Listen to the Audio :

As the cryptocurrency market expands, understanding how to safeguard your digital assets becomes crucial. Utilizing a cryptocurrency wallet can help you achieve this. Through cryptocurrency wallet development, you can securely buy, sell, or store your digital currency. It acts as your entry point into the digital economy, ensuring the safety of your funds while enabling you to send and receive digital currencies like Bitcoin and Ethereum. Learn about what a crypto wallet is and how it operates. By using private keys to protect your assets, crypto wallets ensure that only you can access and manage your funds. Let’s delve deeper into how cryptocurrency wallet development functions and why it is essential.

Understanding What a Crypto Wallet Is

A crypto wallet is a digital tool that allows you to send, receive, and store cryptocurrencies such as Ethereum and Bitcoin. Instead of physical cash, it stores your digital assets in the form of private keys, which are secret codes used to access and manage your cryptocurrency. Cryptocurrency wallets can be offline (cold wallets) for added security or online (hot wallets) for convenience. They work similarly to a virtual bank account, enabling you to track your digital wealth, conduct transactions, and securely manage your cryptocurrency holdings. When using a crypto wallet, you have complete control over your digital currency.

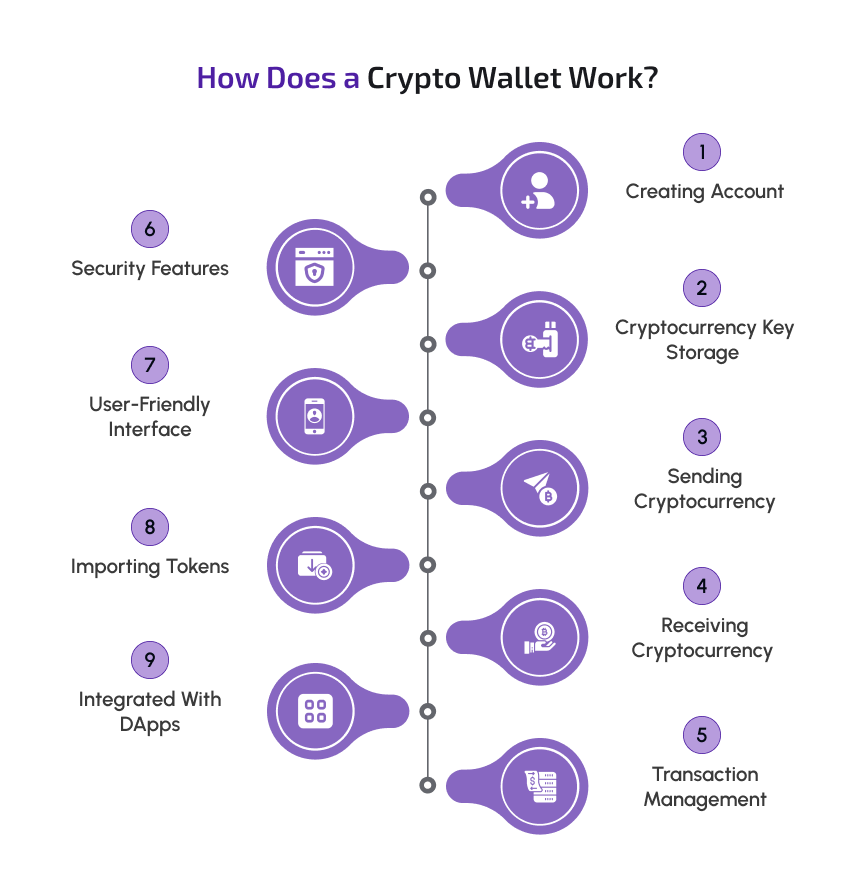

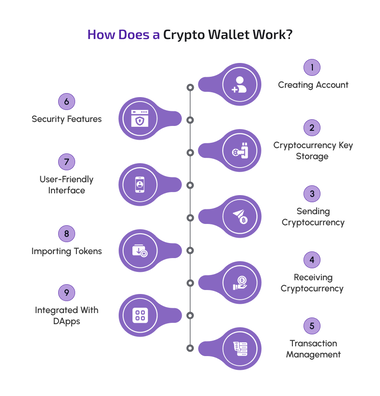

How a Crypto Wallet Functions

Creating an Account

Users start by creating an account, where the wallet generates a private key and unique phrase for secure access and recovery of your wallet and cryptocurrency assets.

