As the world continues to become more digitized, so do the traditional ways of handling financial records. One such development is the emergence of virtual bookkeeping. With the rise of internet-based technology and cloud-based accounting software, businesses can now outsource their bookkeeping needs to a virtual bookkeeper.

A virtual bookkeeper is a professional who provides bookkeeping services to clients remotely. They use cloud-based accounting software to access and manage their clients’ financial records. This approach eliminates the need for physical contact, as all communication and data sharing are done online. In this article, we will explore the concept of virtual bookkeeping, its benefits, and how it can help businesses streamline their financial operations.

A virtual bookkeeper is an online service provider who offers accounting and bookkeeping services to organizations remotely. Virtual bookkeepers are experienced and highly trained professionals who use cloud-based accounting systems to provide accurate and timely financial information. Their services include setting up books, reconciling bank accounts, preparing financial statements, tracking expenses, and more. They also provide advice on financial planning and budgeting.

What is a Virtual Bookkeeper?

A virtual bookkeeper is an individual who provides bookkeeping services from a remote location. Virtual bookkeepers use accounting software and other tools to record financial transactions for businesses, such as invoices, payments, and payroll. Virtual bookkeepers also provide other services such as financial analysis, budgeting, and tax preparation.

Advantages of Virtual Bookkeeping

Hiring a virtual bookkeeper has several advantages for businesses. First, virtual bookkeepers can cost less than hiring an in-house bookkeeper, as there are often no overhead costs associated with remote employees. Furthermore, virtual bookkeepers can be hired on a part-time or full-time basis, allowing businesses to save on payroll costs when needed. Finally, virtual bookkeepers can provide more flexibility in terms of scheduling, allowing businesses to work with their bookkeeper on their own time.

Virtual bookkeepers also provide businesses with access to the latest accounting technology. This allows businesses to save time and money, as they can utilize the latest technology to record financial transactions without the need to invest in their own software. Additionally, virtual bookkeepers can provide expert advice and help businesses stay up to date with the latest tax laws and regulations.

Services Provided by Virtual Bookkeepers

Virtual bookkeepers provide a variety of services to businesses. These services include recording financial transactions, managing accounts receivable and payable, preparing financial statements, and providing financial analysis. Virtual bookkeepers can also help businesses with budgeting and creating financial forecasts. Additionally, virtual bookkeepers can provide tax preparation services and help businesses stay in compliance with local, state, and federal tax laws.

Virtual bookkeepers can also provide advice on financial strategies, such as setting up retirement accounts and investments. Furthermore, they can help businesses streamline their accounting processes and ensure that they are using the most efficient methods for tracking and recording financial transactions. Finally, virtual bookkeepers can provide businesses with the necessary resources to develop financial plans and strategies that can help them achieve their long-term goals.

Frequently Asked Questions

A virtual bookkeeper is a bookkeeper or accountant who works remotely, often from a home office, providing bookkeeping, accounting, and payroll services to clients.

What is a Virtual Bookkeeper?

A virtual bookkeeper is a professional bookkeeper or accountant who works remotely, often from a home office. Virtual bookkeepers provide bookkeeping, accounting and payroll services to clients. By working remotely, virtual bookkeepers can provide their services to multiple clients, often across different states or countries.

Virtual bookkeepers use the same financial software as a traditional bookkeeper, but they have the added benefit of being able to access their clients’ data from anywhere in the world. As such, they can provide their clients with timely and accurate financial data and analysis, and can make changes to the data as needed.

What Benefits Does a Virtual Bookkeeper Provide?

A virtual bookkeeper can provide a number of benefits to clients. By working remotely, virtual bookkeepers are able to provide their services to multiple clients at once, often across different states or countries. This makes it much easier for a business to find a bookkeeper who meets their needs.

Virtual bookkeepers also have the added benefit of being able to access their clients’ data from anywhere in the world. This allows them to provide timely and accurate financial data and analysis, and to make changes to the data as needed. Furthermore, virtual bookkeepers are often much more cost effective than traditional bookkeepers, as they don’t need to pay for office space or equipment.

What Types of Services Does a Virtual Bookkeeper Provide?

A virtual bookkeeper can provide a variety of services to their clients. These services include bookkeeping, accounting, payroll, tax preparation, and financial reporting. Additionally, many virtual bookkeepers also provide consulting services such as budgeting, forecasting, and financial planning.

How Does a Virtual Bookkeeper Work?

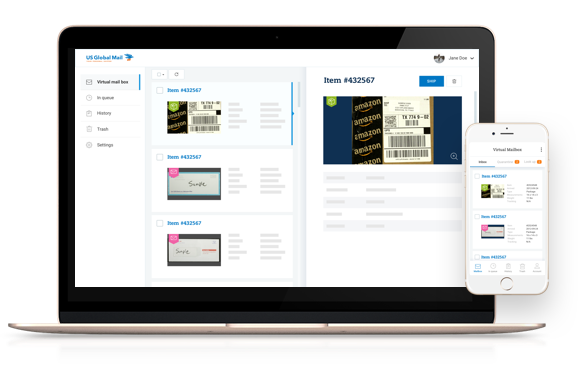

A virtual bookkeeper typically works with their clients over the internet or telephone. They will typically use a secure online interface to access their clients’ financial data and to make changes to it as needed. They will then provide their clients with timely and accurate financial data and analysis.

Additionally, a virtual bookkeeper may also be able to provide their clients with consulting services such as budgeting, forecasting, and financial planning. This allows the client to make informed decisions about their financial future.

What Qualifications Does a Virtual Bookkeeper Need?

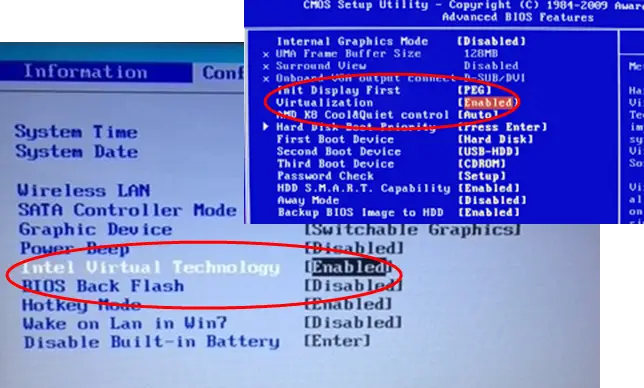

In order to become a virtual bookkeeper, a person must have a background in accounting and bookkeeping. They must also be knowledgeable in financial software and be able to use it to access their clients’ financial data and make changes to it as needed. Additionally, they must have a strong understanding of the tax laws in the areas where they provide services.

How to get started as a virtual bookkeeper in 7 steps

In conclusion, a virtual bookkeeper is a modern solution for small business owners who want to keep their financial records accurate, organized and up-to-date. It provides a cost-effective way to manage bookkeeping processes remotely, without having to hire an in-house bookkeeper. Virtual bookkeeping services offer a range of benefits, including flexibility, convenience and access to the latest technology. With a virtual bookkeeper, business owners can focus on what they do best, growing their business, while having confidence in their financial management.

Overall, virtual bookkeeping provides a lot of advantages over traditional bookkeeping methods. It is a modern way to manage financial records that is efficient, reliable and cost-effective. As technology continues to advance, virtual bookkeeping will only become more popular, and it is important for small business owners to stay ahead of the curve. If you are a small business owner and are looking for a way to streamline your bookkeeping processes, consider hiring a virtual bookkeeper today.