RNDR, the native token of Render, is gaining attention amidst the current market correction, showing signs of potential upward momentum. This speculation is driven by RNDR’s bullish price action pattern, increased participation from traders and investors, and overall positive market sentiment.

Render (RDNR) Technical Analysis and Upcoming Level

As per CoinPedia’s technical analysis, RNDR recently broke out of a bullish double-bottom price action pattern and is now eyeing the next resistance level at $10. This breakout occurred in a lower time frame (four hours), indicating a shift towards the bullish side.

Render (RNDR) Price Prediction

Considering recent price action and historical momentum, RNDR has the potential to surge by 18% and reach $10 in the near future. Moreover, on a daily time frame, the altcoin displays a bullish trend and could potentially rise by 35% to hit the $12 mark soon.

Bullish On-Chain Metrics

Alongside technical analysis, traders have shown significant interest and confidence in RNDR, as per on-chain analytics firm Coinglass.

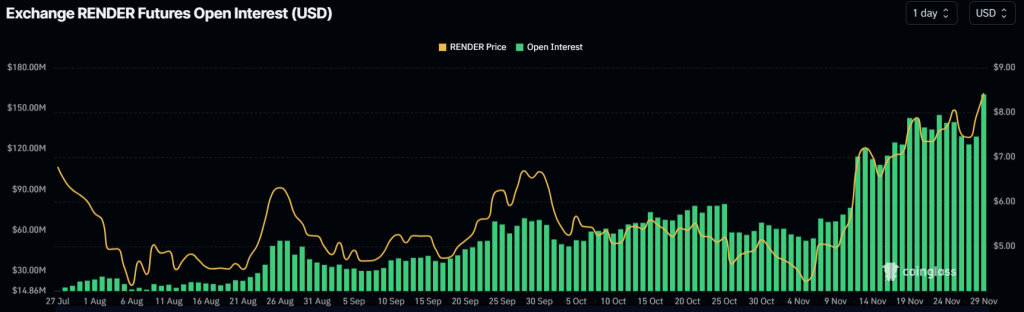

According to the data, RNDR’s open interest (OI) has surged by 29% in the past 24 hours and 12.8% in the last four hours, leading to a record high open interest of $160.30 million.

This increasing interest not only signifies new positions being built but also reflects traders’ confidence in the token.

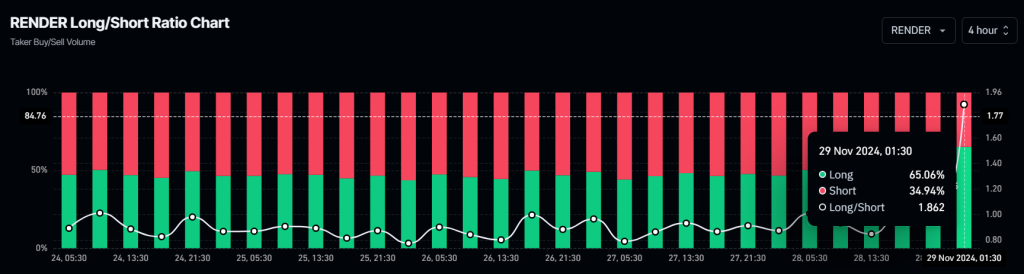

Furthermore, RNDR’s Long/Short ratio is currently at 1.86, indicating a strong bullish sentiment among traders. The data shows that 65% of top RNDR traders hold long positions, while 35% hold short positions.

Traders and investors often use a combination of rising open interest and a Long/Short ratio above 1 as a signal when considering long positions.

Current Price Momentum

While most top cryptocurrencies are struggling to find momentum, RNDR stands out as the 3rd highest gainer in terms of price. Currently trading around $8.50, RNDR has seen an increase of over 9.25% in the past 24 hours. Additionally, its trading volume has surged by 98% during the same period, indicating significant participation from traders and investors amidst the positive outlook for the asset.