Listen to the Audio :

Modern technology enables us to enhance both accessibility and efficiency when it comes to asset ownership and trading in the current digital world. The discussion about converting physical assets into blockchain-based digital tokens remains a central topic today because this process enables users to transform their real estate, gold, art and company share assets for blockchain-based digital tokens.

This guide will illustrate the step-by-step procedure of How to Tokenize Real World Assets (RWAs). It provides a comprehensive overview for business owners seeking capital, investors exploring new opportunities, and anyone interested in blockchain applications. By explaining How to Tokenize Real World Assets transforms asset ownership, this guide highlights the future of digital assets and their impact on various industries.

Understanding Real World Asset Tokenization

Converting physical assets like real estate, gold, art, and company shares into blockchain-based digital tokens is known as Real World Asset Tokenization. This process makes it easier to trade and manage these assets digitally. Users gain ownership by means of digital tokens which represent shares or portions of the asset and operate in the blockchain system.

Asset tokenization requires a systematic process which includes choosing the asset followed by legal compliance verification next to token creation then blockchain integration and secure trading establishment.

A proper methodology for compliance along with security measures and liquidity advantages forms the basis for implementing How to Tokenize Real Assets. Prescribed approaches toward Real World Asset Tokenization enable investors to discover new ventures together with better transparency and interweave more participants into market networks.

How To Tokenize Real World Assets in 8 simple steps

Physical assets can be converted through tokenization on blockchain networks which is called Tokenizing real-world assets (RWAs). The procedures boost financial fluidity and provide better market accessibility and streamlined transaction systems.If you want to know how to tokenize real world assets, read this step-by-step guide for more information.

Step 1 – Identify the Asset:

At the beginning of RWA tokenization one must identify the asset that needs digital transformation.Consumers must tokenize both physical real estate and financial stocks alongside fine art and intellectual property through the system.

The first important step in Tokenization of Real World Assets involves setting up clear ownership rights as well as validating whether legal Tokenization of Real World Assets is feasible for each asset.

A market value valuation comes first in the process, followed by an expert valuation to check the accuracy. It is highly important to understand how to tokenise real world assets because while tokenising assets, one would need to capture all the supporting documentation and must ensure that such tokenisation happens as per prevalent laws and regulation. As laws in each state differ regarding tokenized real world assets, intensive legal checks would be required.

Step 2 – Choose the Tokenization Model:

The range of ownership or financial rights which the tokens will represent determines the choice of Tokenization of Real World Assets approach. The objective to give investors fractional ownership of assets requires the deployment of equity-based tokens. They serve as financial obligations because their holders receive periodic interest payments on top of debt-based tokens.

Utility tokens provide users with service entry while homeownership through asset-backed tokens is linked to physical materials such as gold or oil. Companies need careful planning to select an appropriate token model since this selection impacts legal misunderstandings and investor forecasted return expectations.

Step 3 – Legal and Regulatory Compliance:

Tokenization Real World Assets needs to follow financial and security laws that depend on the specific location. When tokens qualify as securities they must fulfill the requirements of financial regulations established by government authorities including FINMA (Switzerland) or the SEC (U.S.) and other agencies responsible for financial controls.

Operation of KYC and AML procedures is essential to validate customer identities while stopping unauthorized financial activities. The enforceability of smart contracts needs to be ensured because this establishes that blockchain-recorded ownership corresponds to actual real-world legal agreements. To prevent future legal problems taxpayers should retain legal experts who deal specifically with blockchain regulations.

Step 4 – Select the Blockchain Platform:

Typing in the right blockchain infrastructure constitutes an essential element that determines both system security levels along with scalability environments and operational abilities. The selection of Ethereum as a platform stands strong due to its ERC-20 and ERC-1400 security token standards while Binance Smart Chain, Solana and Tezos and Polkadot provide different options with speed and expense considerations.

