Bitcoin has been trading within a range, with its last transaction above $90,000 recorded on March 7. Towards the end of the previous year, Bitcoin had crossed the $100,000 milestone, but it was short-lived as the price quickly dropped. Since then, Bitcoin has been on a downward trajectory, even falling below $80,000.

In addition to the market challenges, President Trump’s tariff announcement added pressure to the crypto space, leading to a decline in most cryptocurrencies alongside Bitcoin.

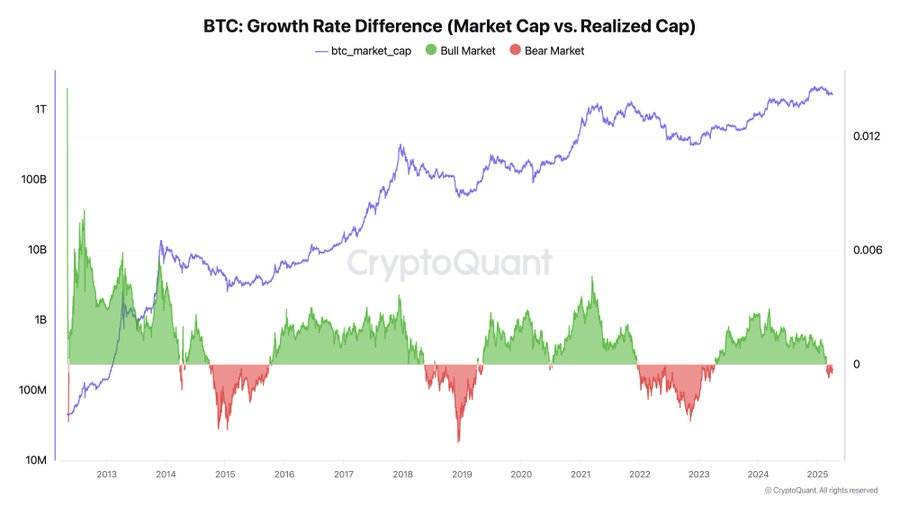

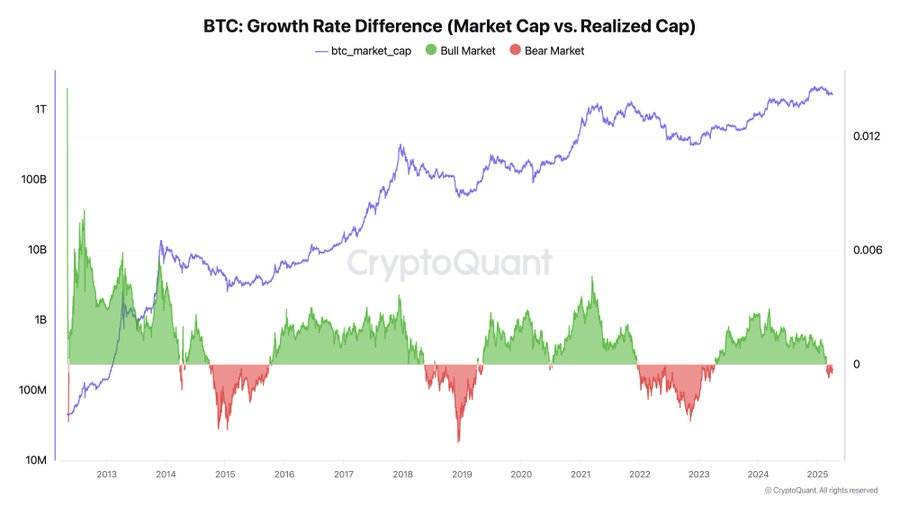

Ki Young Ju, CEO of CryptoQuant, suggests that the Bitcoin bull market may have come to an end based on on-chain data analysis. The key metric being Realized Cap, which tracks the actual capital inflow into the market by monitoring when BTC is bought (enters a wallet) and sold (leaves a wallet).

“However, when there is high selling pressure, even large purchases fail to impact the price. There are simply too many sellers. For instance, when Bitcoin was trading around $100K, there were massive volumes in the market, but the price barely budged,” he explained.

When the Realized Cap increases but the Market Cap (based on the latest trading price) remains stagnant or decreases, it indicates that money is entering the market, but prices are not responding—signaling a bearish trend. This is the current scenario.

On the contrary, in a bullish market, even small amounts of new capital can drive prices up. However, at present, even significant capital injections are unable to influence Bitcoin’s price, indicating a bear market. Historical data shows that genuine market reversals typically take at least six months, making a quick recovery unlikely.

“To sum it up: in a bull market, small capital drives prices up. In a bear market, even large capital fails to push prices higher. The current data clearly indicates the latter. While selling pressure could alleviate at any time, historical trends suggest that real reversals take a minimum of six months—thus, a short-term rally seems improbable,” he concluded.