A leading crypto analytics company reports that a significant group of Bitcoin investors is selling off BTC at a rapid pace.

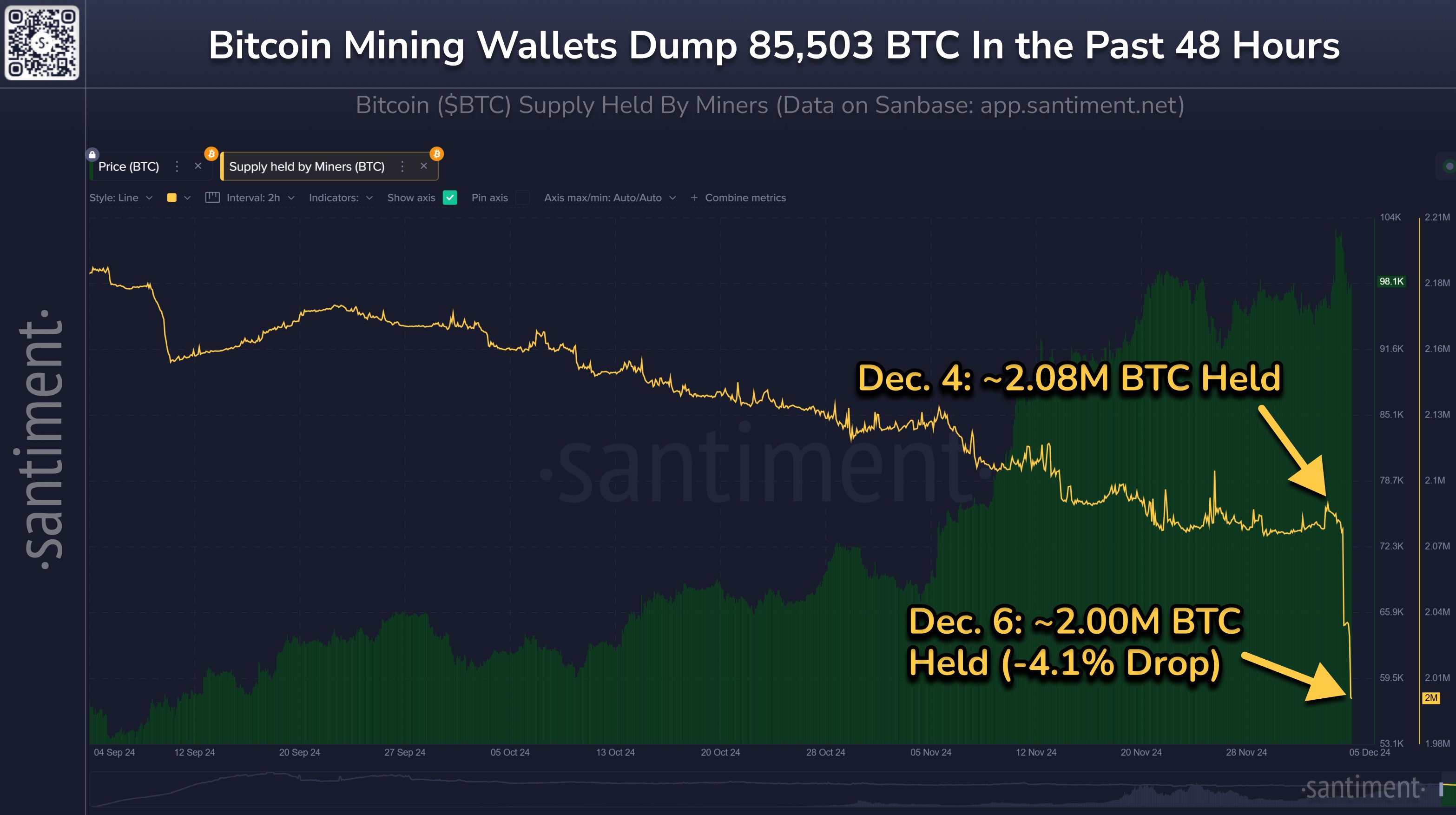

According to Santiment, Bitcoin miners have sold more than $8.55 billion worth of BTC in just two days, marking the largest distribution in the past 10 months.

While Bitcoin miners are reducing their BTC holdings, Santiment highlights that other wealthy investors are stepping in to make purchases.

“Bitcoin’s total mining balances have been decreasing since April 2024. However, the recent drop of 85,503 BTC in just 48 hours is the most significant we’ve seen since late February (two weeks before the then $73,000 all-time high). Note that these wallets have not been directly correlated with the price for most of this year. Overall, non-mining whales and large investors are still accumulating. This can be seen as a neutral signal for now.”

Regarding Bitcoin’s current price movement, Santiment notes that BTC seems to be trading in line with the S&P 500 (SPX). The analytics firm suggests that breaking this correlation between stocks and Bitcoin would be beneficial for BTC.

“After the hype surrounding crypto has settled in the past two weeks, Bitcoin has started to move in close correlation with the S&P 500. Throughout the year, there has been a strong connection between the two, with BTC often being referred to as a ‘high leveraged tech stock’ by cryptocurrency traders. However, it is important to monitor for a potential shift in the relationship between crypto and equities in the medium to long term. If this correlation weakens, it would be a positive sign. Historically, the crypto market has thrived when it is less dependent on global stock markets.”

As of the time of writing, Bitcoin is being traded at $99,856.

Stay Updated – Subscribe to receive email alerts directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Explore The Daily Hodl Mix

Generated Image: DALLE3