Keeping up with market developments is crucial for making well-informed financial decisions. This week witnessed significant changes across global markets and the cryptocurrency sector.

Let’s delve into the highlights. One thing is for sure – it has been a challenging week all around!

US Market Weekly Update

The S&P 500 index saw a 2.02% decline, dropping from $6,050.84 to $5,930.84. Similarly, major markets in Europe, China, Japan, India, South Africa, and Australia also experienced downturns.

Key happenings in the US market include:

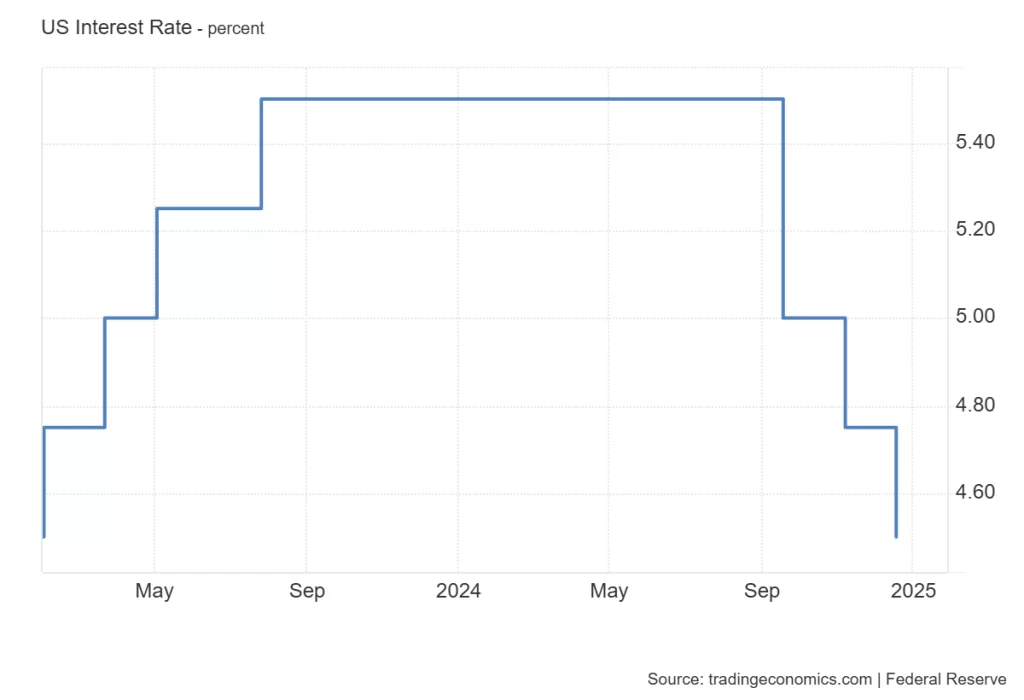

- Interest Rate Cut: The Federal Reserve lowered the interest rate by 25 basis points, reaching 4.25%-4.5%.

- GDP Growth: The GDP growth showed a slight improvement from 3% in Q2 to 3.1% in Q3.

- Jobless Claims: Initial jobless claims decreased from 224K in early December to 220K in the second week.

- Core Inflation: The Core PCE Price Index MoM dropped to 0.1% in November, down from 0.3% in October.

Other Indicators

The economic data presented a mix of results:

- The NY Empire State Manufacturing Index plunged from 31.2 to 0.2 points.

- The S&P Global Composite PMI Flash surged from 54.9 to 56.6 in December.

- The Retail Sales MoM Index decreased to 0.7% in November from 0.5% in October.

- Industrial Production MoM showed a smaller decline, improving from -0.4% to -0.1%.

Housing data remained weak, with the NAHB Housing Market Index staying at 46 points and Housing Starts dropping to 1.29 million units from 1.31 million.

The US dollar gained strength against major currencies such as the Euro (+0.70%), Chinese Yuan (+0.27%), Japanese Yen (+1.78%), and Indian Rupee (+0.20%).

Crypto Market Performance This Week

The cryptocurrency market cap saw an 8.2% decline, with the altcoin market cap decreasing from $1.55T to $1.39T. Excluding Bitcoin and Ethereum, the market cap dropped from $1.07T to $969.31B. Cryptocurrencies outside the top ten witnessed a significant drop, with their market cap falling to $348.32B from $406.93B.

Bitcoin Market Overview

Bitcoin faced significant challenges this week:

- Monday: Started at $106,058.18.

- Thursday: Hit a low of $97,461.38.

- Friday: Briefly dropped to $92,198.03 before recovering to close at $97,812.27. Bitcoin’s performance between December 16-20 showed a 7.77% decline.

Ethereum Market Scenario Analysis

Ethereum also faced challenges:

- December 16: Started at $3,988.87.

- December 19: Dropped to a low of $3,415.69, a 14.36% decrease.

