Quantum computing is the latest buzzword in the tech world, and it has the potential to revolutionize the financial services industry. It is a new computing paradigm that uses the principles of quantum mechanics, which are fundamentally different from classical computing. Quantum computing can solve complex problems that are impossible for classical computing, making it a game-changer for the financial services industry.

The financial services industry is data-intensive, and quantum computing can help to process and analyze large amounts of data more efficiently. It can also help to identify patterns and trends that are not visible to classical computing. This can lead to better risk management, fraud detection, and portfolio optimization. Additionally, quantum computing can enable faster and more accurate pricing of complex financial instruments, such as derivatives, which can benefit both buyers and sellers. In this article, we will explore the potential benefits of quantum computing for the financial services industry in greater detail.

How Could Quantum Computing Benefit the Financial Services Industry?

Quantum computing has the potential to revolutionize the financial services industry. This technology could provide enhanced security, faster processing speeds, and more accurate predictions and analysis. In this article, we will explore how quantum computing could benefit the financial services industry.

Enhanced Security

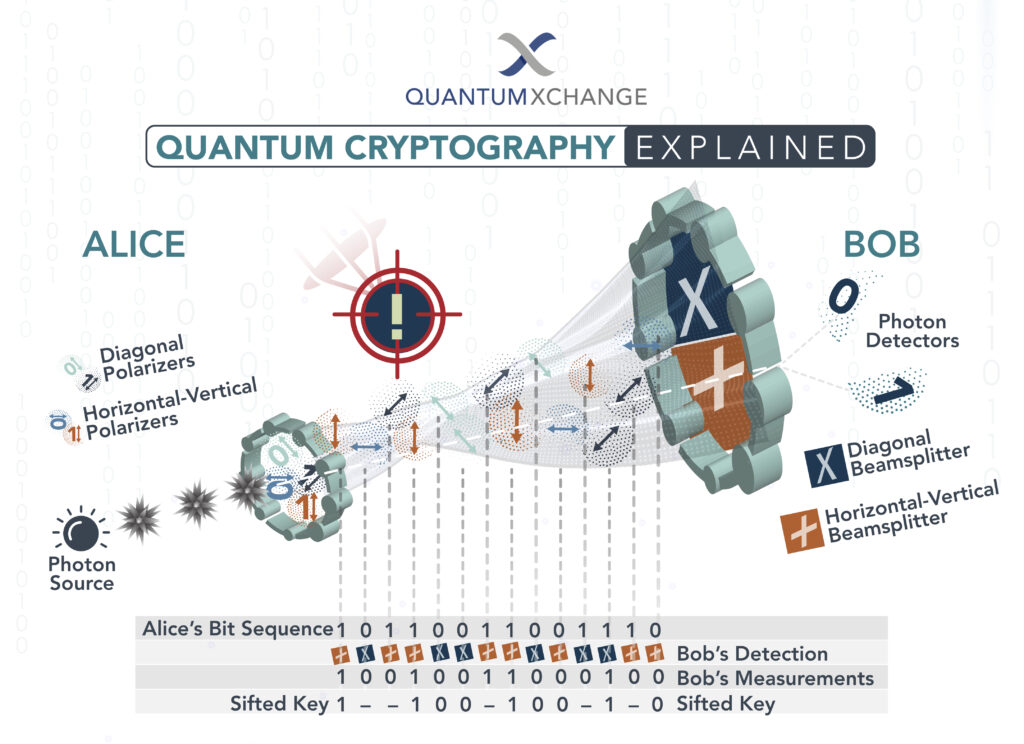

The financial services industry is highly sensitive to security threats, so any improvement in this area can be extremely beneficial. Quantum computing can provide enhanced security by using quantum encryption. This technology uses the principles of quantum mechanics to create cryptographic keys that are nearly impossible to crack. In addition, quantum computing can also be used for authentication, which can help prevent fraud and other malicious activity.

Quantum computing can also be used to detect and prevent cyber attacks. By utilizing quantum algorithms, it is possible to detect malicious activity before it can cause any damage. This can help protect financial assets from being stolen or compromised.

Faster Processing Speeds

The financial services industry is highly reliant on data processing and analysis. Quantum computing can provide significant improvements in this area. By utilizing quantum algorithms and data processing, it is possible to process large amounts of data much faster and more accurately than traditional methods. This can help financial institutions make more informed decisions and reduce errors.

In addition, quantum computing can also help with risk management and forecasting. By utilizing quantum algorithms, it is possible to make more accurate predictions and help financial institutions better manage risk. This can help reduce the potential costs associated with unexpected events.

Better Predictions and Analysis

Quantum computing can also be used for better predictions and analysis. By utilizing quantum algorithms, it is possible to make more accurate predictions about future markets and financial trends. This can help financial institutions make better investment decisions and reduce their exposure to risk.

In addition, quantum computing can also be used for complex analysis. By utilizing quantum algorithms, it is possible to analyze large data sets and uncover hidden patterns and correlations. This can provide insights that can help financial institutions make better decisions and optimize their operations.

