Bitcoin Poised for Breakout, Says Rekt Capital

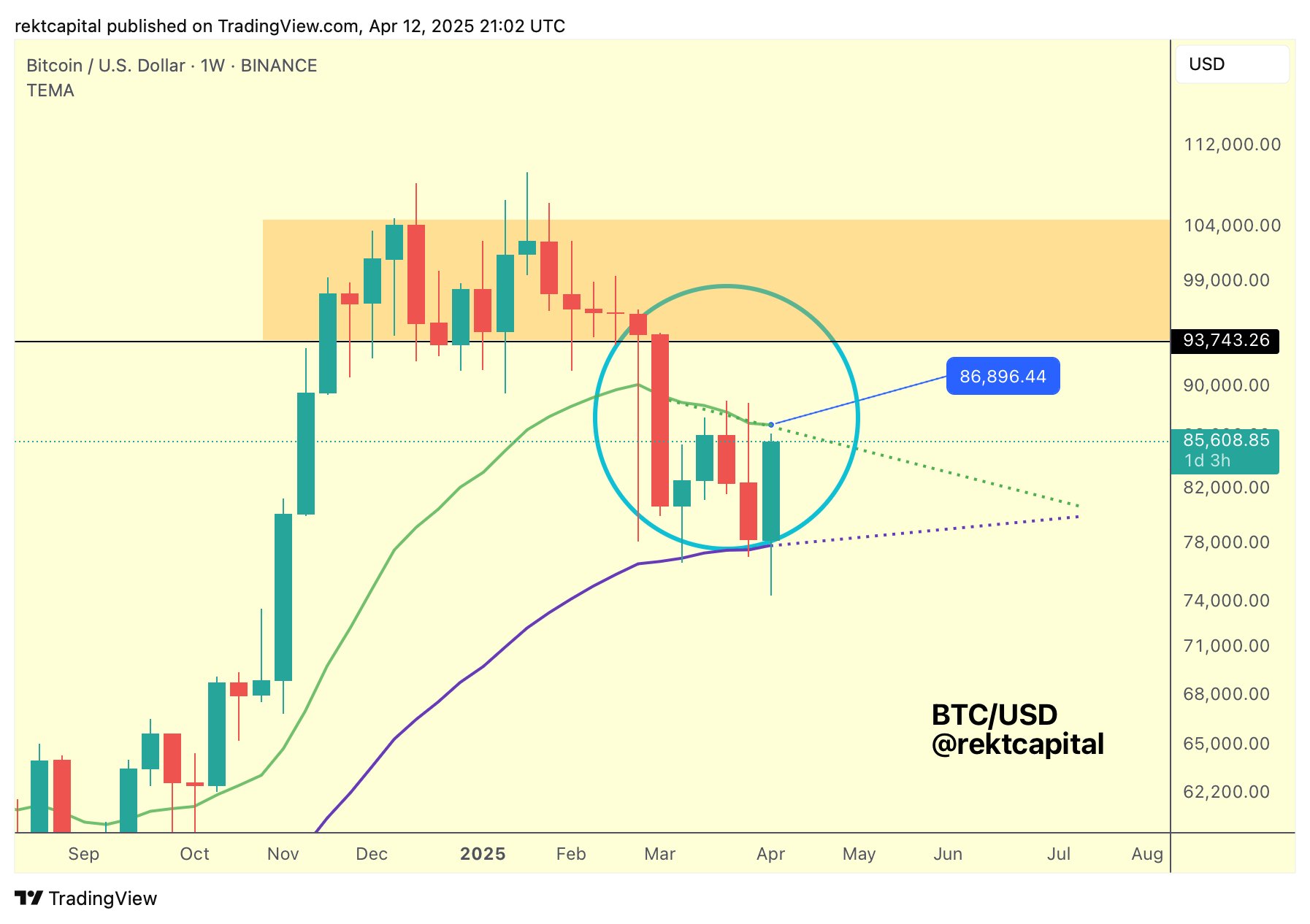

Cryptocurrency analyst Rekt Capital believes that Bitcoin (BTC) is on the verge of a breakout, according to classic technical analysis. The analyst, known for their insights on social media platform X, points out that BTC is showing signs of confirming a breakout after closing above a downward resistance line.

Expressing their optimism, the trader states, “Bitcoin is on the cusp of a breakout. Mere hours away from performing the initial but crucial steps towards fully confirming a breakout beyond the multi-month Downtrend. And when BTC breaks a technical downtrend, BTC enters a new technical uptrend.”

Looking at the weekly chart, Rekt Capital highlights the importance of BTC surpassing a critical exponential moving average (EMA) to enhance its chances of a sustained rally. The analyst explains, “Bitcoin is slowly approaching the 21-week EMA resistance (green). Price will need a Weekly Close above ~$86,900 Sunday/Monday midnight UTC to position itself for a breakout from the triangular pattern formed by these two Bull Market EMAs.”

