Binance US is one of the most popular cryptocurrency exchanges in the United States. It offers a wide range of trading options, including spot trading, margin trading, and staking. However, one question that often comes up for traders on the platform is whether Binance US sends out tax forms.

As a professional writer, I can tell you that taxes are an important part of any financial transaction, including cryptocurrency trading. The IRS has made it clear that virtual currency is treated as property for tax purposes, and any gains or losses from trading must be reported on your tax return. So, if you’re a Binance US trader, it’s important to know whether you can expect to receive tax forms from the exchange. In the following paragraphs, we’ll explore this topic in more detail and provide you with the information you need to stay on top of your tax obligations.

Does Binance US Send Tax Forms?

Binance US is a cryptocurrency exchange that offers users the ability to buy and sell digital currencies. The platform is regulated by the US Financial Crimes Enforcement Network (FinCEN) and is subject to federal, state, and local laws. As such, the platform is required to report all taxable events to the Internal Revenue Service (IRS). This article will answer the question: does Binance US send tax forms?

What Is a Tax Form?

A tax form is a document used to report taxable income and expenses to the IRS. Tax forms can be either physical documents or digital files, such as PDFs. The type of form used depends on the type of transaction that has taken place. For example, if you buy and sell digital currencies on Binance US, you will need to file Form 8949 with the IRS.

Tax forms are used to report income and expenses related to financial transactions. They include information such as the type of transaction, the date of the transaction, the amount of money involved, and any fees or taxes that were associated with the transaction. Taxpayers must file the appropriate form with the IRS in order to accurately report their taxable income and expenses.

Does Binance US Send Tax Forms?

Yes, Binance US does send tax forms. The platform is required to report all taxable events to the IRS, and it does so by sending out tax forms. Binance US sends out Form 1099-K for customers who have earned more than $20,000 in a calendar year and have completed more than 200 transactions.

Form 1099-K is the standard form used to report income from digital currency transactions. It includes the taxpayer’s name, address, and Social Security Number, as well as the amount of income earned and any applicable taxes. It is important to note that Binance US only sends out 1099-K forms if the taxpayer has earned more than $20,000 in a calendar year and completed more than 200 transactions.

In addition to Form 1099-K, Binance US may also send out other forms, such as Form 1099-MISC. This form is used to report miscellaneous income, such as income from interest, dividends, and certain types of bartering transactions. It is important to note that Form 1099-MISC is not required for digital currency transactions.

How to Receive Your Tax Forms

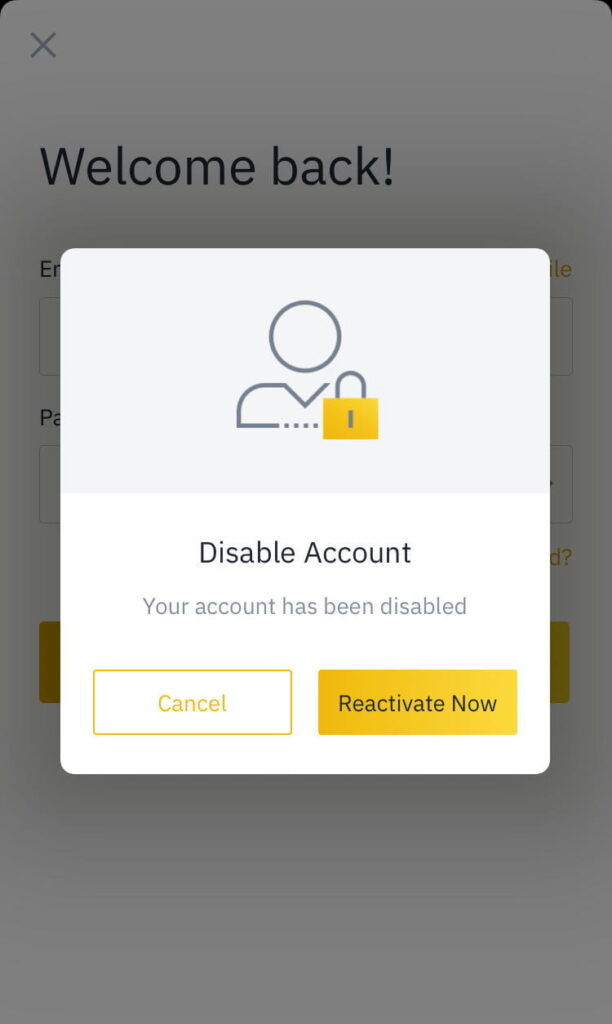

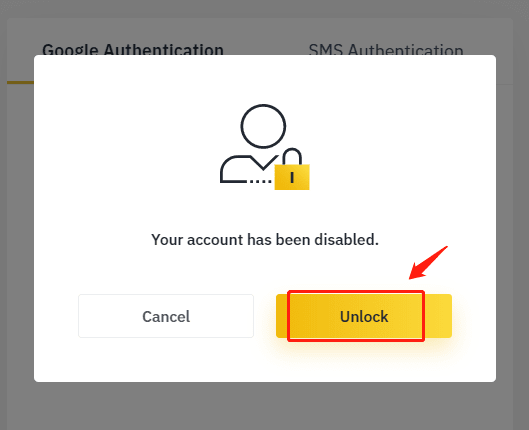

Binance US sends tax forms to customers via email. Customers must log into their Binance US account and select “Tax Documents” from the drop-down menu. Once there, customers can view and download their tax forms. It is important to note that customers may have to wait up to 30 days after the end of the tax year to receive their tax forms.

In addition to email, Binance US also provides customers with the option to receive their tax forms via paper mail. Customers must log into their Binance US account and select “Account Settings” from the drop-down menu. From there, customers can select “Paper Copy” and enter their mailing address. It is important to note that customers may have to wait up to 60 days to receive their tax forms via paper mail.

Conclusion

In conclusion, Binance US does send tax forms. The platform is required to report all taxable events to the IRS and does so by sending out Form 1099-K for customers who have earned more than $20,000 in a calendar year and have completed more than 200 transactions. Customers can receive their tax forms via email or paper mail by logging into their Binance US account and selecting the appropriate options.

Freequently Asked Questions

Binance US is the American arm of the leading cryptocurrency exchange Binance. It provides US customers with access to a wide range of cryptocurrencies and a secure platform to buy, sell, and trade them.

Does Binance US Send Tax Forms?

Yes, Binance US is required to send tax forms to its customers. All customers who make at least $600 in trading profits must receive Form 1099-K from Binance US. This form includes information about your total trading profits from the previous year and must be included with your tax filing. Binance US also provides customers with a Form 1099-MISC for trades that involve non-cash payments. This form must also be reported to the IRS when filing taxes.

As a customer, you are responsible for filing your taxes accurately and on time. Binance US recommends that customers consult with a tax professional to ensure they are filing their taxes correctly. It is important to note that the US tax system is complex, and customers should familiarize themselves with the relevant laws and regulations.

In conclusion, Binance US is a reputable cryptocurrency exchange that is committed to complying with US tax laws. As such, they provide their users with tax forms for their transactions on the platform. This makes it easier for users to report their cryptocurrency gains or losses to the IRS and avoid any penalties for non-compliance.

It is crucial for cryptocurrency traders and investors to keep accurate records of their transactions and report them to the IRS. With Binance US providing tax forms, users can confidently trade on the platform knowing that they are fulfilling their tax obligations. By doing so, they can enjoy the benefits of trading on a secure and reliable exchange without worrying about the consequences of non-compliance with tax laws.