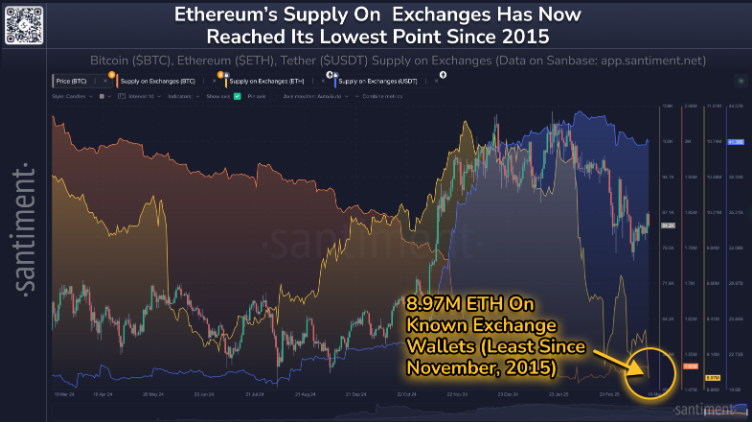

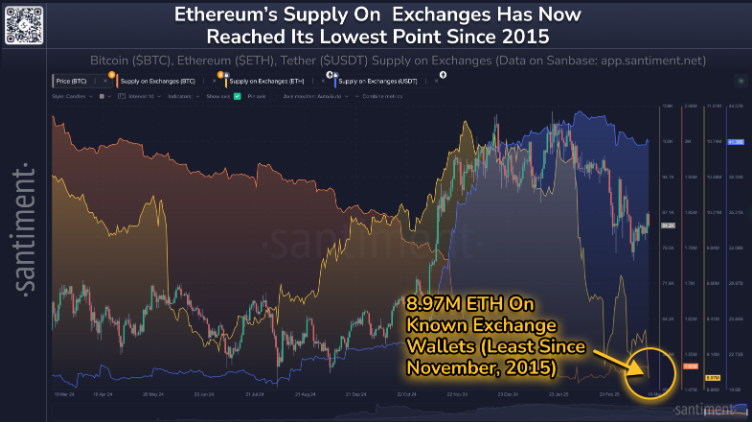

During the recent price decline of Ethereum (ETH), whales and long-term holders have taken advantage of the situation by buying the dip. On March 21, 2025, the on-chain analytics firm Santiment revealed that crypto enthusiasts have been accumulating ETH tokens, resulting in only 8.97 million ETH remaining on exchanges. This trend suggests a bullish outlook for the cryptocurrency.

Ethereum Reserves Fall to 8.97 Million

This significant decrease in exchange reserves is a rare occurrence, with the last instance reported in November 2015. The current reserve is 16.4% lower than it was seven weeks ago, indicating substantial accumulation by whales and long-term holders.

Market experts interpret these metrics positively, viewing them as bullish signals amidst the ongoing price decline and diminishing ETH exchange reserves. In addition to the notable 16.4% drop in reserves, asset prices have also decreased during this period, prompting investors to capitalize on the opportunity.

Current Price Momentum

At present, Ether is trading around $1,960, experiencing a 0.50% decline in the past 24 hours. The trading volume has also decreased by 40% during the same period, reflecting reduced engagement from traders and investors possibly due to market uncertainties.

Ethereum (ETH) Price Action and Upcoming Levels

Despite the prevailing bearish sentiment and diminished participation from market players, the current level of ETH appears optimistic. The lack of a significant rally is not solely attributed to negative sentiment.

Technical analysts suggest that ETH remains bullish, having recently broken out of a prolonged consolidation phase that lasted over a week. Following the recent price dip, the asset seems to have successfully retested that zone, signaling a potential upward movement in its price.

Based on recent price movements and historical patterns, if Ether maintains its position above $1,950, there is a strong likelihood of a 12% surge towards $2,200 in the near future.

Currently, the asset is trading below the 200 Exponential Moving Average (EMA) on the daily timeframe, suggesting a possible price recovery.