During this period of price correction, Popcat (POPCAT), a well-known Solana-based meme coin, is showing bullish signs and has presented a great buying opportunity with a favorable risk-reward ratio. The positive outlook for this meme coin is likely due to its daily chart pattern and the bullish price action it has been exhibiting.

POPCAT Technical Analysis and Future Levels

Expert technical analysis suggests that POPCAT is in a bullish trend and is currently moving towards the lower boundary of a bullish channel pattern that has been a strong support level for the coin since the beginning of October 2024.

Historically, when the price of POPCAT approaches this support level, it tends to attract buying interest and experiences an upward movement. Traders and investors are anticipating a similar rally this time around.

If POPCAT maintains its position above the lower boundary of the bullish channel pattern, there is a strong chance that the coin could surge by 30% to reach $1.84 in the near future. This level presents an attractive buying opportunity with a risk-reward ratio of 1:4.

Bullish On-Chain Metrics

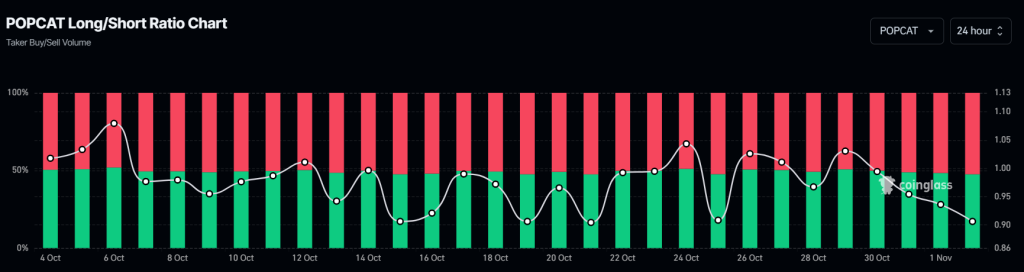

Despite the positive technical outlook, on-chain metrics for POPCAT show mixed sentiment. According to Coinglass, an on-chain analytics firm, the Long/Short ratio for POPCAT currently stands at 0.90, indicating a bearish sentiment among traders. Additionally, the open interest for POPCAT has decreased by 12% in the last 24 hours, suggesting that traders’ positions are being liquidated at a higher rate compared to the previous day.

The combination of declining open interest and a Long/Short ratio below one indicates a weak bearish sentiment among traders, as there is a lack of new positions being established.

Current Price Momentum

Currently, POPCAT is trading around $1.44, with a price drop of over 11% in the last 24 hours. During the same period, its trading volume has decreased by 30%, indicating reduced participation from traders and investors amidst the ongoing price decline.