Cryptocurrency Key Storage

The wallet holds the private and public keys that provide access to and management of cryptocurrencies, rather than containing the actual digital assets.

Sending Cryptocurrency

To send cryptocurrency, enter the recipient’s wallet address, specify the amount, and approve the transaction using secure authentication methods such as a fingerprint or PIN.

Receiving Cryptocurrency

To receive cryptocurrency, share your public wallet address with the sender. The blockchain validates the transaction and updates your balance accordingly.

Transaction Management

The blockchain records all transactions for transparency and accountability, allowing users to conveniently view their history within the wallet.

Security Features

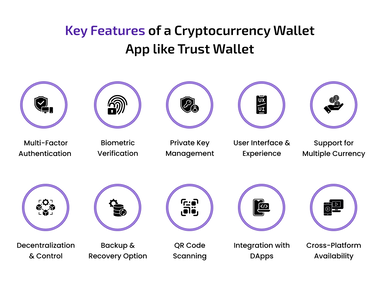

Customize the solution to your company’s needs, including branding, additional functionality, and improved user experience. Our wink crypto wallet ensures robust protection for users’ funds and data through advanced security features like encrypted private keys, PINs, biometrics, and backup recovery phrases.

User-Friendly Interface

Both beginners and experts can easily manage assets, monitor balances, and interact with tokens or dApps due to the user-friendly interface.

Importing Tokens

Users can enhance wallet functionality by manually adding custom tokens through entering the token contract address and blockchain network data.

Integrated With DApps

Users can explore staking, trading, and other blockchain services through the wallet UI, leveraging Wink’s integration with decentralized apps.

Types of Crypto Wallets

There are various types of crypto wallets based on how they store secret keys and whether they are online. Here is an in-depth look at the different kinds of cryptocurrency wallets.

Hot Wallets

Cold Wallets

Custodial Wallet

Non-Custodial Wallet

Hot Wallet :

Hot wallets are suitable for frequent transactions and are connected to the internet. They can be accessed through desktop apps, smartphone apps, or web browsers. Different types of hot wallets include:

Web Wallets

Increasing convenience and security by allowing fingerprint or facial recognition for wallet login or transaction approval.

Mobile Wallets

Ensuring that private keys are securely stored on users’ devices, allowing them complete ownership and management of their funds without third-party interference.

Desktop Wallets

Simplifying crypto management with a user-friendly interface accessible to both novice and experienced users.

Cold Wallets :

Cold wallets, being offline storage options, offer greater protection from online attacks. They are ideal for storing cryptocurrencies for extended periods. Different types of cold wallets include:

Hardware Wallets

Physical devices like Trezor or Ledger Nano X, which require careful handling to prevent loss or physical damage despite their high security.

Paper Wallet

A printed sheet containing private and public keys. While susceptible to physical loss or damage, paper wallets are impervious to cyberattacks.

Custodial Wallet:

Managed by a third party like cryptocurrency exchanges such as Binance or Coinbase, custodial wallets depend on the provider to safeguard private keys.

Non-Custodial Wallet:

Users retain control over their private keys with non-custodial wallets, making them ideal for those valuing complete control over their funds.

Selecting the Right Crypto Wallet – Factors to Consider

After understanding what a crypto wallet is and how it works, you can choose the best cryptocurrency wallet based on your requirements and preferences. Here are some key points to help you make a decision:

Assess Your Use

For quick access and convenience, a hot wallet (web, mobile, or desktop) is suitable if you engage in frequent cryptocurrency trading or spending. If you hold cryptocurrency for an extended period without many transactions, a cold wallet (hardware or paper wallet) offers better security and less vulnerability to online attacks.

Consider Security

Hot wallets are more susceptible to hacking due to their internet connectivity. Cold wallets, being offline, provide higher security and are less vulnerable to cyberattacks, making them ideal for long-term holdings or significant cryptocurrency storage.

