Sending and receiving money has never been easier, thanks to the advent of technology. With virtual cards, you can now send and receive money from the comfort of your home, office or even on the go. Virtual cards have become increasingly popular in recent times, as they offer a secure and convenient way of making transactions. In this article, we’ll be taking a look at how to send money with current virtual cards.

Virtual cards are digital versions of physical cards that can be used for online transactions. They are designed to provide a safe and secure way of making online purchases, and they come with a unique set of numbers that can be used for a single transaction or multiple transactions. With virtual cards, you don’t need to worry about hackers stealing your card details, as they are not linked to your bank account. In addition, virtual cards are easy to use and can be set up in a matter of minutes, making them an ideal option for people who are always on the go. So, if you’re looking for a convenient and secure way to send money, virtual cards are definitely worth considering.

Sending money with a virtual card is easy. Just follow these simple steps:

- Log into your virtual card account

- Choose the amount of money you want to send

- Enter the recipient’s details and payment information

- Confirm the payment

If you want to compare sending money with a virtual card vs other payment methods, here is a helpful comparison table:

| Payment Method | Fees | Speed | Security |

|---|---|---|---|

| Virtual Card | Low | Fast | High |

| PayPal | Medium | Medium | High |

| Bank Transfer | High | Slow | High |

Sending Money with a Virtual Card

A virtual card is a type of card that only exists in the digital world. It is not a physical card and is instead tied to a user’s bank account or credit card. Virtual cards are typically used for online payments and can be used to send money from one person to another. In this article, we will explain how to send money with a virtual card.

Obtaining a Virtual Card

The first step to sending money with a virtual card is to obtain a virtual card. Most major banks, credit card companies, and online payment processors offer virtual cards. To obtain a virtual card, you must first create an account with the provider. Once you have created an account, you will be able to add funds to your virtual card and use it to send money.

Once you have your virtual card set up, you will need to link it to your bank account or credit card. This will allow you to transfer funds to and from your virtual card. You can also use your virtual card to make online payments or purchases.

