The cryptocurrency market as a whole is facing challenges, with major players like Bitcoin (BTC) and Ethereum (ETH) struggling. Despite this downturn, whale transaction tracker Lookonchain recently reported on X (formerly Twitter) that a new wallet withdrew a significant 1,850 BTC valued at $183.37 million from Binance, the world’s largest cryptocurrency exchange.

Whale Purchases $183 Million Worth of Bitcoin

The withdrawal occurred as BTC dropped to a support level near $97,300, following MicroStrategy’s acquisition of 21,550 BTC worth $2.1 billion at an average price of $98,783, as per CoinPedia.

These acquisitions suggest that both the whale and the institution are taking advantage of the opportunity to buy the dip.

$335 Million of Bitcoin Outflow from Exchanges

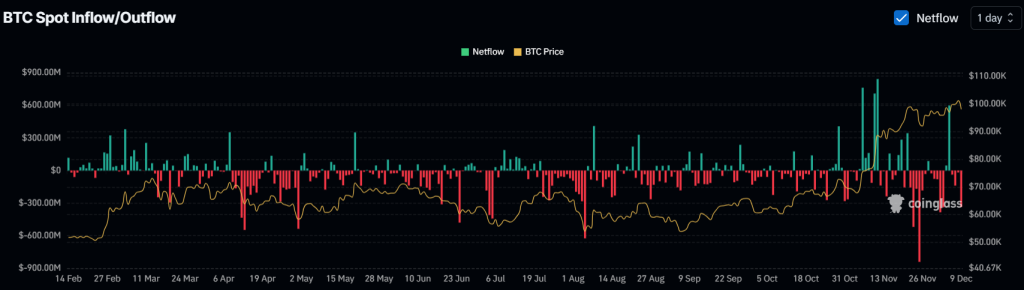

Coinglass revealed that exchanges witnessed a significant outflow of $335 million in Bitcoin over the past 24 hours. This outflow signals a potential buying opportunity and hints at potential upward momentum in the days ahead.

Bitcoin Technical Analysis and Future Levels

Technical analysis indicates that BTC has been following a pattern of higher highs and higher lows since November 11, 2024. Currently, BTC has reached a higher low within this pattern.

Historically, when BTC reaches this level, it tends to experience upward momentum. However, there is speculation among investors and traders about whether the same will happen this time, which could explain the increased interest from whales and institutions.

Based on recent price movements, there is a strong likelihood that BTC could rise by 6.5% to reach $104,160 in the near future.

On the positive side, BTC’s Relative Strength Index (RSI) is currently at 44, close to the oversold region, indicating a potential upward rally soon. Additionally, BTC is trading above the 200 Exponential Moving Average (EMA) on the daily timeframe, signaling an uptrend.

Current Price Momentum

Currently, BTC is trading around $97,700, with a price decline of over 2.15% in the last 24 hours. During this period, its trading volume has surged by 85%, indicating increased participation from traders and investors amidst bullish price action.