Do you often find yourself forgetting your physical debit card at home or losing it altogether? Have you ever wished for a simpler and more secure way to manage your finances? Dave Virtual Card is the solution to all your problems. It is a digital debit card that can be used to make purchases and withdraw cash just like a physical card. In this article, we will guide you on how to use Dave Virtual Card at an ATM.

Firstly, it is important to note that you can only use your Dave Virtual Card at ATMs that accept Visa or MasterCard debit cards. To begin, you need to locate an ATM that accepts your card. Once you have found a compatible ATM, insert your Dave Virtual Card into the card slot just like you would with a physical card. Next, enter your PIN number and select the amount of cash you want to withdraw. It’s that simple! With Dave Virtual Card, you can access your funds anytime, anywhere without worrying about losing your physical card or compromising your security.

Using Dave Virtual Card At ATM: To use your Dave Virtual Card at an ATM, you need to first download the Dave app and activate your card. Once your card is activated, you can use it to withdraw cash at any ATM that accepts Visa. To do this, simply insert your card and enter your PIN. You will then be able to withdraw your desired amount of cash.

- Download the Dave app and activate your card.

- Insert your card at the ATM.

- Enter your PIN.

- Choose to withdraw cash.

- Enter the desired amount of cash.

- Collect your cash.

How to Use Dave Virtual Card at ATM?

Dave virtual card is a great way to access your money without the need for a physical card. The Dave virtual card allows you to use your debit and credit cards from anywhere in the world. With the Dave virtual card, you can withdraw cash from any ATM, make purchases online, and receive payments from anyone. Here’s how you can use the Dave virtual card at an ATM.

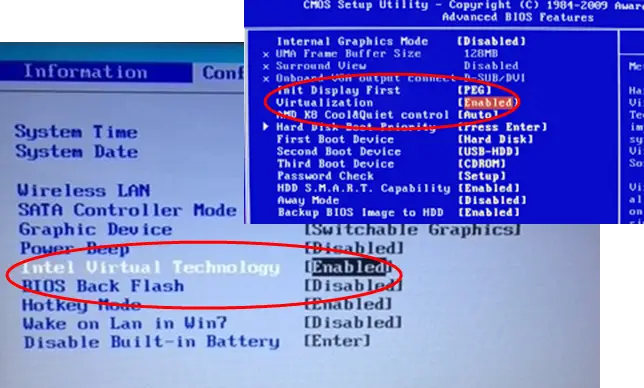

Step 1: Activate Your Card

Before you can use your Dave virtual card at an ATM, you’ll need to activate it. You can do this by logging into your account on the Dave app. Once you’ve logged in, you’ll be able to activate your card. Once your card is activated, you’ll be able to use it at any ATM.

Step 2: Find a Compatible ATM

Once your Dave virtual card is activated, you’ll need to find an ATM that is compatible with the card. You can check the list of compatible ATMs on the Dave website. Once you’ve found an ATM that is compatible with your card, you can proceed to the next step.

Step 3: Insert the Card into the ATM

Once you’ve found a compatible ATM, you’ll need to insert your Dave virtual card into the ATM. You can do this by inserting the card into the card slot at the top of the ATM. Make sure that the card is inserted correctly.

Step 4: Enter Your PIN

Once you’ve inserted your card into the ATM, you’ll need to enter your PIN. You’ll be prompted to enter your PIN on the ATM’s screen. Make sure you enter the correct PIN or your transaction will be declined.

Step 5: Select the Transaction You Wish to Carry Out

Once you’ve entered your PIN, you’ll be prompted to select the type of transaction you wish to carry out. You’ll be able to select from a variety of options, such as withdrawing cash, checking your balance, or transferring funds.

Step 6: Confirm the Transaction

Once you’ve selected the transaction you wish to carry out, you’ll need to confirm the transaction on the ATM’s screen. Make sure you double-check the details of the transaction before you confirm it. Once you’ve confirmed the transaction, your funds will be transferred and you’ll be able to access your money.

Step 7: Collect Your Funds

Once you’ve confirmed the transaction, the ATM will dispense your funds. Collect your funds and then remove your card from the ATM. Once you’ve removed your card, your transaction is complete.

Frequently Asked Questions

Dave is a money management app that lets you set up a virtual card to pay bills and make ATM withdrawals. Here are some frequently asked questions about how to use Dave virtual card at an ATM.

How do I add funds to my Dave virtual card?

To add funds to your Dave virtual card, you can either transfer money from your bank account or add money directly with your debit card. To transfer money from your bank account, simply open the Dave app and select ‘add money’. Then, follow the on-screen prompts to link your bank account to Dave and transfer the funds. To add money with your debit card, open the Dave app and select ‘add money’. Then, follow the on-screen prompts to enter your debit card information and add the funds.

How do I use my Dave virtual card at an ATM?

To use your Dave virtual card at an ATM, first you must add funds to your Dave account. Once you have added the funds, go to your nearest ATM and insert your card. Then, select ‘Debit Card’ and enter your PIN number. Next, select ‘Withdrawal’ and enter the amount you would like to withdraw. The ATM will then dispense the cash and deduct the amount from your Dave account.

How much can I withdraw from an ATM with my Dave virtual card?

The amount of money you can withdraw from an ATM with your Dave virtual card depends on the amount of money you have added to your Dave account. You can withdraw up to the amount of money you have added to your Dave account, but no more than $400 per day.

