Despite the recent price decline, XRP, the native token of Ripple Labs, has exhibited a bullish price action pattern and is poised for a substantial price rally in the near future. As of January 31, 2025, the overall cryptocurrency market is showing signs of recovery, with Bitcoin (BTC) and Ethereum (ETH) also experiencing gains, although XRP is facing some challenges.

XRP Current Market Sentiment

Despite the positive market sentiment, XRP is currently trading around $3.13 and has seen a modest price increase of over 0.80% in the last 24 hours. However, trading volume has decreased by 35% during the same period, indicating lower interest from investors and traders.

This slight price increase has led XLM to outperform XRP in terms of gains, with XLM surging more than 13% in the past 24 hours. It seems that XRP traders and investors are now turning their focus towards XLM, possibly due to talks of a potential spot ETF.

XRP Technical Analysis and Upcoming Levels

Expert technical analysis suggests that XRP has formed a bullish flag and pole price action pattern on the daily time frame, but it is struggling to break out.

Based on recent price action, if XRP successfully breaks out of this pattern and closes a daily candle above the $3.21 level, there is a strong possibility of a 40% surge towards the $4.50 level in the future.

With XRP’s Relative Strength Index (RSI) hovering around 59, there is room for the asset to experience significant price gains.

XRP’s Mixed Sentiment

Despite the bullish price action, data from the on-chain analytics firm Coinglass reveals that investors are accumulating XRP. Spot inflow/outflow data shows that exchanges have witnessed an outflow of over $12 million worth of XRP in the past 24 hours, indicating potential accumulation that could lead to buying pressure and further upside movement.

Traders Betting on XRP

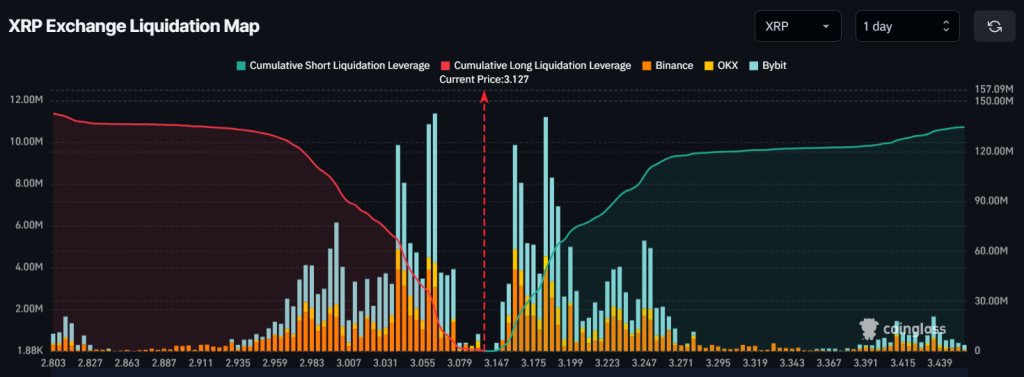

While investors and whales are optimistic about XRP, intraday traders are taking a bearish stance. XRP’s exchange liquidation map shows that long positions worth $24.50 million are concentrated at the $3.063 level, while short sellers hold $50.09 million worth of short positions at the $3.183 level.

This data indicates that short sellers currently have the upper hand in the short term, with nearly double the positions of long-term holders.