As our world goes increasingly digital, so too do our financial transactions. In recent years, virtual credit cards have emerged as a popular alternative to traditional plastic credit cards. One such virtual card that has gained significant attention is the Affirm virtual card. But how does it work, and what are its benefits?

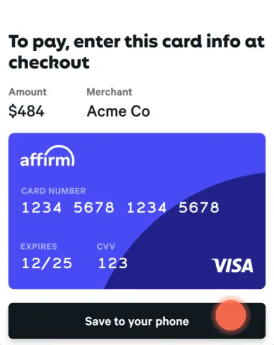

Affirm virtual card is a virtual credit card that allows users to make purchases online without having to provide their actual credit card information. Instead, users are given a one-time-use virtual card number that they can use to complete their transactions. This added layer of security helps to prevent fraud and identity theft, making it a safer way to shop online. In addition, Affirm virtual card offers a unique feature that sets it apart from other virtual credit cards: the ability to split purchases into smaller payments over time, with no interest or fees. This makes it an ideal option for those who want to make larger purchases but may not be able to pay for them all at once.

How Does Affirm Virtual Card Work?

Affirm Virtual Card is a secure and convenient way to make purchases online. It allows customers to make purchases without having to enter their credit card information every time they make a purchase. Instead, customers can pay with their Affirm Virtual Card, which can be used anywhere that accepts Visa. With Affirm Virtual Card, customers can also shop with confidence knowing their personal information is safe and secure.

Step-by-Step Guide on How to Use Affirm Virtual Card

Step 1: Sign up for an Affirm Virtual Card account. Customers will need to provide personal information such as their name, address, and phone number.

Step 2: Choose a payment plan. Customers can choose from a variety of payment plans, such as monthly, bi-weekly, or one-time payments.

Step 3: Activate the card. Once the customer has chosen a payment plan, they will need to activate the card. This is done by entering the activation code that was sent to the customer’s email address.

Step 4: Shop with the card. Customers can now make purchases online or in stores that accept Visa. They can also use their card to pay for services such as travel and entertainment.

Benefits of Using Affirm Virtual Card

Affirm Virtual Card provides customers with a secure and convenient way to make purchases online. The card is secure, meaning customer’s personal information is protected from fraud. Additionally, customers can choose from a variety of payment plans, allowing them to make purchases without worrying about large upfront payments. With Affirm Virtual Card, customers can also take advantage of special offers and rewards.

Another benefit of using Affirm Virtual Card is that it can be used anywhere that accepts Visa. This means customers can shop online or in stores with ease. Additionally, customers can use their card to pay for services such as travel and entertainment. This makes it easier to shop and pay for goods and services while on the go.

Frequently Asked Questions

At Affirm, we understand that shopping online is a different experience than in-store, and we want to make sure that our customers have all the information they need when it comes to using our virtual card. Read on for answers to our frequently asked questions about how the Affirm virtual card works.

How does the Affirm virtual card work?

The Affirm virtual card is a secure and convenient way to shop online with Affirm. It works just like a regular credit card, but without the physical card. All you need to do is link your bank account to your Affirm account, and you’ll be able to make purchases online or in-store using your virtual card. When you make a purchase, the money will be deducted from your bank account and the purchase will be charged to your Affirm virtual card.

The virtual card also allows you to manage your finances in a much easier way. You can set up auto-payments for your Affirm loans, and you can also set up payment reminders and notifications to ensure that you never miss a payment. You can also view your payment history, transaction details, and more in your Affirm account.

What are the benefits of using the Affirm virtual card?

Using the Affirm virtual card has several benefits. It allows you to shop online or in-store without having to carry a physical card. You’ll also be able to manage your finances more easily, as you can set up auto-payments and payment reminders. Additionally, you’ll be able to view your payment history, transaction details, and more in your Affirm account. And, if you ever need help, you can always contact the Affirm customer service team.

The Affirm virtual card also helps you save money. You can take advantage of discounts, rewards, and other special offers when shopping with your Affirm virtual card. Plus, you won’t have to pay any annual fees or interest charges, so you can save money each time you make a purchase.

Is the Affirm virtual card secure?

Yes, the Affirm virtual card is secure. All of your information is encrypted and stored securely on our servers, and we use advanced security measures to protect your data. Additionally, your virtual card is protected by your Affirm account password, so you can be sure that your information is safe.

We also use fraud monitoring technology to help protect against unauthorized charges. If we detect any suspicious activity, we will notify you right away and take action to protect your account. We also provide 24/7 customer support in case you ever need help.

How do I add my bank account to my Affirm account?

Adding your bank account to your Affirm account is easy. You can link your bank account directly from the Affirm app or website. All you need to do is enter your bank account information (including your routing number and account number) and then follow the instructions on the screen. You’ll also need to enter your bank’s name and website, if applicable. Once you’ve entered all the information, you’ll be able to link your bank account to your Affirm account.

It’s important to note that Affirm does not store any of your banking information. We use secure encryption technology to protect your data, so you can rest assured that your information is safe.

Can I use my Affirm virtual card to make purchases in-store?

Yes, you can use your Affirm virtual card to make purchases in-store. All you need to do is link your bank account to your Affirm account, and then you’ll be able to use your virtual card to make purchases at any store that accepts credit cards. When you make a purchase, the money will be deducted from your bank account and the purchase will be charged to your Affirm virtual card.

It’s important to note that not all stores accept virtual cards. Be sure to check with the store before making a purchase. Additionally, some stores may require a physical card in order to process the transaction. If this is the case, you’ll need to provide the store with your virtual card number, expiration date, and security code.

In conclusion, the Affirm virtual card is an innovative solution that allows users to make purchases securely and conveniently. With this virtual card, users can enjoy greater control over their finances, as they can set limits on their spending and monitor their transactions in real-time. Additionally, the Affirm virtual card offers peace of mind to those who are concerned about the security of their personal and financial information, as it uses advanced encryption technologies to protect user data.

Overall, the Affirm virtual card is a valuable tool for anyone who wants to manage their money more effectively and make purchases with confidence. Whether you’re looking to make a one-time purchase or you want to use it for your everyday spending, the Affirm virtual card is a reliable and secure option that can help you achieve your financial goals. So why not give it a try and see how it can simplify your life?

Hey everyone! I’ve just stumbled upon an amazing website that’s all about cryptocurrency exchanges. If you’re looking to dive deeper into the world of crypto, this might be the right resource for you!

The site https://foodrecipeai.com/blog/ offers in-depth analysis of a wide range of cryptocurrency platforms, including the ins and outs of their trading platforms, security protocols, supported coins, and overall reliability. Whether you’re a novice just starting out or an experienced trader, there’s something for everyone.

What I found particularly helpful was their side-by-side comparisons, which made it super easy to compare different exchanges and find the one that best fits my needs. They also cover the latest trends in the crypto world, which keeps you informed on all the important news.

If you’re interested in exploring different cryptocurrency exchanges, I highly recommend checking this site out. It’s a goldmine of information that can help you make informed decisions in the dynamic world of cryptocurrency.

Let’s explore it together and exchange tips! Would love to hear your thoughts and experiences with different exchanges as well.