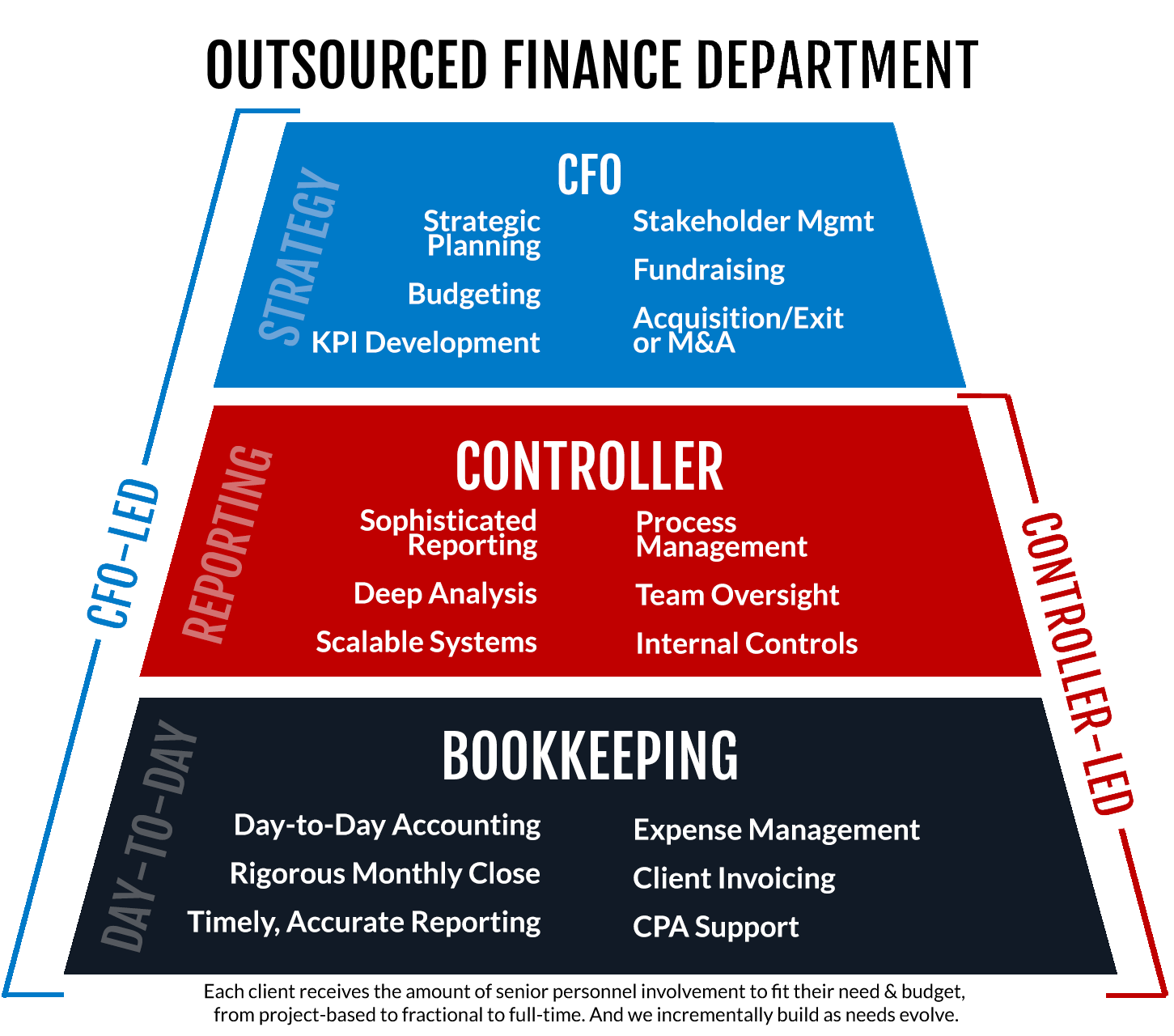

In today’s fast-paced business environment, small and medium-sized enterprises (SMEs) require more than just traditional financial reporting services. They need someone who can help them navigate the complexities of cash flow management, budgeting, forecasting, and financial analysis. This is where a virtual Chief Financial Officer (vCFO) comes in.

A virtual CFO, also known as an outsourced CFO, is a financial expert who works remotely to provide financial guidance and support to SMEs. In this role, the vCFO is responsible for managing the financial health of the business, identifying areas for improvement, and developing strategies to drive growth and profitability. In this article, we will explore the role of a virtual CFO, the benefits of hiring one, and what to look for when choosing a vCFO for your business.

A virtual CFO is a financial expert who provides CFO-level services remotely. They work with businesses to advise on financial strategy, manage budgets, analyze data, and provide guidance on making sound financial decisions. Virtual CFOs can also help businesses with forecasting and other financial tasks.

For businesses that don’t have the resources to hire a full-time CFO, a virtual CFO provides the same level of expertise at a fraction of the cost. They can save time and money for growing businesses by removing the need for hiring, training and managing a full-time CFO.

Whether you are starting a business or need assistance managing your finances, a virtual CFO can help you make the most of your resources to reach your financial goals.

What is a Virtual CFO?

A Virtual CFO (Chief Financial Officer) is a professional who provides financial oversight and guidance to a company or organization. They are employed remotely and provide services through an online platform. They are responsible for developing financial strategies and creating financial reports to help the business reach their goals.

A Virtual CFO can provide a range of services including budgeting, forecasting, financial analysis, cash flow management, financial modeling, risk management, and more. They can also provide advice on financial matters and help the business make informed decisions.

