Dogecoin (DOGE), the leading meme coin worldwide, is set to maintain its upward trajectory following a two-week consolidation period. The positive outlook for DOGE is attributed to both its bullish price action and the recent victory of Donald Trump in the United States presidential election.

Dogecoin (DOGE) Technical Analysis and Upcoming Level

Since the election results, DOGE has surged by more than 150% without any significant pullback. However, between November 12 and November 30, 2024, it has been consolidating within a narrow range of $0.353 to $0.428.

During this consolidation phase, expert technical analysis indicates that DOGE’s daily chart has formed a bullish ascending triangle pattern, hinting at a potential breakout. Nevertheless, DOGE’s current price level has historically encountered selling pressure and downward momentum.

Dogecoin (DOGE) Price Prediction

Considering recent price movements and historical trends, a breach above the $0.45 level and a daily candle close could potentially propel DOGE by 30% towards the $0.57 mark in the near future.

Bullish On-Chain Metrics

On a positive note, DOGE has garnered significant interest from traders and investors, as highlighted by the on-chain analytics firm Coinglass. Over the past 24 hours, DOGE’s open interest (OI) has surged by 17% and increased by 11% in the last four hours, indicating a rising confidence among traders and a surge in new positions.

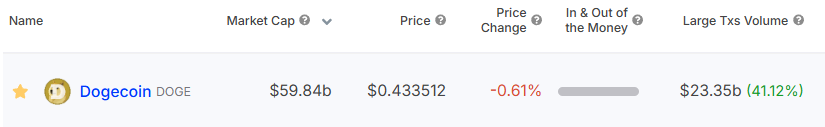

In addition to trader participation, whales and institutions have also shown interest in DOGE, as reported by the on-chain analytics firm IntoTheBlock. Notably, large transaction volumes by whales have spiked by 41.15%, signaling increased activity from long-term holders.

The combination of optimistic on-chain metrics and technical analysis suggests a potential upward momentum in the coming days, offering favorable buying opportunities.

Current Price Momentum

Currently, DOGE is trading around $0.43 with an upward momentum of over 8.15% in the last 24 hours. Simultaneously, its trading volume has risen by 5.5%, indicating increased participation from traders and investors amidst a bullish sentiment.