In today’s digital age, online transactions have become the norm, and using a physical credit card is slowly becoming a thing of the past. The emergence of virtual credit cards has made online transactions even more convenient and secure. One such virtual card that has gained popularity in recent times is the Affirm virtual card. If you’re new to the concept of virtual credit cards or are looking to use the Affirm virtual card, this guide will take you through all the necessary steps.

Affirm virtual card is a secure way to make purchases online without having to share your personal information with the merchant. With its easy-to-use interface and high levels of security, it’s no wonder that many online shoppers are turning to the Affirm virtual card to make their online purchases. Whether you’re purchasing goods or services from an online store, paying bills, or booking travel, the Affirm virtual card is a reliable and secure payment option that can help you make the most of your online transactions. In this guide, we’ll take you through the steps of setting up and using the Affirm virtual card, so you can start making hassle-free online purchases today.

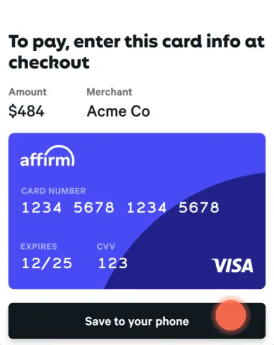

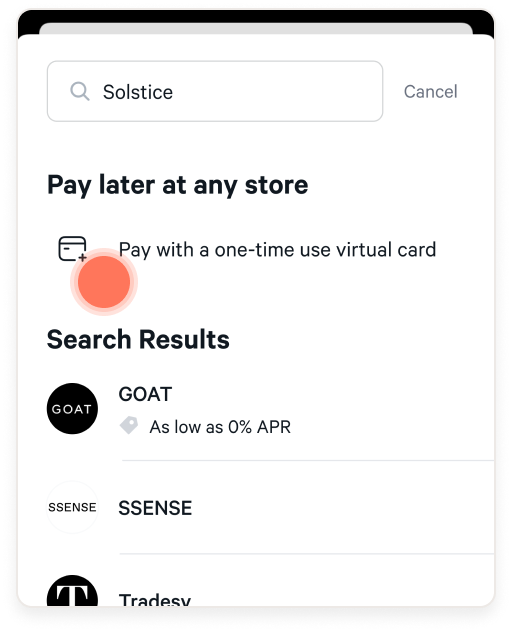

Using an Affirm Virtual Card is easy and secure! Here’s how:

- Create an Affirm account.

- Choose an amount to finance (up to your approved limit).

- Select the “Virtual Card” as your payment method.

- Receive an email with your one-time use virtual card number, expiration date, and three-digit security code.

- Use your virtual card number to make purchases online or over the phone.

- Enjoy the convenience and security of your Affirm Virtual Card!

What Is an Affirm Virtual Card?

Affirm virtual cards are a type of credit card issued by Affirm, a financial technology company. They allow customers to make secure online payments without having to provide their credit card information. The cards are issued through a bank or other financial institution, and can be used anywhere that accepts major credit cards. Customers can also choose to pay their balance in full each month, or opt for a monthly payment plan.

How to Use an Affirm Virtual Card

Step 1: Sign Up for an Affirm Account

The first step to using an Affirm virtual card is to sign up for an account. Customers can sign up online or via the Affirm app. They will be asked to provide personal information, such as their name, address, and Social Security number, as well as a valid form of payment. Once the account is created, customers will receive a unique virtual card number and a verification code.

Step 2: Activate the Card

Once the card is issued, customers will need to activate it in order to start using it. This can be done online or through the Affirm app. Customers will need to enter their card number and the verification code they received when signing up for the account. Once the card is activated, customers can start using it to make purchases.

Step 3: Make Purchases

Once the card is activated, customers can use it to make purchases online or in stores. Customers can simply enter their card number and security code at the checkout, and their purchase will be charged to their Affirm virtual card.

Step 4: Monitor Balance and Payments

It is important for customers to monitor their balance and payments to ensure that they are not overspending. Customers can track their spending and payments through the Affirm app or website. They can also set up reminders to make sure that their payments are made on time.

Step 5: Pay Balance in Full or Choose a Payment Plan

Once customers have finished using their card, they will need to pay off their balance. Customers can choose to pay their balance in full each month, or opt for a monthly payment plan. Customers can also set up automatic payments to ensure that their payments are made on time.

Frequently Asked Questions about How to Use Affirm Virtual Card

Affirm virtual cards are a convenient way to pay for online purchases. They are a secure and easy way to make payments without the hassle of entering a credit card number. Here are some frequently asked questions to help you understand how to use your virtual card.

What is an Affirm Virtual Card?

An Affirm virtual card is a digital version of a physical credit card. It is a secure and easy way to make payments online without having to enter a credit card number. The virtual card is linked to your Affirm account, allowing you to make purchases quickly and securely. You can use your Affirm virtual card to pay for items online, in-store, or anywhere else where a major credit card is accepted.

How do I get an Affirm Virtual Card?

You can get an Affirm virtual card in just a few easy steps. First, you’ll need to create an Affirm account. Once you have created your account, you can then request a virtual card. Once your request is approved, you’ll be able to use your virtual card to make payments online or in-store.

What are the benefits of using an Affirm Virtual Card?

Using an Affirm virtual card has several benefits. First, it is a secure and easy way to make payments without having to enter a credit card number. Additionally, your virtual card is linked to your Affirm account, so you can easily keep track of your payments. Finally, you can use your virtual card to make purchases wherever a major credit card is accepted.

Are there any fees associated with using an Affirm Virtual Card?

No, there are no fees associated with using an Affirm virtual card. You only pay for the items that you purchase with your virtual card.

How do I pay with my Affirm Virtual Card?

Paying with your Affirm virtual card is quick and easy. When making a purchase online, you can enter your virtual card number, expiration date, and security code just like you would with a physical credit card. If you’re making an in-store purchase, you can provide the cashier with your virtual card number and expiration date. Your virtual card number and expiration date can be found in your Affirm account.

In conclusion, using the Affirm virtual card is a simple and convenient way to make online purchases. By providing a unique card number and security code for each transaction, the virtual card helps protect your personal and financial information from potential fraud. Additionally, the ability to set spending limits and expiration dates on the card can help you stay within your budget and avoid overspending.

Whether you’re looking to make a one-time purchase or want to use the Affirm virtual card for all of your online shopping needs, it’s important to take the time to understand how it works and how to use it effectively. With a little bit of practice and some caution, the Affirm virtual card can be a valuable tool for managing your finances and making secure online purchases. So why not give it a try and see how it can help simplify your online shopping experience?