As the world becomes more digitized, many traditional businesses are shifting to a virtual model, and the tax preparation industry is no exception. Starting a virtual tax preparation business can be a lucrative and flexible career choice. With the right planning, preparation, and execution, you can create a business that allows you to work from anywhere while serving clients all around the world.

However, starting any business comes with challenges and requires careful consideration. In this guide, we will provide you with the information you need to start your virtual tax preparation business. From developing a business plan to marketing your services, we will guide you through the process of building a successful virtual tax preparation business. Whether you are a seasoned tax professional or just starting your career, this guide will provide you with the tools and resources you need to succeed in the virtual business world.

How to Start a Virtual Tax Preparation Business

Starting a virtual tax preparation business is an excellent way to make money while taking advantage of the convenience of working remotely. With the right tools and knowledge, you can set up your own virtual tax preparation business and start offering services to clients almost immediately.

Step 1: Gather the Necessary Resources

Before you can start a virtual tax preparation business, you will need to obtain the necessary resources. This includes a tax preparation software, such as TaxSlayer or TurboTax, a reliable computer and a secure internet connection. You may also want to purchase a basic accounting software, such as QuickBooks, to help you manage your finances. Additionally, you should research the local laws and regulations for tax preparation in your state, as well as any required certifications or licenses.

Step 2: Market Your Business

Once you have the necessary resources, it’s time to start marketing your virtual tax preparation business. You can use social media, email campaigns, and other digital marketing strategies to reach potential customers. Additionally, you can work with local businesses or organizations to create referral networks. This can be an effective way to reach more clients and build your reputation.

Step 3: Set Your Rates

When setting your rates for virtual tax preparation services, you will need to consider the amount of time it will take to complete each job, as well as the complexity of the task. You should also consider the competition in your area, and make sure your rates are competitive. Once you have determined your rates, you should communicate them clearly to potential customers.

Step 4: Establish Policies and Procedures

Before you start accepting clients, you should establish clear policies and procedures that outline the services you are offering, the fees you will charge, the payment terms, and any other relevant information. This will help ensure that both you and your clients understand the terms of the agreement, and can help reduce any potential misunderstandings.

Step 5: Create a Professional Website

A professional website is essential to the success of any business. Your website should include information about your services, rates, contact information, and any other relevant information. Additionally, you should create an online booking system so clients can easily book appointments. This will make it easier for customers to find and contact you, and will help you manage your client base more efficiently.

Step 6: Stay Up-to-Date on Tax Laws and Regulations

Tax laws and regulations are constantly changing, so it’s important to stay up-to-date on the latest developments. This will help ensure that you are providing accurate and up-to-date advice to your clients. Additionally, you should consider taking continuing education classes to stay up-to-date on the latest trends and developments in the tax industry.

Step 7: Invest in the Right Tools

Having the right tools is essential to running a successful virtual tax preparation business. Investing in the right software and hardware will help you manage your business more efficiently and effectively. Additionally, you should consider investing in cloud-based storage solutions, so you can easily access and store your clients’ information securely.

Frequently Asked Questions about Starting a Virtual Tax Preparation Business

Ready to start your own virtual tax preparation business? Here are some of the most common questions to help you get started.

What is a Virtual Tax Preparation Business?

A virtual tax preparation business is a business that provides tax preparation services to individuals and businesses, but does so entirely online. This type of service allows customers to take advantage of the convenience of submitting their taxes electronically without having to visit a physical office.

What Do I Need to Start a Virtual Tax Preparation Business?

If you’re looking to start a virtual tax preparation business, there are a few requirements you’ll need to meet. First, you’ll need to be an IRS-approved tax preparer. This means that you must have a professional tax preparer license, or pass the IRS’s competency exam. Additionally, you’ll need to have the necessary software and hardware to securely process and store sensitive financial information.

What Are the Benefits of Running a Virtual Tax Preparation Business?

There are a number of benefits to running a virtual tax preparation business. The most obvious benefit is that you don’t have to worry about the overhead costs associated with owning a physical office. Additionally, you can provide your services to a much wider audience, since customers can access your services from anywhere in the world. Furthermore, you don’t have to worry about the time constraints associated with traditional tax preparation.

How Do I Market My Virtual Tax Preparation Business?

Marketing your virtual tax preparation business is no different than marketing any other business. You’ll want to focus on creating a strong online presence, including a website and various social media accounts. Additionally, you should consider using SEO strategies, such as keyword optimization, to make sure your business is easily findable by potential customers.

How Can I Ensure the Security of My Customers’ Financial Information?

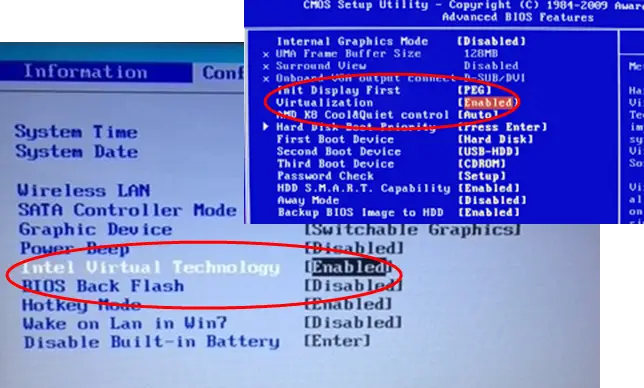

The security of your customers’ financial information should be one of your top priorities when running a virtual tax preparation business. You’ll want to make sure that all of your customers’ data is encrypted and stored securely. Additionally, you should use two-factor authentication, such as a username and password, to make sure that only authorized personnel can access your customers’ information.

How To Start A Virtual Tax Preparation Business: 5 Pros Starting a Virtual Tax Preparation Business

In conclusion, starting a virtual tax preparation business can be a profitable venture for those who have the right skills and tools. With the increasing demand for remote services and the ease of technology, it is now more accessible than ever before. However, it is crucial to do your due diligence and research the industry thoroughly before diving in. Consider obtaining the necessary certifications, investing in reliable software, and building a strong online presence to establish credibility and attract clients.

Overall, starting a virtual tax preparation business requires hard work, dedication, and a willingness to adapt to the ever-changing landscape of the industry. By following the right steps and continuously improving your skills and services, you can build a successful business that provides value to your clients and meets their tax needs. With the right mindset and determination, you can turn your passion for taxes into a thriving virtual business.