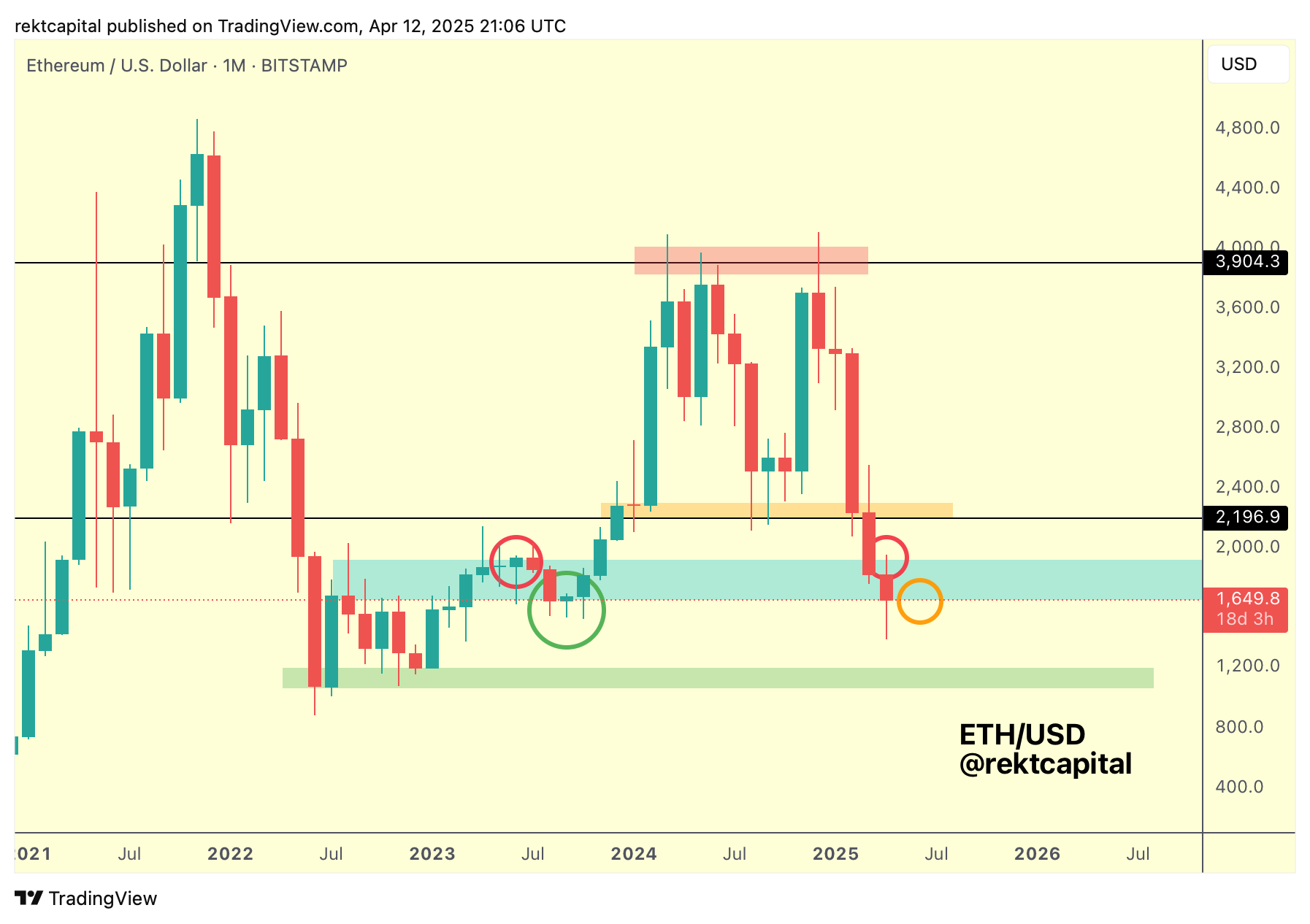

Currently, Bitcoin is trading at $84,463. Shifting focus to Ethereum (ETH), the second-largest digital asset by market cap, Rekt Capital suggests that ETH must maintain its current price range to potentially trigger a rally reminiscent of 2023. The analyst notes, “ETH needs to hold the bottom of the light blue historical demand area if it wants to position itself for a repeat of mid-2023 history.”

ETH is currently trading at $1,595. Stay updated with the latest crypto news and analyses by following us on X, Facebook, and Telegram. Don’t miss out on important updates – subscribe to receive email alerts directly to your inbox.

Check out the latest price action and explore The Daily Hodl Mix for more insights. Generated Image: Midjourney