- December 20: Hit a bottom at $3,108.75 before rebounding to close at $3,471.16. Ethereum’s weekly performance fell by 12.97%.

Top Cryptos: Weekly Performance Highlights

Most top cryptocurrencies faced losses:

- Dogecoin: Decreased by 19.1%.

- Cardano: Fell by 13.4%.

- Solana: Declined by 12.5%.

- Ethereum: Dropped by 10.8%.

- Bitcoin, XRP, BNB: Experienced declines of 3.9%, 6.0%, and 5.6%, respectively.

- Also Read :

- Donald Trump’s Inauguration: Ripple Leads the $200M Crypto Donation Wave

- ,

Trending This Week

Binance HODLer Airdrops, Circle Ventures Portfolio, Binance Launchpool, Binance Labs Portfolio, and Coinbase Ventures Portfolio are the top five trending categories at the moment. Among these categories, Binance HODLer Airdrops show the highest seven-day change of +181.3%.

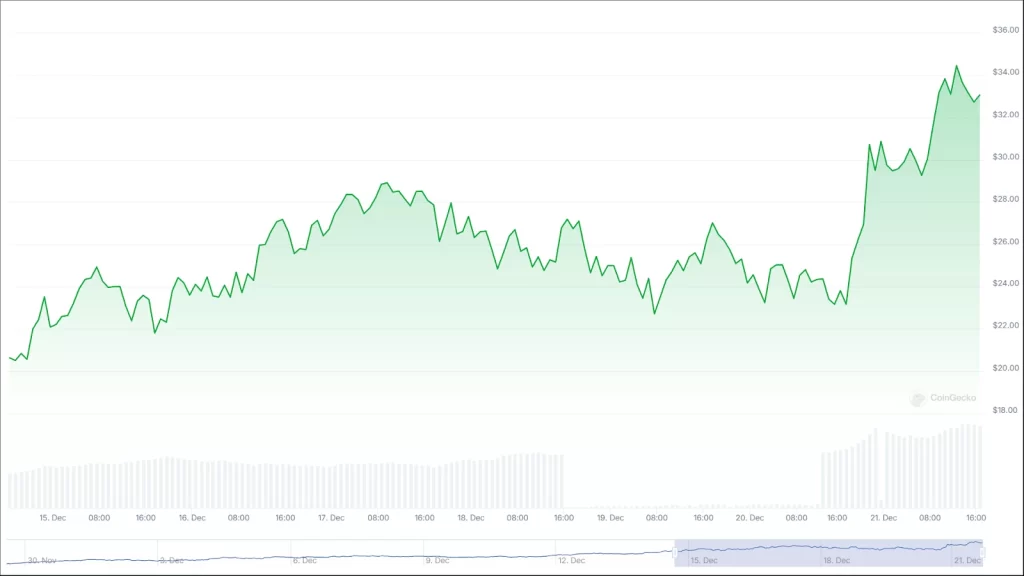

Hyperliquid, LUKSO, Pudgy Penguins, Ethena, and Sui are the top five trending cryptocurrencies. Hyperliquid, among the top five, displays the highest seven-day change of 54.6%.

Crypto Category Overview

Over the past week, the Smart Contract Platform category saw a decline of about 6.7%, Layer 1 by 6.0%, Proof of Work by 4.4%, Proof of Stake by 11.6%, Centralised Exchange Token by 4.1%, Decentralised Finance by 9.9%, Meme by 16.9%, Liquid Staking by 11.7%, Crypto-Backed Tokens by 8.7%, Wrapped-Tokens by 8.6%, Decentralised Exchange by 3.8%, Artificial Intelligence by 14.5%, DePIN by 17.6%, NFT by 21.4%, Layer 2 by 13.1%, GameFi by 20.7%, Yield Farming by 17.4%, Real World Assets by 8.9%, Layer 0 by 19%, Metaverse by 20.7%, Internet of Things by 20.1%, Gaming Utility Tokens by 19.5%, Gaming Governance Tokens by 19.9%, Liquid Staking Governance Tokens by 22.2%, and Bridge Governance Tokens by 18.6%.

On the other hand, Stablecoins have grown by 0.8%, Perpetuals by 35.9%, Binance HODLer Airdrops by 181.3%, AI Agent Launchpad by 2.2%, and Virtuals Protocol Ecosystem by 13.9%.

A Challenging Week for Markets – Can It Bounce Back?

Global markets, including the US, Europe, China, and India, faced declines alongside an 8.2% drop in the cryptocurrency market. Bitcoin, Ethereum, and other major cryptocurrencies saw substantial losses, while the US dollar strengthened against major currencies. Despite these difficulties, Stablecoins and Perpetuals exhibited resilience.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

Market fluctuations may shake confidence, but they also fuel the persistence that drives long-term growth.