BNB Chain TVL Rises 2%, NFT Trading Volume Surges 283%, but On-Chain Activity and Network Revenue Decline

Recent data reveals significant changes in the BNB Chain metrics during Q3 2024, despite market challenges. The chain witnessed a modest increase in Total Value Locked (TVL) and a remarkable surge in NFT trading activity.

BNB DeFi and Staking See Modest Gains

BNB Smart Chain’s DeFi TVL in USD rose by 2% quarter-over-quarter, reaching $4.85 billion in Q3 compared to $4.74 billion in Q2. However, BNB Smart Chain slipped to the fourth position in TVL rankings, surpassed by Solana.

Staking activity also showed growth, with the total BNB staked increasing by 7% to 32.4 million BNB. ListaDAO’s slisBNB dominated the liquid staking solutions, although staked volumes decreased by 2% QoQ to 406,200 slisBNB.

BNB DeFi TVL

BNB Chain Revenue Declines

BNB Chain’s total revenue, reflecting the network’s collected fees, declined in Q3 to $34.9 million, marking a 28% decrease from Q2’s $48.4 million. Revenue denominated in BNB also decreased by 22% QoQ.

NFT Activity Surges

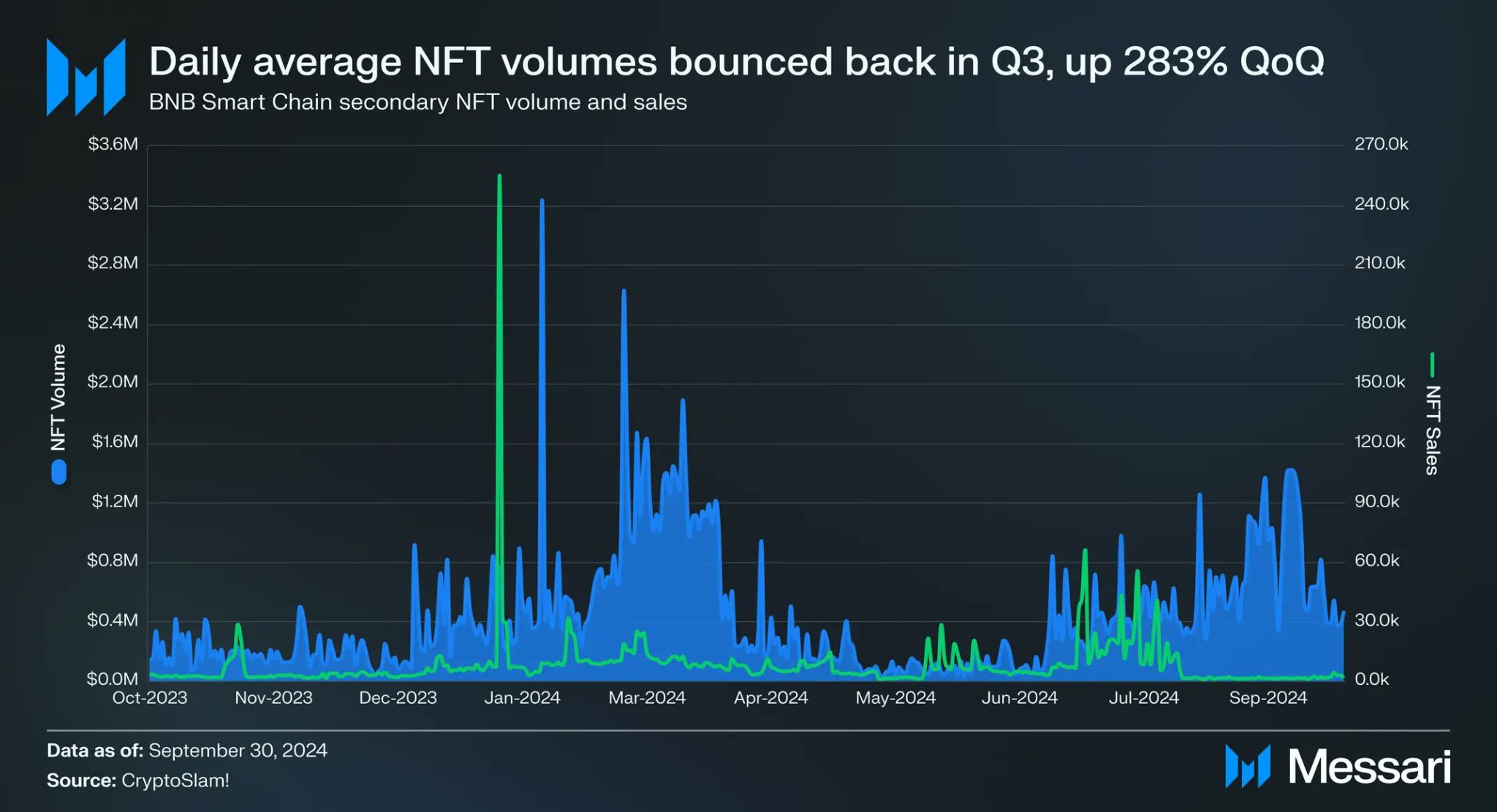

After a quiet Q2, BNB Chain witnessed a significant uptick in NFT activity in Q3. Average daily trading volume surged by 283% to $600,400, while average daily sales increased by 47% to 8,900.

BNB NFT Volumes

On-Chain Activity & Gas-Free Initiative

Despite some positive trends, BNB Smart Chain’s on-chain activity slowed down in Q3. Average daily transactions decreased by 8% to 3.4 million, and active daily addresses dropped by 19% to 868,300.

Stablecoin transactions remained strong, with USDT leading in active addresses at 294,000 daily, a growth of 8% QoQ. PancakeSwap maintained its position as the second most active protocol with 94,600 daily addresses.

BNB Chain launched the “Gas-Free Carnival” to promote stablecoin usage, offering gas-free transfers for USDT, USDC, and FDUSD. This initiative, supported by Bitget Wallet and SafePal, includes fee-free withdrawals and free bridging options via Celer cBridge to enhance user experience and adoption.