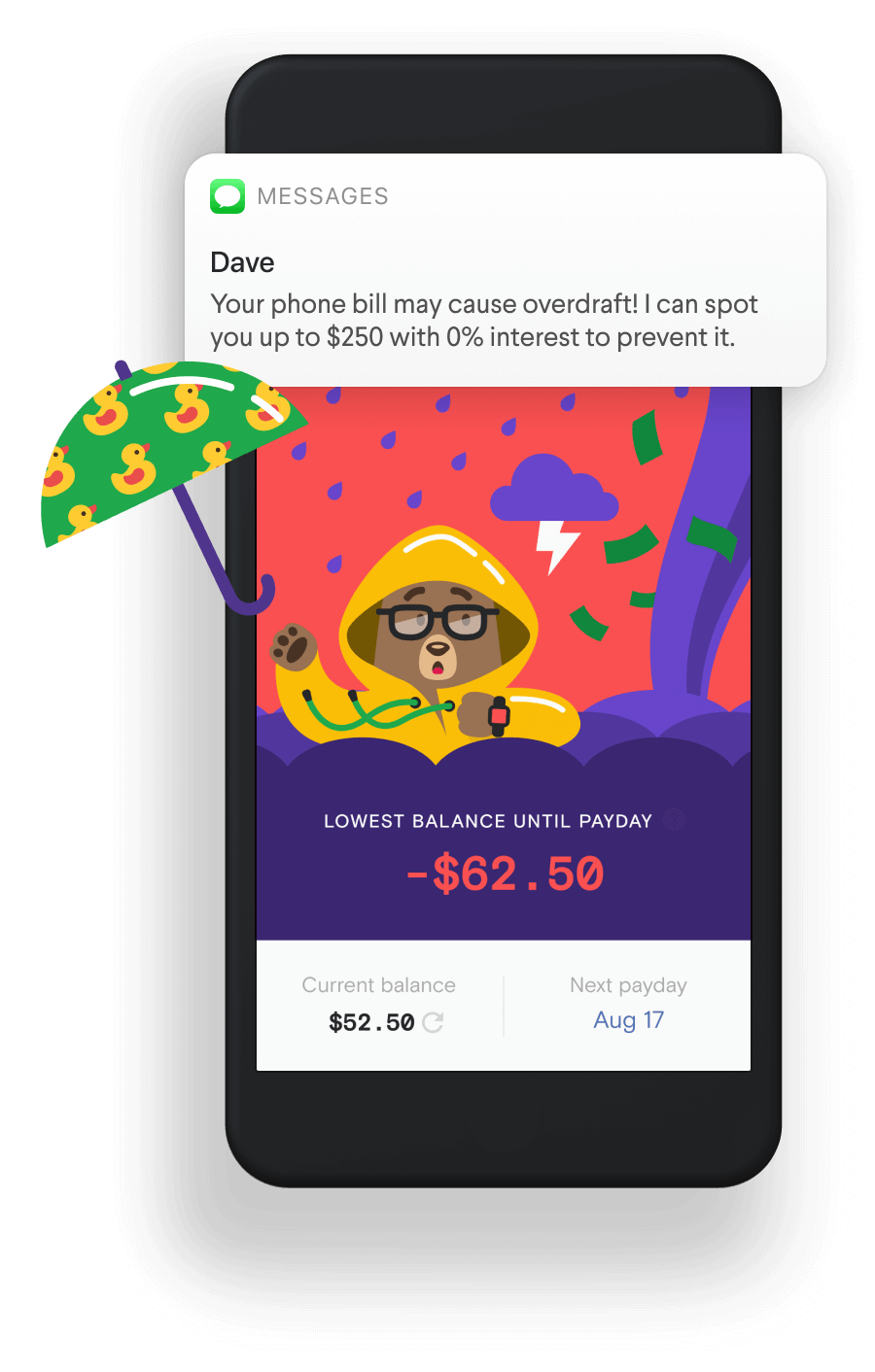

Are there any fees associated with using my Dave virtual card at an ATM?

Yes, there are fees associated with using your Dave virtual card at an ATM. Dave charges a flat fee of $2.50 per ATM withdrawal, plus any fees that may be charged by the ATM operator. Additionally, you may incur a fee if you exceed your monthly withdrawal limit.

Are there any locations where I cannot use my Dave virtual card?

Yes, there are some locations where you cannot use your Dave virtual card. Dave virtual cards cannot be used at international ATMs. Additionally, Dave virtual cards cannot be used at certain merchant locations, such as gas stations and convenience stores. Make sure to check the Dave app before using your Dave virtual card to make sure your card is accepted at your intended location.

In conclusion, using a virtual card like Dave at an ATM is a convenient and secure way to access your funds while on the go. By following the steps outlined above, you can easily link your virtual card to your bank account, withdraw cash, and keep track of your spending. Additionally, Dave offers features like overdraft protection and alerts to help you manage your finances and avoid costly fees.

As more consumers turn to virtual cards as a way to manage their finances, it’s important to understand how to use them effectively. With Dave, you have access to a user-friendly app and a range of features designed to help you stay on top of your finances. Whether you’re looking to save money on fees or simply streamline your banking experience, using a virtual card like Dave can be a game-changer. So why not give it a try and see how it can benefit you?