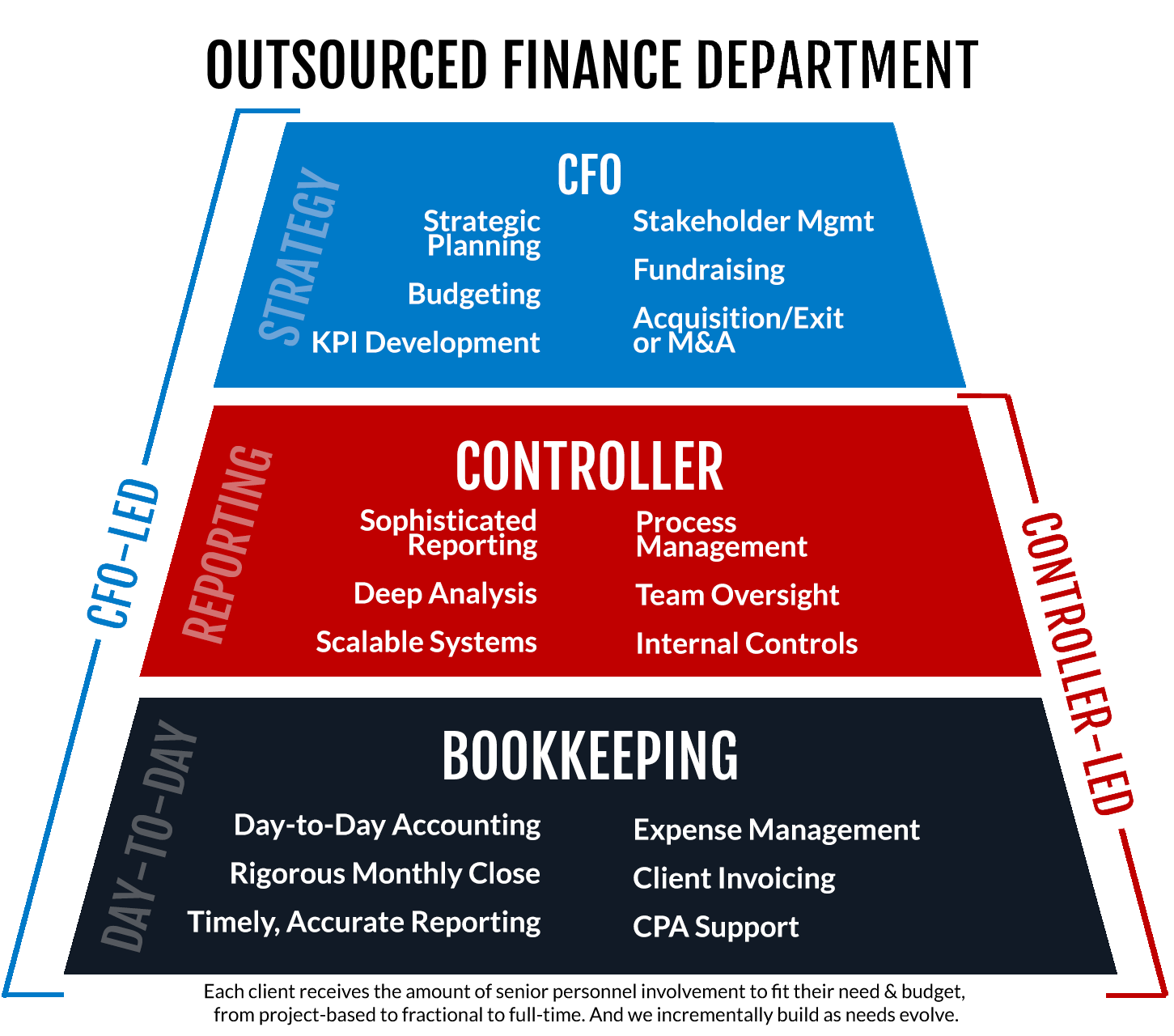

As a business owner or manager, you may be wondering about the cost of hiring a Virtual CFO (Chief Financial Officer). A Virtual CFO is an outsourced financial expert who provides financial management services remotely to businesses. This includes financial analysis, forecasting, budgeting, and strategic planning. Virtual CFOs have become increasingly popular in recent years, particularly for small and medium-sized businesses that cannot afford a full-time CFO.

