It seems that Ripple’s native token XRP may be heading towards a price decline, as whales have recently sold off millions of XRP tokens while the price hovers around the $0.545 breakdown level. On September 12, 2024, Whale Alert, a transaction tracker, reported on X (previously Twitter) that Ripple whales had unloaded 39.32 million XRP tokens, valued at $21.13 million, to Bitstamp.

Ripple Whales Recent Action

This significant XRP dump by whales has contributed to a more bearish sentiment, particularly as it coincided with the price retesting the $0.545 breakdown level.

Currently, XRP is trading near $0.535, experiencing a slight price drop of over 1.12% in the last 24 hours. However, trading volume has surged by 25% during the same period, indicating increased trader participation despite the price decline.

XRP Price Prediction

Expert technical analysis suggests a bearish outlook for XRP, as it is currently trading below the 200 Exponential Moving Average (EMA) on a daily time frame. The coin is finding some support at the $0.531 level, but if this support fails, there is a strong possibility of a 10% plunge to the $0.475 level.

Furthermore, XRP’s Relative Strength Index (RSI) is in oversold territory, hinting at a potential price reversal.

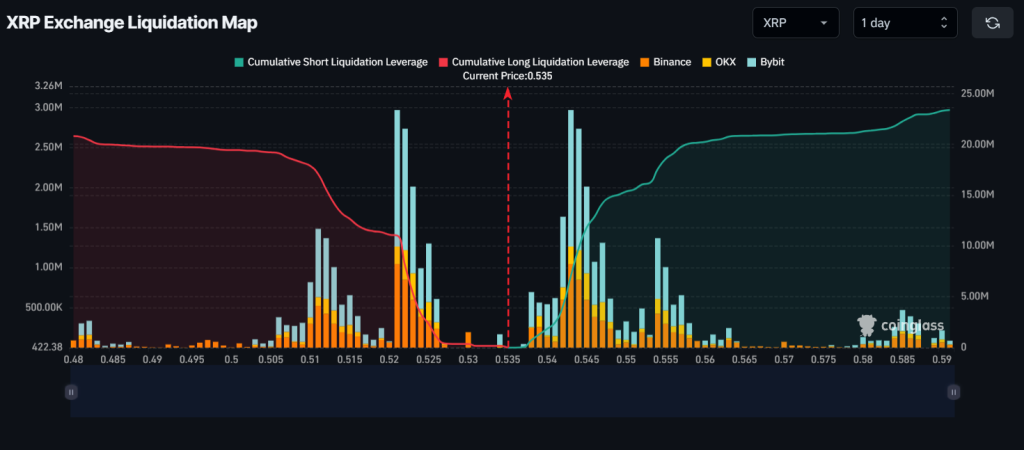

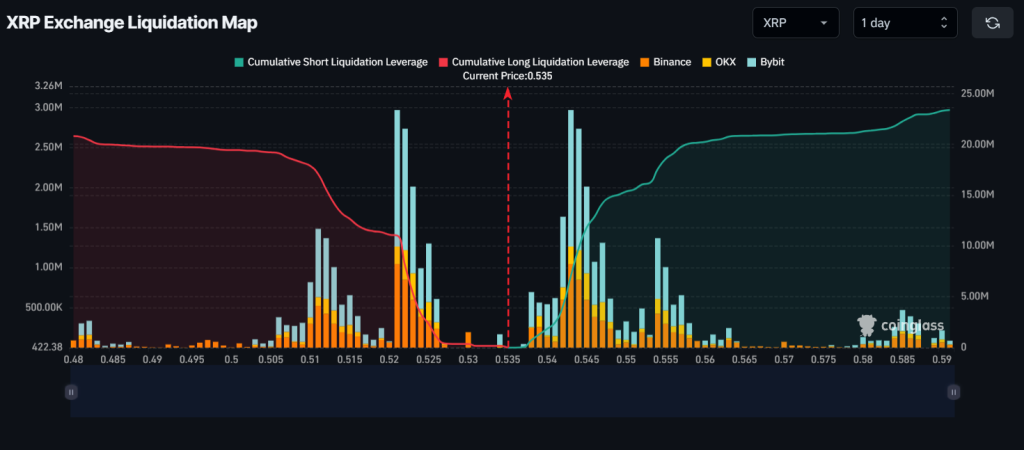

Major Liquidation Levels

Currently, major liquidation zones are around the $0.521 support level on the lower end and $0.543 on the upper end, with traders being heavily leveraged at these levels, according to CoinGlass.

If the bearish sentiment persists and XRP drops to $0.521, long positions worth around $11.04 million could face liquidation. Conversely, a shift in sentiment leading to a rise to $0.543 could trigger the liquidation of short positions worth approximately $7.07 million.

According to CoinGlass’s XRP Long/Short ratio data, over the past four hours, 53.64% of top XRP traders have taken short positions, while 46.36% have opted for long positions.

Considering all these factors, it appears that bears are currently dominating XRP’s market and could potentially exert further selling pressure.