In a world where digital transactions have become the norm, virtual cards have emerged as a popular alternative to traditional credit and debit cards. These cards are essentially digital versions of physical cards, which can be used for online purchases without the need for a physical card. However, one of the most significant advantages of virtual cards is the ability to receive cashback rewards, which can be redeemed for real cash. In this article, we will explore how to get cash from virtual cards and maximize your earnings.

First and foremost, it is essential to understand how virtual card cashback works. When you make a purchase using a virtual card, a percentage of the transaction amount is credited back to your account as cashback rewards. This cashback can accumulate over time, and once you reach a certain threshold, you can redeem it for real cash. The process of redeeming cashback rewards varies depending on the service provider, but it typically involves transferring the cashback amount to your bank account or PayPal. In the following sections, we will discuss some tips and tricks to help you earn more cashback rewards and make the most of your virtual cards.

How to get cash from virtual card?

- Visit an ATM that supports the virtual card.

- Enter your virtual card’s details into the ATM.

- Enter the amount of cash you wish to withdraw.

- Follow the instructions on-screen to complete the transaction.

- Collect your cash from the ATM.

How to Get Cash From Virtual Card?

Virtual cards are prepaid debit cards that can be used to make purchases online or in-store. They are convenient and secure, as they do not require you to provide your personal information or financial details. Many virtual cards also offer the ability to withdraw cash from an ATM or other locations. Here is how to get cash from a virtual card.

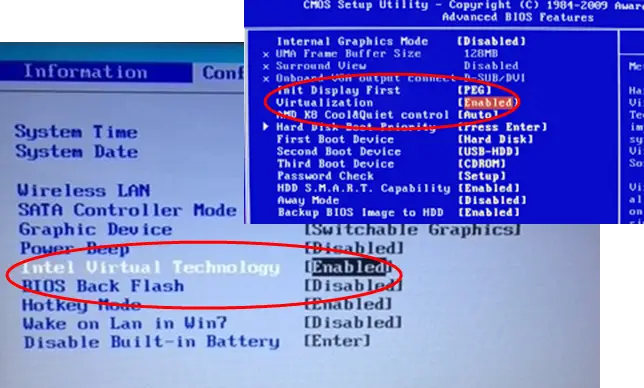

Step 1: Activate the Virtual Card

Before you can use a virtual card to withdraw cash, you must first activate it. You can do this online or by calling the customer service number listed on the back of the card. During the activation process, you will be asked to provide your contact information and a valid form of ID. Once the card is activated, you will be able to use it to make purchases and withdraw cash.

