After a period of struggle, HyperLiquid is starting to show early signs of recovery. The cryptocurrency, which was previously in a significant downturn, has seen an 8% increase in value over the past few days. This may seem promising, but there are still obstacles ahead. Resistance levels and low market inflows continue to hinder its progress. Let’s delve into the current situation and its significance.

A Look at HYPE

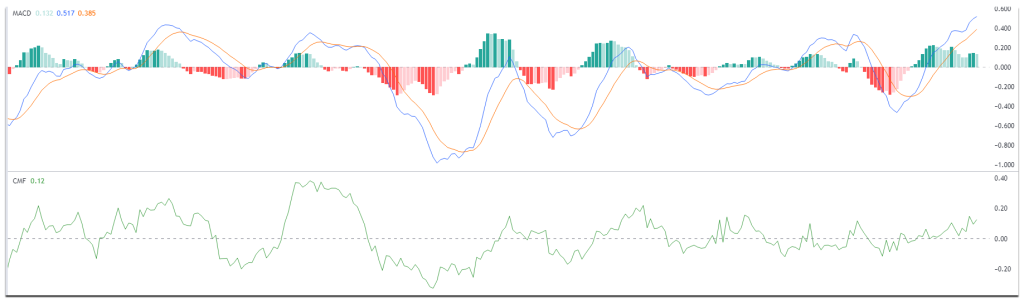

For the first time in a while, HYPE’s technical indicators are suggesting a potential turnaround. The MACD has turned bullish, indicating that HyperLiquid is gaining momentum that could drive prices higher if there is enough buying interest. However, investor confidence remains uncertain.

The Chaikin Money Flow (CMF), which monitors the movement of capital, is currently negative, indicating a cause for concern. Without stronger inflows, any potential recovery could lose steam before gaining substantial traction.

Despite its recent uptick, HYPE is at a critical juncture. While prices are currently above the $19.47 support level, breaking through the $23.20 mark is necessary to convince investors of a sustained upward trend.

The Importance of Resistance Levels

Here’s the dilemma. Failure to surpass the $23.20 resistance level could result in a drop back to the $19.47 support level, which poses a significant risk. Falling below this threshold could erode remaining investor confidence, potentially leading to further declines.

Conversely, establishing $23.20 as a strong support level could trigger a push towards $29.85. However, without increased inflows or greater investor participation, this goal may remain elusive.

What Lies Ahead

The recovery of HYPE goes beyond mere numbers and charts; it hinges on trust. Investors need to witness genuine momentum supported by capital inflows before recommitting. Progress may be slow until there is more robust market support.

While the technical signals are encouraging, they alone may not suffice. Greater market backing is imperative. If HyperLiquid fails to attract this support, its recent gains could dissipate rapidly.