With the overall cryptocurrency market starting to recover, Tron (TRX) shows signs of bullishness as traders’ short positions worth over a million dollars are on the brink of liquidation. TRX has been trading in a parallel channel pattern between $0.22 and $0.25 since the beginning of February 2024.

TRX Current Price Momentum

Currently, TRX is hovering around $0.223 and has maintained stability over the last 24 hours. However, trading volume has dropped by 15%, indicating a sense of caution among traders and investors compared to the previous day.

Traders Over-Leveraged Positions

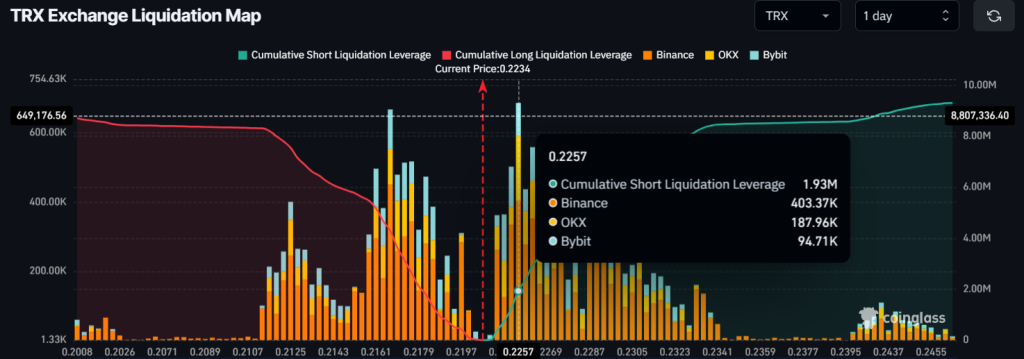

Data from the on-chain analytics firm Coinglass reveals that traders are over-leveraged at $0.2167 on the lower side, holding $4.30 million worth of long positions, believing that the price won’t drop below this level. On the other hand, at $0.2257, traders have $2 million worth of short positions, anticipating that the price won’t surpass this level.

Considering the current market scenario, TRX’s price seems to be on an upward trajectory and is likely to experience a rally soon.

Tron (TRX) Price Action and Upcoming Levels

Despite recent market uncertainties, TRX has reached the lower end of the channel pattern and is consolidating. Expert technical analysis suggests that TRX is primed for an upward rally, contingent on breaking out of consolidation.

Based on recent price movements and historical trends, if TRX breaks out of consolidation and closes a daily candle above $0.225, there is a strong possibility of a surge by 11% towards $0.25 in the coming days.

Despite the challenges, TRX has managed to stay above the 200 Exponential Moving Average (EMA) on the daily timeframe, a bullish indicator signaling an upward trend rather than a downtrend.