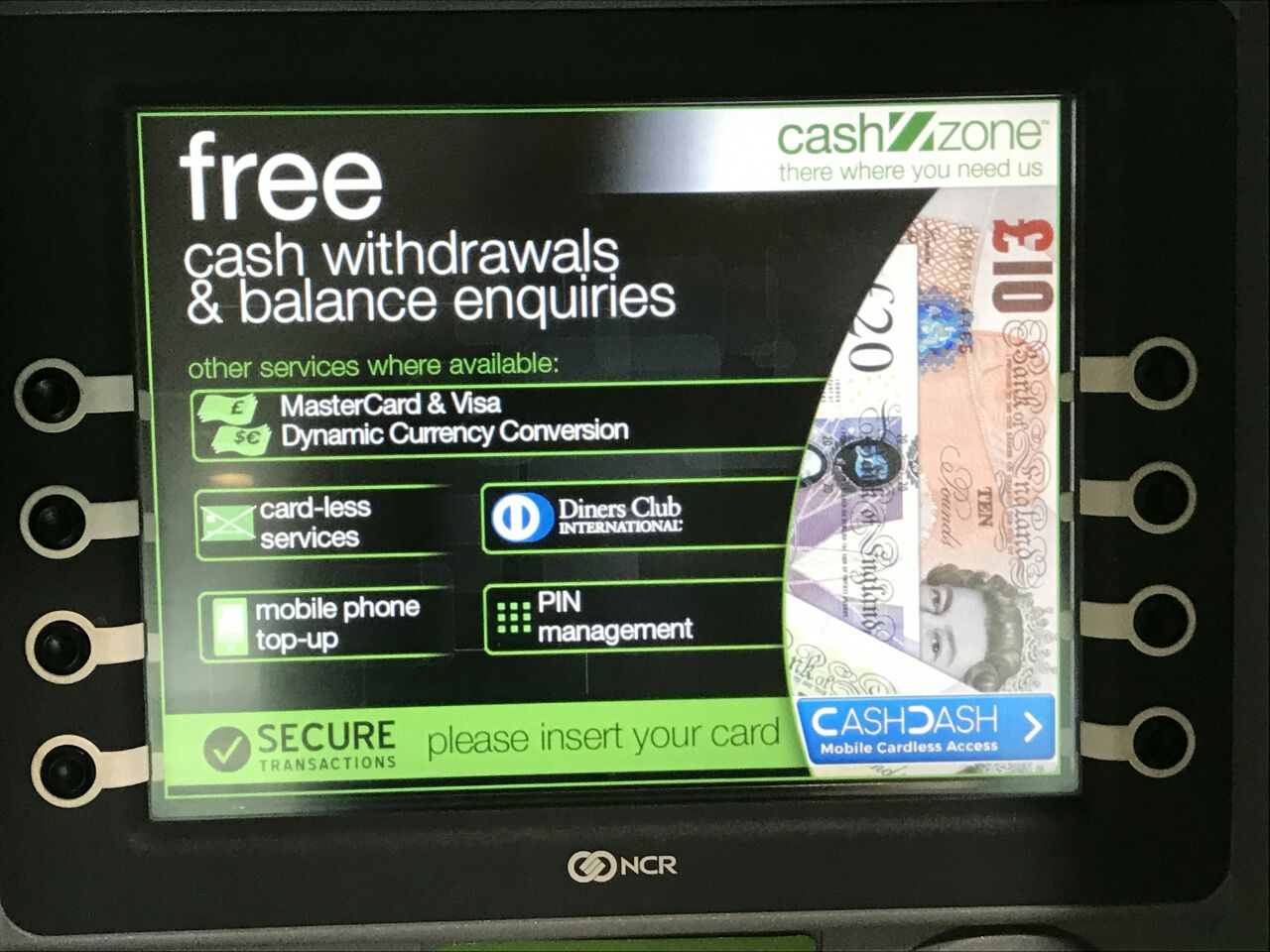

Step 2: Find an ATM

Most virtual cards can be used to withdraw cash from any ATM with the Visa, MasterCard, or American Express logo. You can also use certain ATMs that are equipped with the technology to process virtual card payments. To find an ATM that accepts virtual cards, you can use an online search engine or the app provided by your card issuer.

Step 3: Withdraw Cash

Once you have found an ATM that accepts virtual cards, you can withdraw cash. Insert your card into the ATM and enter your PIN. Next, select the “withdrawal” option and enter the amount of cash you would like to withdraw. The ATM will then dispense the cash, deduct the amount from your virtual card balance, and confirm the transaction.

Step 4: Check Balance

After you have withdrawn cash from an ATM, it is important to check your virtual card balance to make sure that the correct amount has been deducted. You can easily check your balance online or via the app provided by your card issuer. If you notice any discrepancies, you should contact your card issuer immediately.

Step 5: Monitor Transactions

To ensure the security of your virtual card, it is important to monitor your transactions. You can easily do this online or via the app provided by your card issuer. You should keep an eye out for any suspicious transactions and report them to your card issuer immediately.

Step 6: Manage Your Card

Once you have withdrawn cash from your virtual card, you should manage it properly. This includes not sharing your PIN, not storing your card information online, and notifying your card issuer of any changes in your contact information. You should also be sure to use your card responsibly and pay any outstanding balances on time.

Frequently Asked Questions

Here are some frequently asked questions about how to get cash from virtual cards.

How do I use a virtual card to get cash?

Using a virtual card to get cash is a convenient and secure way to access your funds. To get cash from a virtual card, you will need to first link the card to your bank account or a payment processor. You can then use the virtual card to withdraw cash from an ATM, transfer funds to a bank account, or make purchases with your virtual card. Depending on the provider, you may also be able to use the virtual card to pay bills or make online purchases.

What is the maximum amount I can withdraw from a virtual card?

The maximum amount you can withdraw from a virtual card depends on the provider and the type of card you have. Some cards may have lower withdrawal limits than others. Generally, the maximum withdrawal amount is $3,000 or less, but this can vary depending on the card. Some cards may also have a daily withdrawal limit and a maximum number of withdrawals per month.

Is it safe to get cash from a virtual card?

Yes, it is safe to get cash from a virtual card. Most virtual cards are backed by major card networks like Visa or Mastercard, which provide added security. Additionally, the provider of the virtual card may also offer fraud protection and other security measures.

How quickly can I get cash from a virtual card?

The amount of time it takes to get cash from a virtual card depends on the provider and the type of card you have. Generally, you can expect to receive your cash within 1-2 business days. However, some providers may offer faster delivery options, such as same-day delivery or even instant delivery.

Are there any fees for getting cash from a virtual card?

Some providers may charge fees for getting cash from a virtual card. These fees may vary depending on the provider and the type of card you have. Generally, the fees are minimal and can range from a few cents to a few dollars. It is important to check with your provider to find out if they charge any fees for getting cash from a virtual card.

How to Turn PREPAID Visa/Master Cards into CASH (Using PayPal)

In conclusion, obtaining cash from a virtual card has become a seamless process thanks to the advancement of technology. With the numerous online payment platforms available, it is now possible to access funds from your virtual card with ease. However, it is important to note that the process of getting cash from a virtual card varies depending on the platform used. Therefore, it is essential to conduct due diligence and research on the available options to choose the most convenient and secure platform.

In summary, virtual cards have revolutionized the way we transact online, providing convenience and security to users. With the ability to withdraw cash from virtual cards, users can enjoy the flexibility of accessing their funds from anywhere in the world. As more people embrace online transactions, it is expected that the demand for virtual cards will continue to rise, making it an essential tool for financial transactions in the digital age.