When selecting a blockchain framework together with transaction pricing and network performance as well as regulatory standards need to be factored.

Step 5 – Develop Smart Contracts:

Asset tokenization through blockchain operates with self-executing smart contracts for automation of diverse features in the process of tokenization. Users need to understand how to tokenize real-world assets because smart contracts both establish tokenification criteria and rules and control ownership transfers and regulatory compliance mechanisms.

The programming languages Solidity for Ethereum and Rust for Solana serve with additional financial and legal systems for development purposes.

Step 6 – Mint and Issue the Tokens:

Smart contracts need minting tokens as a critical step which creates either rigid or variable token supplies that symbolize asset rights along with ownership capabilities. A unique identification system is applied to tokens as part of duplicate prevention and fraud protection measures.

Users can access the distributed tokens through three mechanisms including initial token offerings (ITOs) and private sales and direct issuance. Users need to integrate their tokens with crypto wallets.

Step 7 – Establish a Custodial or Asset-Management Structure:

The blockchain does not contain real-world assets hence there must be a method which connects their digital representation to their physical counterpart. A physical asset management system through third-party custodians such as banks or specialized asset management firms provides asset security by establishing control over and responsible custody of these assets.

When dealing with real estate assets, token holders are often served by a legal trust which manages the assets through a Special Purpose Vehicle (SPV). The real-time verification of asset status relies on the implementation of on-chain oracles which serve as verification tools. The implementation of proper asset management requires proper custodianship that safeguards trust between both token holders and asset managers while maintaining legal enforceability.

Step 8 – Set Up a Marketplace for Trading and Liquidity:

After asset tokenization, investors should have access to platforms that facilitate token trading, buying, and selling. Navigating how to tokenize real world assets involves utilizing security token exchanges like tZERO, INX, and Securitize, which ensure regulatory compliance for digital asset trading.

Additionally, DeFi markets and peer-to-peer trading platforms offer alternative liquidity solutions. Implementing staking, yield farming, and institutional investor partnerships can further enhance market activity.

Benefits of Tokenizing Real Assets

Through blockchain technology Real world asset tokenization development delivers multiple advantages to the sector involving real estate together with commodities and valuable artwork. Tokenization functions as a system that makes tangible assets digital while making their trade simpler and clearer and more accessible for all users.

Understanding the benefits of tokenizing real assets is fundamental when you are learning How to Tokenize Real World Assets. The essential advantages consist of the following points

1. Increased Liquidity:

Real estate and art are hard to sell quickly, making them illiquid. How to tokenize real world assets is key, as tokenization divides them into smaller, tradable parts for faster transactions.

Investors gain a speed advantage in purchasing asset fragments without requiring full asset completion in order to proceed. A larger group of market participants joins the market when Real World Asset Tokenization occurs, which drives overall trading activity up.

2. Fractional Ownership:

Through Real World Asset Tokenization businesses can divide assets into smaller portions which enables several investors to share ownership of particular sections.

The Real World Asset Tokenization system gives investors who never had enough capital to enter these markets previously the possibility to conduct business in luxuries and antiques.

Through this system different categories of people can obtain investing opportunities.

3.Transparency & Security:

The blockchain technology generates an immutable public transaction register to minimize cases of fraud.

A decentralized ledger system should be established because it enables users to track asset ownership through every transaction.

The execution of transactions through smart contracts provides security for equitable business agreements between two entities.

4. Reduced Costs & Intermediaries:

Old payment processes demand financial intermediaries such as brokers and lawyers along with banking institutions leading to prolonged time frames of transactions and high operational costs.

In Real World Asset Tokenization businesses can do without intermediaries between them thus improving transaction efficiency.

By removing middlemen tokenization facilitates both quick and affordable deals which remain secure.

5. Global Accessibility:

Universal trade of Tokenized Real World Assets becomes possible because they bypass international legal and financial prohibitions.

The Real World Asset Tokenization system enables people from various nations to hold parts of property ownership.

