Solana (SOL), the world’s fourth-largest cryptocurrency by market cap is attracting significant attention from crypto enthusiasts amidst an ongoing price correction. Some investors are seen accumulating SOL, while others are dumping their tokens.

Report Uncovers $23 Million Solana Sell-off

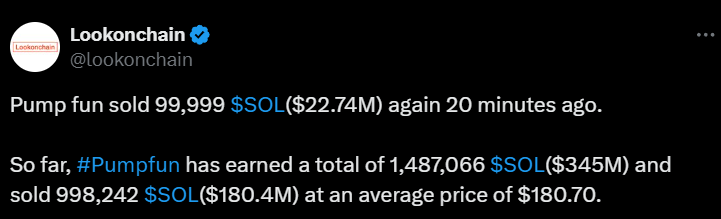

On November 26, 2024, a whale transactions tracker Lookonchain reported on X (formerly Twitter) that the Solana-based meme coin generator, Pump Fun, had sold a substantial 99,999 SOL valued at $22.74 million.

The report highlighted that this significant token sell-off occurred on the Kraken cryptocurrency exchange. Pump Fun has so far earned more than 1.487 million SOL tokens valued at $345 million from generating the meme coin, out of which they have sold 998,242 SOL worth $180.4 million at an average price of $180.70.

Given the current market sentiment, this SOL offload is not considered excessive. However, it has the potential to impact investors and whales during this market phase, creating selling pressure and leading to further price declines.

Solana (SOL) Technical Analysis and Future Levels

Per expert technical analysis, SOL is currently at a strong support level of $230. However, due to significant selling pressure and the ongoing market correction, it is struggling to sustain this level. Based on recent price movements, if SOL fails to hold this support, there is a high chance it could drop by 12%, reaching the $200 level in the near future.

On a positive note, the asset is trading above the 200 Exponential Moving Average (EMA) on a daily timeframe, indicating an uptrend for SOL.

Furthermore, the Relative Strength Index (RSI) is below 70 and currently stands at 57.30, hinting at a potential upward rally in the days ahead. RSI is a commonly used technical indicator by traders and investors for decision-making.

Current Price Movement

Currently, SOL is hovering around $230 and has witnessed a price decrease of over 3.55% in the last 24 hours. During the same period, its trading volume surged by 24%, indicating increased engagement from traders and investors amidst the ongoing price correction.