to navigate. We can assist you in starting a cryptocurrency exchange regardless of your technology or business knowledge.

A centralized cryptocurrency exchange (CEX) is a digital platform that simplifies the process of buying, selling, and trading cryptocurrencies by monitoring and controlling all transactions from a single location. In contrast, decentralized exchanges (DEXs) allow users to trade directly with each other, while a CEX acts as an intermediary, keeping user funds in secure accounts and managing buy and sell orders on its platform. Despite some drawbacks, many cryptocurrency traders prefer centralized exchanges for their ease of use, security features, and customer service.

Here are the key features that make a centralized cryptocurrency exchange a preferred place for trading cryptocurrencies.

1. High liquidity

Centralized exchanges ensure high liquidity, minimizing price slippage and providing a smooth trading experience.

2. Currency to crypto exchange

Users can purchase cryptocurrencies using traditional currencies like USD, EUR, or GBP, making it easier for new users to enter the crypto market.

3. Centralized order matching system

A centralized order matching system pairs buy and sell orders efficiently, ensuring quick and fair transactions.

4. User authentication and account management

Strong user authentication processes protect user accounts and provide simple account management.

5. Custody and wallet services

Centralized exchanges offer secure custody and wallet services to store digital assets safely.

6. Order matching engine

The order matching engine in centralized exchanges speeds up trade execution by correctly matching buy and sell orders.

7. Regulatory compliance

Centralized exchanges follow KYC and AML regulations, ensuring legal operation in various countries.

8. More advanced trading options

Advanced trading tools like stop loss and margin trading give users more control over their trades.

9. High transaction speed

High transaction speed ensures a seamless trading experience, even during market fluctuations.

Here are the crucial processes involved in creating a centralized crypto exchange.

1. Choose your specialty & Do market research

Research market requirements, target market, and competitor exchanges to differentiate your exchange.

2. Follow the rules

Check legal requirements, obtain permits, and set up compliance framework to ensure legal operation.

3. Selecting the technology stack

Choose the software for managing your exchange, either build your platform or use a white label solution.

4. Create features for the exchange

Provide essential features like order matching, wallets, and account management with encryption and secure transaction processing.

5. Develop a user interface

Design a user-friendly interface for easy navigation on both desktop and mobile devices.

6. Safety rules enforcement

Implement security measures like two-factor authentication and cold wallets to protect user funds.

7. Include any concerns

Ensure sufficient liquidity by using market makers or linking to other platforms to reduce slippage and attract new customers.

8. Comprehensive testing

Thoroughly test user experience, security, and functionality before launch to ensure a seamless trading environment.

9. Launch the exchange and begin

Develop a marketing strategy to attract clients and launch the exchange after testing.

1. Common security threats

Hacking and phishing are significant security threats that centralized exchanges face. Implement strong security protocols like encryption and multi-signature wallets to mitigate these risks.

2. Implement strong security protocols

Use encryption, multi-signature wallets, and regular security audits to enhance security and protect user funds.

Working with liquidity providers and market-making bots ensures reliable liquidity on a centralized cryptocurrency exchange, creating a stable trading environment for users.

Frontend development

HTML, CSS, Javascript, React, Angular, Vue.js

Backend development

Node.js, Ruby, Jave, Go

Blockchain integration

Web3.js, Ether.js, Binance API, Coinbase API

Security Protocols

SSL/TLS, AES, and RSA for data encryption

Real-time data processing

Websockets, Apache Kafka, RabbitMQ

Compliance and KYC/AML

Custom KYC/AML solutions

Infrastructure and DevOps

AWS, Google Cloud, Microsoft Azure

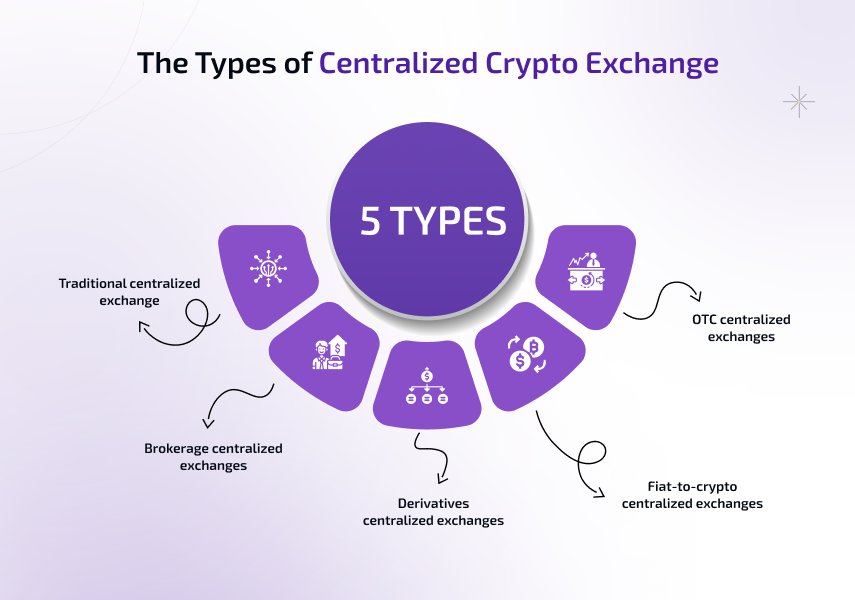

The Types of Centralized Crypto Exchange

The following five primary types of centralized crypto exchange (CEXs) cater to a variety of user requirements.

1. Traditional centralized exchange

Popular CEXs allow users to trade crypto-to-crypto and fiat-to-crypto pairs directly with real-time price tracking and advanced charting tools.

2. Brokerage centralized exchanges

Users can buy or sell cryptocurrencies at prices set by the brokerage exchange, making it easier for beginners to enter the market.

3. Derivatives centralized exchanges

These exchanges focus on futures and options trading with leverage and margin trading options for experienced traders.

4. OTC (over-the-counter) centralized exchanges

OTC exchanges facilitate direct trading between members without impacting market prices, ideal for high-volume traders and institutional investors.

5. Fiat-to-crypto centralized exchanges

These exchanges allow users to trade cryptocurrencies with traditional fiat currency, making digital currencies accessible to new users.

The development cost of a centralized crypto exchange varies based on project scope, technology stack, and the development team’s geography.

These are approximate prices for several centralized crypto exchanges.

Base exchange – $50,000–$100,000

Advanced Exchange – $100,000-$200,000

Enterprise exchange – $200,000+

Development costs are not the only costs associated with creating a centralized crypto exchange. Legal and regulatory fees, security costs, marketing expenses, and operational costs also play a significant role.

The latest developments in centralized crypto exchanges focus on integrating blockchain and AI, enhancing regulatory compliance, prioritizing user privacy, tokenizing traditional assets, and optimizing for mobile devices.

BlockchainX offers comprehensive solutions for centralized cryptocurrency exchange development, security, regulatory compliance, and post-launch support. Contact BlockchainX today to start your own reliable and legally compliant exchange.