Sending Money with a Virtual Card

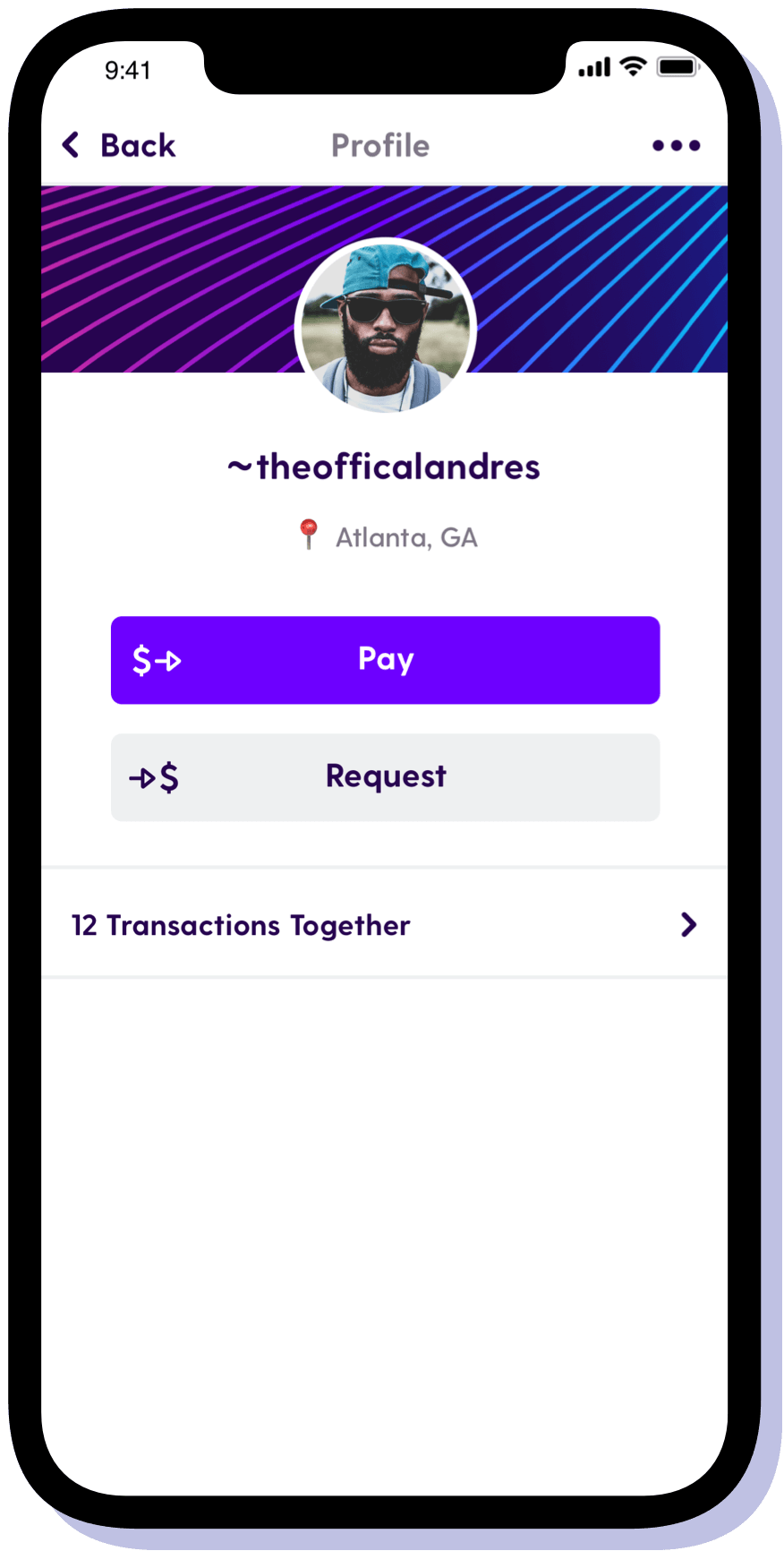

Once you have your virtual card set up, you can begin sending money. To do this, you will need to have the recipient’s bank account information. You can then use your virtual card to transfer the funds to the recipient’s account.

