Following a recent sharp decline in the market, sentiments have become more sensitive, with some investors seizing the opportunity to acquire assets while others are offloading their holdings. During this period, whales have been actively accumulating Dogecoin (DOGE), the meme coin that has gained popularity.

Whales Acquire 750 Million DOGE

A well-known crypto expert recently shared a post on X, highlighting that crypto whales purchased a significant amount of 750 million DOGE coins during a recent dip. This substantial acquisition by whales indicates a strong bullish outlook for the meme coin, showcasing confidence in its potential.

Despite the significant accumulation by whales, the price of DOGE has not seen major changes. Currently, the meme coin is trading around $0.253, experiencing a decrease of over 5.50% in the last 24 hours, presenting a potential buying opportunity for investors.

However, the trading volume of DOGE has decreased by 30% during the same period, signaling fear among traders and investors, leading to a decrease in market participation.

$25 Million Worth of DOGE Outflow

Despite the lower participation, on-chain analytics firm Coinglass reveals that long-term holders and investors are continuing to accumulate meme coins. Data from spot inflow/outflow indicates that exchanges have witnessed an outflow of over $25 million worth of meme coins, suggesting a potential accumulation trend.

This outflow suggests that long-term holders have been transferring assets off exchanges, potentially creating buying pressure that could lead to a further upward rally.

Dogecoin (DOGE) Price Movement and Key Levels

Technical analysis experts suggest that DOGE is currently bearish and in a downtrend, trading below the 200 Exponential Moving Average (EMA) on a daily time frame.

Based on recent price movements and historical trends, there is a likelihood of a 10% price decline for DOGE to reach its next support level at $0.22 in the near future.

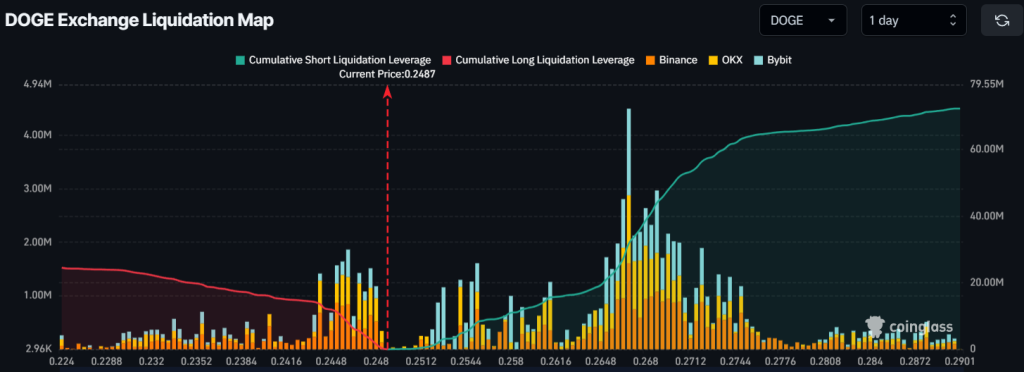

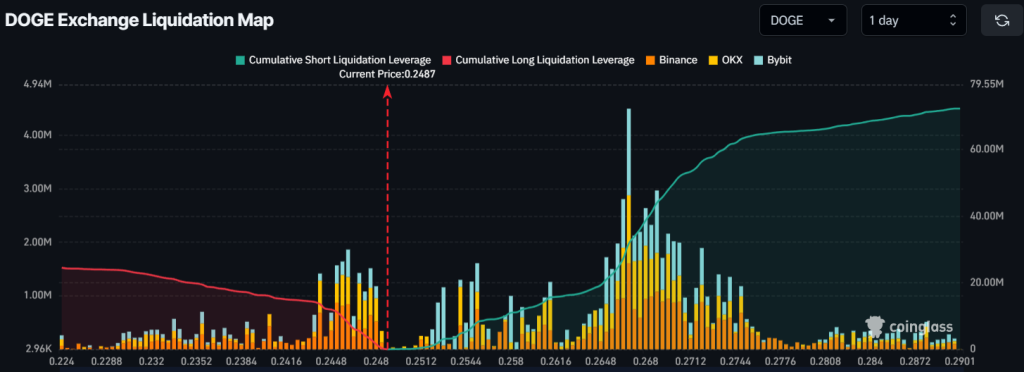

According to Coinglass data, if the price of DOGE drops below $0.246, approximately $8 million worth of long positions could be liquidated, as investors are excessively leveraged at this level.