In today’s digital age, virtual cards have become an essential tool for online transactions. They offer a secure and convenient way to make purchases online without the need for a physical card. However, many people are unaware of how to get money off a virtual card. Whether you have received a refund on a virtual card or have some extra funds you want to withdraw, getting money off a virtual card can seem like a daunting task.

Fortunately, there are several ways to withdraw funds from a virtual card. In this article, we will explore the different methods available to get money off a virtual card. From transferring funds to a bank account to using online payment platforms, we will walk you through each step of the process. So, if you’re looking to get money off a virtual card, read on to discover the different options available to you.

Getting money off a virtual card is easy. Here’s how:

- Log into your virtual card account

- Select the card you want to withdraw money off of

- Enter the amount you want to withdraw

- Confirm the transaction

- Your money will be available on the card within minutes

How to Get Money Off Virtual Card?

Virtual cards are a great way to pay for goods and services online. They can be used to purchase items from websites, apps, and even physical stores. However, getting money off a virtual card can be a bit more complicated. This article will guide you through the process of getting money off a virtual card.

Understand How Virtual Cards Work

Before getting started, it is important to understand how virtual cards work. Virtual cards are prepaid cards that are created with a specific balance. This balance is used to purchase goods and services online, and it is not linked to any bank account or other financial institution. In order to use the card, you must transfer money into the card’s balance before you can use it.

The card’s balance can be used to purchase goods and services wherever the virtual card is accepted. When you purchase a good or service with a virtual card, the amount is taken from the card’s balance. If you need to get money off the virtual card, you will need to transfer the balance back to a bank account or other financial institution.

Transfer Money From Virtual Card to Bank Account

The first step in getting money off a virtual card is to transfer the balance from the card to a bank account. To do this, you will need to find the virtual card’s “transfer” option. This option should be located in the card’s settings or information page. Once you have found the transfer option, you will need to enter the bank account information that you want to transfer the funds to.

Once the bank account information has been entered, you will need to enter the amount of money that you want to transfer. Once this is done, the transfer process will start. Depending on the card provider, the transfer process may take a few minutes or a few hours. Once the transfer is complete, the money will be available in the bank account that you specified.

Withdraw Money From Bank Account

Once the money has been transferred from the virtual card to the bank account, you will then be able to withdraw the funds from the bank account. This can be done with an ATM or by visiting a bank branch. Depending on the bank, there may be a fee for withdrawing funds from an ATM or for visiting a bank branch.

Once you have withdrawn the money from the bank account, the funds will be available for use. The money can be used to purchase goods or services, or it can be saved or transferred to another account. Keep in mind that the money will not be available on the virtual card anymore, as it has been transferred to the bank account.

Frequently Asked Questions

This page answers common questions about using a virtual card to get money.

What is a virtual card?

A virtual card is a type of prepaid card that can be used to make purchases online or in-store. It is not linked to any bank account or credit card, and instead, you can use it to make payments with a balance you preload. It is a secure way to make payments as it does not require you to share your personal financial information.

The card also has a unique number that is used to make payments and can be used in the same way you would use a credit or debit card. You can use it to make purchases online, pay bills, or even get cash back from an ATM.

How do I get money off a virtual card?

You can get money off a virtual card by transferring funds from your bank account or credit card to the card. The process is simple and can be done online or through the card’s app. Once the funds have been transferred, you can then use the virtual card to make purchases or get cash back from an ATM.

You can also add money to your virtual card directly from your bank account. This is usually done through a direct debit or standing order, which is where the funds are taken from your account on a regular schedule. It is a secure and convenient way to add money to your card and can be done quickly and easily.

Are there fees associated with using a virtual card?

Yes, there are usually fees associated with using a virtual card. These fees may vary depending on the card provider, but generally, you can expect to pay for things like ATM withdrawals, foreign transactions, and even for loading the card with funds. It is important to check the fees before you use the card to make sure you are aware of all the costs associated with using it.

The fees are usually quite reasonable and the card can be a great way to save money on fees compared to other types of payment methods. It is also easy to manage and you can easily track your spending and budget your money.

Are virtual cards secure?

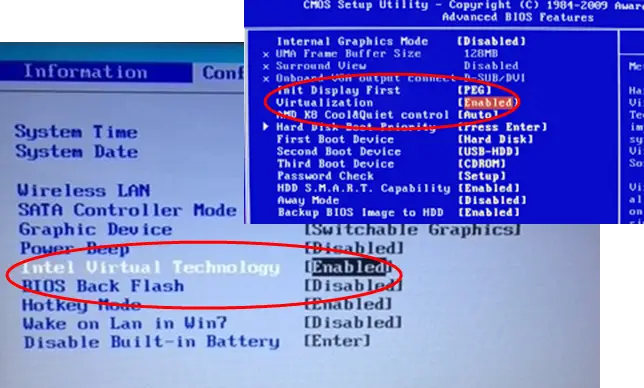

Yes, virtual cards are very secure and they are designed to protect your personal information. The card has a unique number that is used to make payments, and the card issuer will never have access to your personal financial information. The card also has built-in security features, such as two-factor authentication and encryption, that make it difficult for fraudsters to access your account.

The card can also be blocked if it is lost or stolen, and you can easily cancel the card and get a new one if needed. This makes it a secure and convenient way to make payments without having to share your personal financial information.

Can I use a virtual card internationally?

Yes, you can use a virtual card internationally. The card is accepted in many countries and can be used to make payments online or in-store. However, it is important to check with the card issuer before you use it internationally as there may be additional fees or restrictions that apply.

It is also important to check the currency exchange rate before you use the card to make sure you are getting the best rate possible. This is especially important when making large purchases or when traveling to a different country. By using the card internationally, you can save money on fees compared to using a traditional credit card.

In conclusion, getting money off a virtual card is a simple process that can be accomplished through various methods. Whether you choose to transfer funds to your bank account or use an ATM to withdraw cash, it’s important to keep your virtual card information secure to prevent fraudulent activities. With the increasing popularity of virtual cards and online transactions, it’s essential to stay vigilant and protect your personal and financial information at all times.

In today’s digital age, virtual cards have become a convenient and secure way to make online purchases and transactions. By following the steps outlined in this article, you can easily get money off your virtual card and enjoy the benefits of online shopping and banking. Remember to always use reputable virtual card providers and secure your information to ensure a safe and hassle-free experience. With these tips and tricks, you can confidently navigate the world of virtual cards and make the most of your online transactions.