Conclusion

Quantum computing has the potential to revolutionize the financial services industry. This technology can provide enhanced security, faster processing speeds, and more accurate predictions and analysis. By utilizing quantum algorithms, financial institutions can make better decisions, reduce their risks, and optimize their operations.

Frequently Asked Questions

Quantum computing is a revolutionary new type of computing that has the potential to revolutionize the financial services industry. This new technology is based on the principles of quantum mechanics and has the potential to provide unprecedented computing power and speed. Here are some questions and answers about how quantum computing could benefit the financial services industry.

What is quantum computing?

Quantum computing is a new type of computing that is based on the principles of quantum mechanics. It uses the principles of quantum mechanics to create a powerful computing system that is capable of processing and storing data at an unprecedented speed. Quantum computing can help the financial services industry by providing faster and more accurate data processing, which can help to reduce costs and improve services.

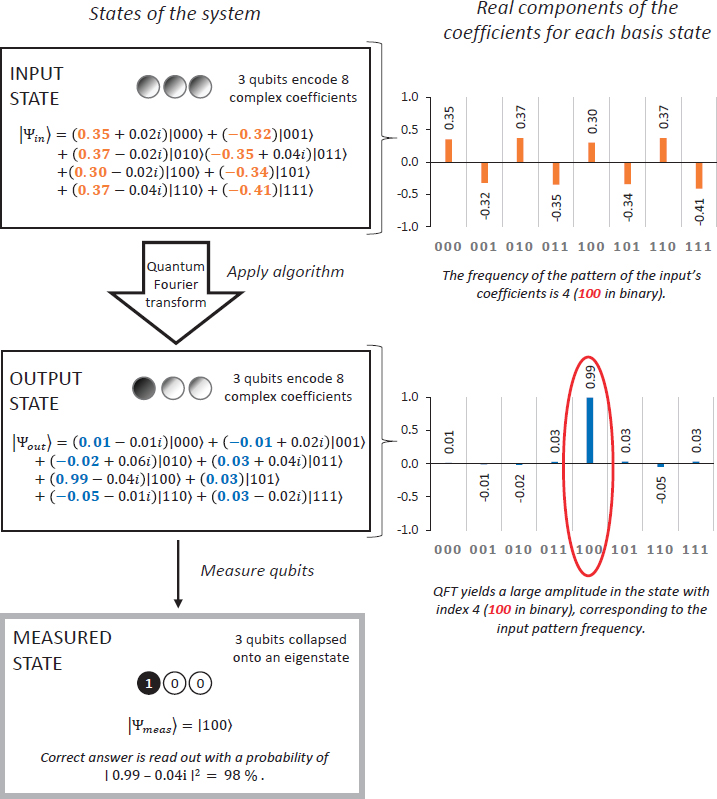

How does quantum computing work?

Quantum computing works by taking advantage of the properties of quantum systems, such as superposition and entanglement, to manipulate and store data. This allows for faster data processing and storage than traditional computers, which can significantly improve the speed and accuracy of financial services. Additionally, quantum computing can help to reduce costs by reducing the amount of resources needed to process and store data.

What are the benefits of quantum computing for the financial services industry?

The main benefit of quantum computing for the financial services industry is its ability to provide faster and more accurate data processing. This can help reduce costs by reducing the amount of resources needed to process and store data. Additionally, quantum computing can help to improve services by providing more accurate predictions and decisions. This can help financial institutions make more informed decisions and increase the accuracy of their services.

How secure is quantum computing?

Quantum computing is highly secure due to its use of quantum mechanics. This means that data stored on quantum computers is incredibly difficult to access or manipulate without the right tools and techniques. This means that financial services can be confident that their data is secure and can be used safely without the risk of data breaches.

What are the challenges of using quantum computing in the financial services industry?

One of the main challenges of using quantum computing in the financial services industry is its cost. Quantum computing is expensive and requires a large investment to build and maintain. Additionally, quantum computing is still a relatively new technology and may require businesses to invest in training and resources to ensure that their staff are knowledgeable about its use. Additionally, the security risks of quantum computing may be higher than that of traditional computing, meaning that businesses need to take the necessary steps to ensure that their data is secure.

Quantum computing in banking explained | Dr Lee Braine, Barclays Bank | MoneyLIVE Interview

In conclusion, quantum computing has the potential to revolutionize the financial services industry. With its ability to process vast amounts of data at lightning-fast speeds, quantum computing can help financial institutions make smarter investment decisions, detect fraud more efficiently, and optimize risk management strategies. Moreover, by offering unprecedented levels of security, quantum computing can help safeguard sensitive financial information and protect against cyber threats.

As quantum computing continues to evolve, we can expect to see a wide range of applications in the financial services industry. From portfolio optimization to fraud prevention to algorithmic trading, quantum computing is poised to transform the way financial institutions operate. As such, it is essential for financial professionals to stay up-to-date on the latest developments in this field and explore how quantum computing can enhance their operations and provide new opportunities for growth.