The cost of hiring a Virtual CFO can vary depending on several factors, such as the size and complexity of your business, the level of expertise required, and the scope of services needed. In general, Virtual CFOs charge an hourly rate, a monthly retainer fee, or a project fee. It is important to note that while the cost of hiring a Virtual CFO may seem high at first, it can ultimately save your business money in the long run by improving financial performance and reducing expenses. In this article, we will explore the different factors that can impact the cost of hiring a Virtual CFO and provide some insights into how you can make the most of this valuable service.

The cost of a virtual CFO varies depending on the size of the business and the complexity of the financials. Generally, a virtual CFO will cost from $250 to $2,500 per month, or more for larger businesses. Virtual CFOs can provide a variety of services such as financial reporting, budgeting, forecasting, bookkeeping, and more.

How Much Does a Virtual CFO Cost?

A virtual CFO (Chief Financial Officer) is a professional finance and accounting expert who works remotely from a business. A virtual CFO can provide a wide range of financial services, from budgeting and forecasting to business strategy and analysis. Whether you’re running a small business or a large organization, having a virtual CFO can be an invaluable asset for managing cash flow and growing your business. But what does it cost to hire a virtual CFO?

The Cost of a Virtual CFO

The cost of a virtual CFO can vary widely, depending on the scope of services they provide and the complexity of the financial operations they manage. Generally, virtual CFOs charge by the hour or by a retainer fee. Hourly rates for virtual CFOs range from $100 to $400 per hour or more, depending on their experience and expertise. Retainer fees will vary depending on the size of the business and the scope of services the virtual CFO will provide.

When considering the cost of a virtual CFO, it’s important to factor in the value they can provide. A virtual CFO can offer valuable insight and analysis that can help a business make better decisions and improve their financial operations. Many businesses find that the cost of a virtual CFO is more than offset by the value they bring to the table.

Factors That Affect the Cost of a Virtual CFO

The cost of a virtual CFO can be affected by a number of factors, including the scope of services they provide and the complexity of the financial operations they manage. The size of the business is also a factor, as larger businesses may require more time and resources from the virtual CFO. The experience and expertise of the virtual CFO can also affect the cost, with more experienced professionals typically charging higher rates.

In addition to the cost of the virtual CFO, businesses should also factor in the cost of additional software, accounting services, and other resources they may need in order to properly utilize the virtual CFO’s services. These costs can vary widely and should be taken into consideration when budgeting for a virtual CFO.

Finding the Right Virtual CFO for Your Business

When looking for a virtual CFO, it’s important to find a professional with the right experience and expertise for your business. Take the time to research potential virtual CFOs and ask for references from previous clients. You should also clearly define the scope of services you need and make sure the virtual CFO you select is a good fit for your organization.

Once you’ve identified a potential virtual CFO, you should discuss the details of the project and the cost of their services. Most virtual CFOs will be willing to work with you to come up with a solution that meets your budget and your needs. With the right virtual CFO, you can be sure that you’re getting the most value for your money.

Frequently Asked Questions

A virtual CFO services is a service wherein a finance professional provides financial advice and guidance to a business, often remotely. It enables businesses to benefit from the expertise of a seasoned finance executive without needing to bring them onto the payroll.

How much does a virtual CFO cost?

The cost of a virtual CFO depends on several factors such as the size of the business, the complexity of the financial situation, and the experience level of the CFO. Typically, a virtual CFO will charge an hourly rate or a flat fee. The hourly rate usually ranges from $125 to $250 per hour, depending on the CFO’s experience and the complexity of the assignment. A flat fee is usually based on the size and complexity of the project and can range anywhere from $3,000 to $15,000 or more.

In addition to the cost of the CFO’s services, there may be additional fees associated with the engagement such as software licensing fees or travel expenses. It’s important to discuss all fees associated with the engagement before signing a contract.

HOW TO BECOME A VIRTUAL CFO & EARN AN ADDITIONAL 6 FIGURES IN REVENUE

In conclusion, the cost of a virtual CFO can vary greatly depending on the needs and size of your business. However, it is important to remember that the benefits of having a virtual CFO far outweigh the cost. A virtual CFO can provide valuable financial insights and guidance, help with strategic planning, and increase the overall financial health of your business.

Ultimately, the decision to hire a virtual CFO should be based on the unique financial needs of your business. By taking the time to research and compare different virtual CFO services, you can find the right fit for your business and ensure that your financial future is secure. Don’t let cost be the only factor in your decision, as the value that a virtual CFO can bring to your business is worth the investment.