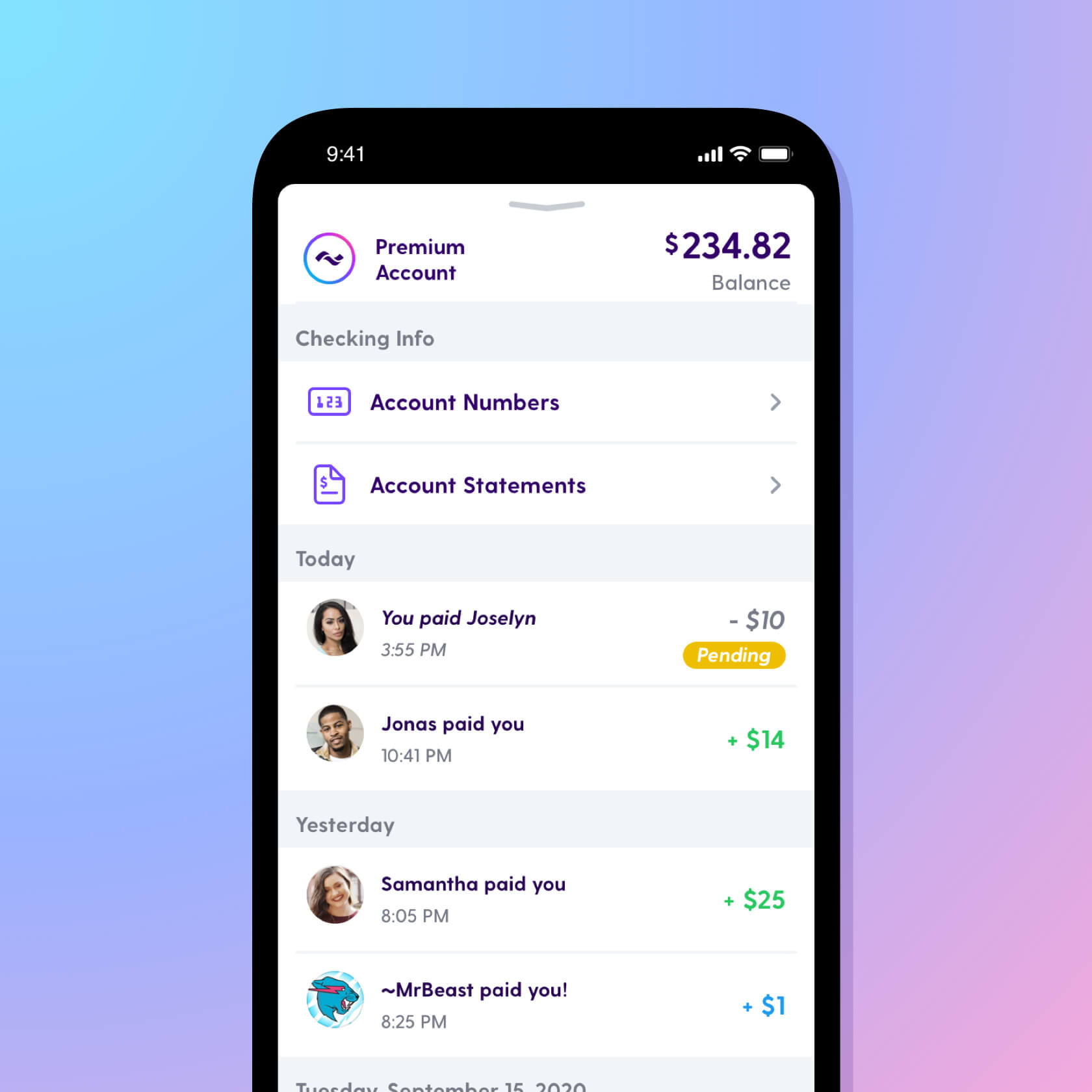

The process of sending money with a virtual card is usually very simple. You will need to log into your virtual card account and enter the recipient’s bank account information. Once you have entered the information, you will need to enter the amount of money you wish to send. You will then be prompted to confirm the transaction. Once the transaction is confirmed, the money will be transferred to the recipient’s bank account.

Using a Virtual Card to Receive Money

In addition to sending money, you can also use your virtual card to receive money. To do this, you will need to provide the sender with your virtual card information. Once the sender has entered your information, they will be able to transfer the funds to your virtual card. You can then use your virtual card to transfer the funds to your bank account or to make online purchases.

Fees and Charges

When using a virtual card, it is important to be aware of any fees or charges that may apply. Many providers charge a small fee for each transaction. It is also important to be aware of any currency conversion fees that may apply when transferring funds to or from your virtual card.

Security

When using a virtual card, it is important to ensure that your information is kept secure. Most providers use advanced security measures to protect your information from being accessed by unauthorized persons. Additionally, you should always be aware of any suspicious activity on your virtual card and contact your provider if you notice anything out of the ordinary.

Frequently Asked Questions:

Sending money with a current virtual card is an easy and secure way to transfer funds to others. Here are some of the most common questions about how to do this.

What Is a Virtual Card?

A virtual card is an electronic version of a physical debit or credit card. It’s used to make payments online and can be linked to your existing bank account. Virtual cards are easy to set up and can be used to make purchases and send money to friends and family.

How Do I Set Up a Virtual Card?

Setting up a virtual card is a simple process. All you need to do is create an account with the financial institution you’d like to use and then link your existing debit or credit card to the account. Once you’ve done this, you can start using the virtual card for transactions.

How Do I Send Money With a Virtual Card?

Sending money with a virtual card is easy and secure. All you need to do is enter the recipient’s name and virtual card number into the payment form. Once you’ve done this, the money will be transferred from your account to theirs. Some virtual card providers also allow you to set up automatic payments, so you can easily send money to the same person on a regular basis.

Are Virtual Cards Secure?

Virtual cards are very secure, as they are encrypted and use two-factor authentication. This means that even if someone were to gain access to your card details, they would not be able to use them to make payments. Virtual cards also come with additional security features such as transaction limits and the ability to disable them if they are lost or stolen.

Are Virtual Cards Free?

In most cases, virtual cards are free to set up and use. Some financial institutions may charge a fee for certain transactions or for setting up a virtual card, so it’s important to check with your provider before signing up.

In conclusion, sending money with a virtual card is a fast and convenient way to transfer funds to anyone, anywhere, at any time. With the current advancements in technology, virtual cards have become a popular payment option, especially for those who prefer online transactions. By following the steps outlined above, you can easily create and use a virtual card to send money to your loved ones, pay bills, or make online purchases without worrying about the security of your personal information.

It is important to note that while virtual cards offer convenience and security, it is essential to be vigilant and ensure that you only use reputable and trusted platforms. Always keep your virtual card details safe, avoid sharing them with anyone, and regularly monitor your transactions to detect any suspicious activity. With these precautions in mind, you can enjoy the many benefits of virtual cards and send money with ease.