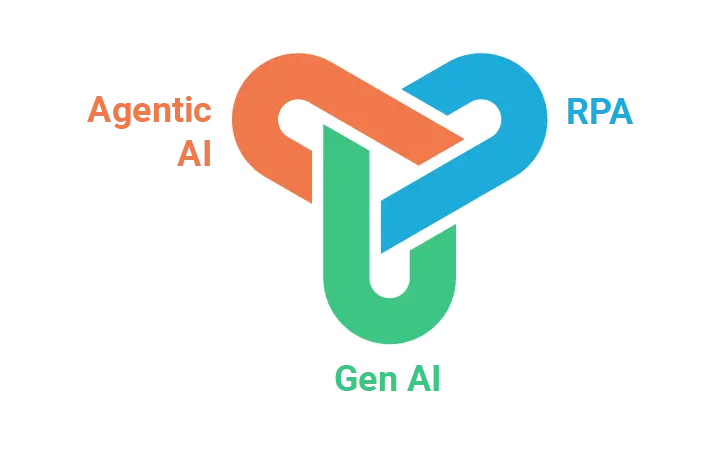

Banks have historically relied on Robotic Process Automation (RPA) to streamline repetitive tasks, reducing manual effort and operational costs. However, RPA alone faces challenges with complex workflows, unstructured data, and decision-making processes. With the emergence of Generative AI (Gen AI) and Agentic AI, banks now have the opportunity to enhance their automation strategies from rule-based systems to intelligent, adaptive, and autonomous operations.

What Do These Technologies Bring to Banking?

- RPA in Banking: Automates repetitive, rule-based tasks but lacks the ability to process unstructured data or make decisions.

- Gen AI in Banking: Enables natural language understanding, document processing, and content generation, making automation smarter and more dynamic.

- Agentic AI: Adds decision-making, adaptability, and self-learning capabilities, enabling autonomous workflows.

By leveraging these technologies, banks can transition from basic automation to intelligent process automation, significantly improving efficiency and customer satisfaction.