In today’s digital age, online transactions are becoming increasingly popular. With the convenience and safety of e-commerce, it’s no surprise that virtual Visa cards have become a popular payment option. These cards can be used to make purchases online, but many people are unaware that they can also be used at ATMs to withdraw cash.

Using a virtual Visa card at an ATM is a straightforward process, but it’s important to understand the steps involved to avoid any issues. In this article, we will guide you through the process of using a virtual Visa card at an ATM, so you can take full advantage of this payment option. From setting up your virtual Visa card to withdrawing cash from an ATM, we’ll cover everything you need to know to make your next transaction a success. So, let’s get started!

Using a Virtual Visa Card at an ATM is easy. Firstly, you need to sign up for a Virtual Visa Card account. Once you have done this, you will be able to add funds to your Virtual Visa Card and use it just like a regular Visa Card.

To use your Virtual Visa Card at an ATM, you will need to locate a compatible ATM. Most ATMs that accept Visa debit cards will also accept Virtual Visa Cards. Then, insert your Virtual Visa Card into the ATM, enter your PIN, and select the amount you want to withdraw.

It is important to note that while Virtual Visa Cards are accepted at most ATMs, they may not be accepted at all ATMs. You should always check the ATM’s compatibility before attempting to use your Virtual Visa Card.

For more information, you can visit the website of the issuer of your Virtual Visa Card and read their FAQs.

Using a Virtual Visa Card at an ATM

Visa cards are an easy and convenient way to pay for goods and services. With virtual Visa cards, you can now use your card at an ATM, allowing you to withdraw cash or transfer money between accounts. Here’s how to use a virtual Visa card at an ATM.

Step 1: Activate Your Virtual Visa Card

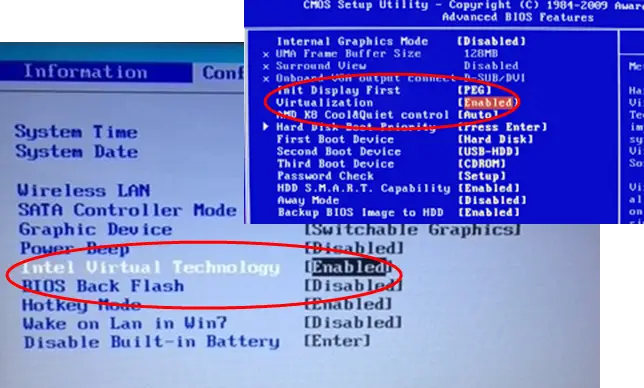

Before you can use your virtual Visa card at an ATM, you must first activate it. This can be done through your bank’s website or app, or through the Visa app. Once your card is activated, you will be provided with a card number, expiration date, and security code. You will need to have this information handy when you use the ATM.

You will also need to set up a PIN for your card. This can be done either online or by calling the number on the back of your card. Once you have your PIN set up, you will be ready to use your card at an ATM.

Step 2: Find a Compatible ATM

Not all ATMs are compatible with virtual Visa cards, so you will need to make sure you are using an ATM that supports Visa. Look for the Visa logo on the ATM, or ask a bank representative to help you find a compatible ATM.

Once you find a compatible ATM, you can then proceed to the next step.

Step 3: Insert Your Card and Enter Your PIN

Once you have located a compatible ATM, insert your virtual Visa card into the ATM. The ATM will prompt you to enter your PIN. After entering your PIN, you will be able to access your account and perform any transactions you need to.

You can withdraw cash, transfer money between accounts, or view your balance. Make sure to check your balance before performing any transactions, as you may be charged a fee for withdrawing cash or transferring money.

Step 4: Collect Your Receipt

Once you have performed your transaction, the ATM will provide you with a receipt. Make sure to take this receipt with you, as it will provide you with a record of your transaction.

You can also use the receipt to check your account balance, as it will show your current balance and any recent transactions. This can be helpful if you need to confirm that a transaction has gone through.

Frequently Asked Questions

Get answers to your questions about how to use virtual visa card at ATMs.

How does a virtual Visa card work?

A virtual Visa card is a prepaid card that works just like a regular Visa card. It can be used to make purchases online, over the phone, and in stores. It can also be used to withdraw cash from ATMs. Virtual Visa cards are issued by banks and other financial institutions, and they are linked to a bank account or credit card. The funds on the card are loaded onto the card, and the card can be used just like a regular Visa card.

To use a virtual Visa card at an ATM, you will need to input the card number and your PIN. After the transaction is completed, the funds will be deducted from your virtual Visa card balance. It’s important to note that you may incur additional fees for using your virtual Visa card at an ATM.

Are virtual Visa cards safe to use?

Yes, virtual Visa cards are a safe and secure way to make purchases and withdraw cash from ATMs. The cards are protected with the same level of security as regular Visa cards, so you can be sure that your personal and financial information is safe.

When using a virtual Visa card at an ATM, it’s important to remember to take your card with you when you leave. Leaving your card in the machine could put your personal and financial information at risk. It’s also important to remember to keep the card in a safe place and to not share your PIN with anyone.

Can I use a virtual Visa card to withdraw money from an ATM?

Yes, you can use a virtual Visa card to withdraw money from an ATM. However, you may incur additional fees for using your virtual Visa card at an ATM. Some ATMs may also have limits on the amount of money you can withdraw using your virtual Visa card. It’s important to check with your bank or financial institution to find out what fees and limits apply to your virtual Visa card.

Can I use a virtual Visa card to make purchases online?

Yes, you can use a virtual Visa card to make purchases online. To use your virtual Visa card online, you will need to input the card number, the expiration date, and the CVV code for the card. Once the information is entered, the transaction will be processed and the funds will be deducted from your virtual Visa card balance.

Can I reload funds onto my virtual Visa card?

Yes, you can reload funds onto your virtual Visa card. Depending on the issuer of your card, you may be able to reload funds using a bank transfer, credit card, or another payment method. It’s important to check with your bank or financial institution to find out what payment methods are accepted for reloading your virtual Visa card.

HOW DOES A VIRTUAL CREDIT CARD WORK? | VIRTUAL CREDIT CARD EXPLAINED

In conclusion, using virtual visa cards at ATMs is a convenient and secure way to access your funds. With the increasing popularity of online transactions, virtual cards provide an added layer of protection against fraud and theft. By following the steps outlined above, you can easily use your virtual visa card at an ATM without any hassle.

However, it is important to note that not all ATMs accept virtual cards, so it’s best to check with your bank or card provider beforehand. Additionally, be sure to keep your virtual card information safe and secure, just as you would with a physical card. By taking these precautions, you can enjoy the benefits of using a virtual visa card at ATMs while keeping your finances protected.