Access Control Over Your Keys

Hot wallets, being convenient and internet-connected, are more prone to hacking. Cold wallets, offline, offer higher security and are less vulnerable to cyberattacks, making them ideal for long-term holdings or significant cryptocurrency storage.

Custodial Wallets

Private keys are managed by third parties such as exchanges. Users rely on the provider to safeguard their private keys, compromising some level of control.

Non-Custodial Wallets

Users have full control over their private keys, enhancing security and privacy, but requiring active protection of the keys.

Consider the Cryptocurrencies You Hold

Ensure the wallet is compatible with the cryptocurrencies you currently own or plan to hold. Some wallets specialize in specific coins or tokens, while others support a wide range of cryptocurrencies.

Consider User Experience

Look for wallets with user-friendly interfaces if you are new to cryptocurrency. Online or mobile wallets like Coinbase Wallet or Metamask are easy to set up. Experienced users might require wallets with advanced features like built-in exchange services, dApp integration, or multi-signature support.

Backup and Recovery Options

Ensure the wallet offers reliable backup options like recovery phrases to regain access in case of device loss or damage.

Verify Compatibility

Check if the wallet is compatible with your preferred hardware, computer, or smartphone. Some wallets may be limited to specific platforms.

Setting Up Your Crypto Wallet

Creating a crypto wallet is a crucial step in safeguarding your digital assets. Choose between a hot wallet and a cold wallet based on your security and access needs. If you require quick and easy access to your cryptocurrency, opt for hot wallets like Trustwallet or Metamask. These wallets are suitable for frequent transactions due to their internet connectivity, but they are more vulnerable to online threats. On the other hand, cold wallets like Trezor or Ledger offer enhanced security for long-term storage by keeping your crypto offline.

Once you decide on the type of wallet, setting it up is straightforward. Your recovery phrase, consisting of 12 to 24 words, should be securely stored along with a strong password. This phrase is essential for recovering your wallet if lost, so keep it safe. Create a public address and share it with anyone looking to send cryptocurrency to your wallet. When sending cryptocurrency, ensure the recipient address is accurate and legitimate. By following these steps, you can securely manage your cryptocurrency and protect your assets.

Avoiding Common Mistakes When Using a Crypto Wallet

Failure to securely backup and store your recovery phrase can lead to permanent loss of wallet access if your device is lost or damaged.

Selecting weak or easily guessable passwords exposes your wallet to hacking or unauthorized access.

Never share your private keys with anyone, as they provide access to your funds.

Keeping large amounts of cryptocurrency in hot wallets exposes your assets to hacking risks. Cold wallets are better suited for long-term storage.

Enabling 2FA on your wallet or exchange account enhances security and prevents unauthorized access.

Always double-check the recipient’s address before completing a transaction, as crypto transactions are irreversible.

Regularly update your wallet software to avoid security vulnerabilities and issues.

Download wallets only from legitimate sites to avoid phishing scams and malware.

Be aware of transaction costs, as some wallets and networks may charge higher fees during peak hours.

Securely store backup copies of your cold wallet’s recovery phrase to prevent loss in case of damage or theft.

The Future of Crypto Wallets

As the blockchain and cryptocurrency industries continue to evolve, cryptocurrency wallets are rapidly changing. To meet the growing demands of users, wallets must enhance security, usability, and integration with new technologies.

Enhanced Security Features

Security will be a top priority for cryptocurrency wallets in the future. Advanced techniques such as multi-signature authentication and biometric verification are expected to become standard as the risk of cyberattacks rises. Hardware wallets will likely incorporate even stronger digital and physical safeguards to maintain their security edge.

Multi-Asset and Cross-Chain Support

Multi-asset wallets supporting multiple tokens and cryptocurrencies across various blockchains are gaining popularity. Cross-chain compatibility will remove existing limitations and enhance transaction efficiency by facilitating seamless transfers and exchanges between different blockchain networks.

Web3 and DeFi Integration

Future wallets will play a crucial role in web3 ecosystems and decentralized finance (DeFi). They will offer integrated services like governance voting, lending, borrowing, and staking within the wallet. Wallets will also become essential for web3 apps due to improved support for NFTs and digital IDs.