The increased possibility of new market participants through Real World Asset Tokenization leads to market competitiveness.

6. Faster Settlement Times:

Traditional real estate transactions typically take six to eight weeks due to extensive paperwork and screening processes. However, understanding how to tokenize real world assets can streamline this process. The time needed to settle transactions becomes achievable through blockchain technology within minutes or hours thus creating rapid operational changes together with higher efficiency rates.

The system performance optimization results from the distributed ledger technology and blockchain union for enhancing operations across the entire asset transfer stakeholder network.

7. Enhanced Portfolio Diversification:

Through Real World Asset Tokenization investors gain the ability to divide their investment value into smaller spans across numerous assets rather than deploying their wealth to one single investment.

Investors obtain access to multiple investment sectors including real estate together with artistic pieces and valuable metal assets.

8. Improved Compliance & Governance:

Smart contracts combine regulatory compliance features which maintain that all transactions adhere to applicable legal standards.

Tokenization of Real World Assets makes it possible to implement automated governance features that provide investors with voting rights.

The investment process becomes more secure and trusted when this feature is implemented.

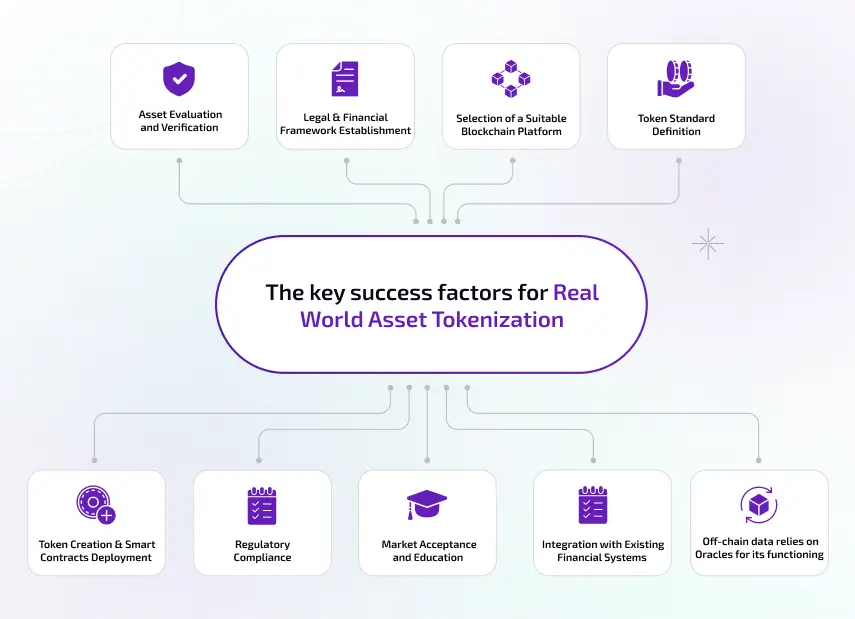

The key success factors for Real World Asset Tokenization

Real-world asset (RWA) tokenization creates digital tokens from tangible properties which ensures higher liquidity levels and expands access and enhances transparency through blockchain technology applications. The execution of real-world asset (RWA) tokenization depends on these primary success factors.When learning How to Tokenize Real World Assets it is essential to know key factors.

1. Asset Evaluation and Verification:

The most important aspect of how to tokenize real world assets is asset evaluation and verification.Evaluation along with authentication of an asset must occur before real world asset tokenization processes begin. An evaluation process here generates investor trust and provides proper value assessment when issuing tokens.

2. Legal and Financial Framework Establishment:

The establishment of an extensive legal system along with financial regulatory structure should determine what privileges ownership rights will have for digital tokens. A set of regulations function to control token market activities and keep regulatory requirements while maintaining security for both issuers as well as investors.

3. Selection of a Suitable Blockchain Platform:

The selection of an ideal blockchain platform proves