Financial Strategies

A Virtual CFO can help to develop financial strategies that are tailored to the needs of the business. They can help to analyze the current financial position of the business and create plans to help the business reach its goals. The Virtual CFO can also provide advice on how to reduce costs and maximize profits. They can also provide advice on how to manage cash flow, how to invest, how to manage debt and how to develop a long-term financial plan.

A Virtual CFO can also provide advice on how to best utilize funds, how to manage investments, and how to develop strategies for growth. They can help to identify areas where the business may be able to reduce costs or increase revenue. They can also provide advice on how to reduce risk and create a more secure financial future for the business.

Financial Reports

A Virtual CFO can help to create financial reports that provide an accurate picture of the business’s financial position. They can create reports on income and expenditure, balance sheets, cash flow statements, and more. These reports can help to inform the business of their financial position and provide insight into how to improve it.

A Virtual CFO can also help to create budgets, forecasts, and financial models. These can help to provide an accurate picture of the future of the business and what it needs to do to reach its goals. They can also provide advice on how to best use funds and manage investments.

Risk Management

A Virtual CFO can help to identify and manage risks associated with the business. They can help to assess the potential impact of certain risks and develop strategies to mitigate or avoid those risks. They can also provide advice on how to handle potential losses or liabilities.

A Virtual CFO can also help to create plans to protect the business’s assets. They can assess the potential financial impact of potential risks and develop strategies to minimize or avoid them. They can also provide advice on how to insure assets to protect the business in the event of a loss.

Tax Planning

A Virtual CFO can help to develop tax strategies to minimize the business’s tax burden. They can provide advice on how to reduce the tax burden and increase profits. They can also help to identify areas where the business can take advantage of tax deductions or credits.

A Virtual CFO can also provide advice on how to comply with tax laws and regulations. They can provide guidance on how to handle different types of taxes and how to file returns. They can also provide advice on how to keep track of payments and deductions.

Business Advisory Services

A Virtual CFO can provide advisory services to help the business reach its goals. They can provide advice on how to develop a business plan, how to set up a business, and how to manage the business. They can also provide advice on how to manage finances, how to develop marketing strategies, and how to launch new products or services.

A Virtual CFO can also provide advice on how to handle employee relations and how to develop an effective organizational structure. They can provide guidance on how to build an effective team and how to manage hiring and training. They can also provide advice on how to develop strategies for growth and how to make the business competitive in the marketplace.

Frequently Asked Questions

A virtual CFO is a professional financial advisor that provides the same services as a traditional CFO, but works remotely instead of in the office. They provide strategic financial guidance to small businesses, startups, and entrepreneurs, helping them to make better financial decisions.

What Does a Virtual CFO Do?

A virtual CFO can provide a variety of services to businesses, depending on their needs. These include financial planning, budgeting, cash flow analysis, financial statement analysis, and performance analysis. They also provide guidance on investment strategies, risk management, and tax planning. Virtual CFOs are also responsible for overseeing the financial operations of their clients, including the preparation of financial statements and reports.

In addition, a virtual CFO can provide guidance on business growth and expansion, helping their clients develop and execute strategies to reach their goals. They can also provide advice on raising capital and managing debt, helping businesses make the most of opportunities and manage any potential risks. Finally, a virtual CFO can provide support with compliance and regulatory requirements, making sure that their clients are always up to date with the latest regulations.

What Are the Benefits of Hiring a Virtual CFO?

Hiring a virtual CFO can be a great way for businesses to get access to the expertise of a professional financial advisor without the need for a full-time employee. A virtual CFO can provide more flexible services than a traditional CFO, as they are able to work remotely, meaning that they can be available to businesses whenever they need them.

A virtual CFO can also provide a cost-effective solution to businesses, as they can provide their services on an as-needed basis. This can be a great way for businesses to access the expertise they need without having to commit to the costs of a full-time employee. Finally, a virtual CFO can provide invaluable guidance to businesses, helping them to reach their goals and make better financial decisions.

How Much Does a Virtual CFO Cost?

The cost of hiring a virtual CFO will vary depending on their experience, qualifications, and the services they are providing. Typically, virtual CFOs charge an hourly rate or a flat fee for their services. Businesses should discuss the cost of services with the virtual CFO before signing a contract, to ensure that they are getting the best value for their money.

What Qualifications Does a Virtual CFO Need?

Virtual CFOs need to be highly qualified in order to be able to provide their services. Most virtual CFOs will hold a degree in accounting, finance, or a related field, as well as a professional certification such as a Certified Public Accountant (CPA) or a Chartered Financial Analyst (CFA). In addition, many virtual CFOs have experience working in the field, either as a traditional CFO or in another financial role.

How Can I Find a Virtual CFO?

The best way to find a virtual CFO is to do some research online. You can search for virtual CFOs in your area, or you can contact professional organizations such as the American Institute of Certified Public Accountants (AICPA) or the National Association of Professional Organizers (NAPO). You can also ask for referrals from other businesses who have used virtual CFOs in the past. Once you have found a few potential virtual CFOs, you can get in touch with them to discuss their services and fees.

What are Virtual CFO Services? (And Do You Need It?)

In today’s fast-paced business world, companies need to be agile and make quick decisions to stay competitive. This is where a virtual CFO comes in. A virtual CFO provides financial leadership and guidance to businesses remotely, providing the expertise of a CFO without the overhead costs of a full-time employee. They offer valuable insights and help companies make informed financial decisions that drive growth and profitability.

In conclusion, hiring a virtual CFO can be a game-changer for businesses, allowing them to access the expertise of a financial leader without the costs associated with hiring a full-time employee. Whether you’re a startup company looking to get off the ground or an established business looking for financial guidance, a virtual CFO can provide the support you need to achieve your goals. With their strategic insights and financial expertise, a virtual CFO can help you navigate the ever-changing business landscape and stay ahead of the competition.