As online shopping continues to grow in popularity, more and more people are turning to virtual credit cards to make purchases. One popular virtual card option is Snap Finance, which offers an easy and convenient way to finance your online purchases. If you’re new to Snap Finance or virtual cards in general, you may be wondering how to use them effectively. In this article, we’ll provide a step-by-step guide on how to use Snap Finance virtual card, so you can start making purchases with confidence.

Snap Finance virtual card is a great alternative to traditional credit cards, especially if you have less than perfect credit. With Snap Finance, you can get approved for a virtual card with no credit check, and use it to make purchases online at participating retailers. Plus, you’ll have the flexibility to pay over time with affordable payment options. But before you start shopping, it’s important to understand how to use Snap Finance virtual card properly to ensure a smooth and hassle-free online shopping experience. So, let’s dive in!

How to use Snap Finance Virtual Card?

- Visit the Snap Finance website and log in to your account.

- Click the ‘Cards’ tab and select ‘Virtual Card’.

- Choose the payment method you want to use for the card. You can choose from credit/debit cards, PayPal, or direct bank transfer.

- Enter the amount for the card and click ‘Submit’.

- You will be provided with a virtual card number and CVV for your transaction. Use this information to make purchases online or by phone.

What is Snap Finance Virtual Card?

Snap Finance Virtual Card is a payment solution that helps customers make purchases online, anytime and anywhere. It is an online card that is linked to your bank account and allows you to make payments online without having to enter your credit or debit card information. With Snap Finance Virtual Card, customers can make purchases, pay bills, and receive cash back rewards all from the convenience of their computer or mobile device.

How to Use Snap Finance Virtual Card

Step 1: Sign Up for an Account

The first step in using the Snap Finance Virtual Card is to sign up for an account. You will need to provide your name, address, date of birth, and phone number. Additionally, you will need to link your bank account to the card. This will allow you to make payments online without having to enter your credit or debit card information.

Once you have completed the signup process, you will receive a confirmation email with a link to activate your card. Once your card is activated, you can start using it right away.

Step 2: Make Purchases with the Card

Once your card is activated, you can start using it to make purchases online. All you have to do is enter your card information at the checkout. The card will then be deducted from your linked bank account. You can use the card for any online purchases and you can also get cash back rewards when you use it.

You can also use the card to pay bills online. All you have to do is enter your card information at the checkout and the payment will be deducted from your bank account. You can also use the card to make payments on subscription services, such as Netflix or Spotify.

Step 3: Track Your Spending

The Snap Finance Virtual Card also lets you track your spending. You can view your transaction history and check your balance at any time. You can also set up notifications so that you get alerts when you make a purchase or when your balance reaches a certain amount.

You can also set a spending limit so that you don’t overspend. This is a great way to stay on top of your finances and make sure you don’t go over your budget.

Step 4: Get Cash Back Rewards

The Snap Finance Virtual Card also offers cash back rewards when you use it to make purchases. You can earn up to 2% cash back on all purchases. You can use the cash back rewards to pay for future purchases or save them for a rainy day.

The rewards are automatically credited to your account and can be used to pay for any future purchases. This is a great way to save money and make your money go further.

Step 5: Manage Your Card

The Snap Finance Virtual Card also allows you to manage your card. You can view your balance, set a spending limit, and view your transaction history. You can also add or remove cards from your account.

You can also set up notifications so that you get alerts when you make a purchase or when your balance reaches a certain amount. This is a great way to stay on top of your finances and make sure you don’t go over your budget.

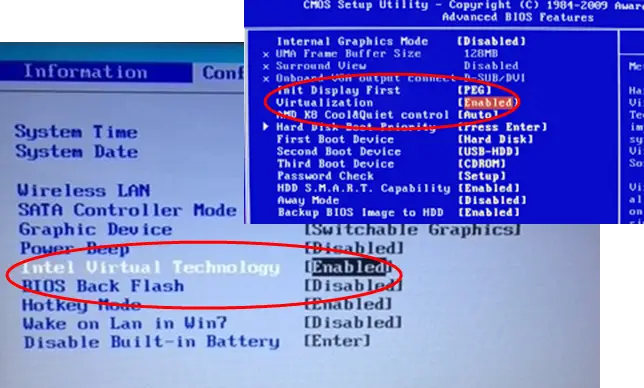

Step 6: Security Features

The Snap Finance Virtual Card also has several security features to keep your information safe. All transactions are encrypted and your card number is not stored on the server. Additionally, your card information is never shared with merchants or third parties.

The card also has a fraud detection system that detects suspicious activity and alerts you if there is any unauthorized activity on your card. This is a great way to protect your information and keep your money safe.

Frequently Asked Questions

Snap Finance Virtual Card is a secure and convenient online payment method that helps you make online purchases without revealing your personal financial information. It also offers extra protection from fraudulent transactions.

How do I get a Snap Finance Virtual Card?

To get a Snap Finance Virtual Card, you’ll need to first set up an account on the Snap Finance website. Once you have an account, you can begin to use the virtual card to make online purchases. To do so, you’ll need to enter your card details, such as the card number, expiration date, and CVV code. You’ll also need to provide your billing address. Once you’ve entered the information, you’ll be able to complete your purchase.

How secure is my Snap Finance Virtual Card?

Your Snap Finance Virtual Card is extremely secure. All transactions are encrypted and your personal financial information is never shared with the merchant. Additionally, the card has additional fraud protection features which monitor transactions to ensure your card is not being used maliciously.

Can I use my Snap Finance Virtual Card in stores?

No, the Snap Finance Virtual Card can only be used for online purchases. If you would like to use your card in stores, you’ll need to apply for a physical Snap Finance Card.

What fees are associated with using my Snap Finance Virtual Card?

Using your Snap Finance Virtual Card is free; however, there may be additional fees associated with certain transactions. For example, if you make a purchase in a foreign currency, you may be charged a foreign transaction fee. Additionally, there may be other fees associated with the card, such as late payment fees or cash advance fees.

Can I add money to my Snap Finance Virtual Card?

Yes, you can add money to your Snap Finance Virtual Card. To do so, you’ll need to log into your account and add funds via your bank account or debit card. You can also add funds via direct deposit or by transferring funds from another account. Once the funds have been added, you’ll be able to make online purchases with your card.

In conclusion, using Snap Finance Virtual Card is a convenient and secure way to make purchases online. It offers flexibility in terms of payment options and allows you to split your payments into manageable installments. By understanding the steps involved in setting up and using your virtual card, you can take advantage of the benefits it provides and make your shopping experience smoother.

Remember to always keep track of your spending and make timely payments to avoid any additional fees or charges. With the Snap Finance Virtual Card, you can make purchases with ease and peace of mind, knowing that your transactions are protected by top-level security measures. So go ahead and start using your virtual card today to enjoy the benefits of hassle-free online shopping!